I have been trading the whole week, and still holding half position of EURGBP long. I just did not find time to write anything here. There are just too many things to think and handle outside my trading life recently. A little bit stress is building up… Anyway, that’s not the point of this post.

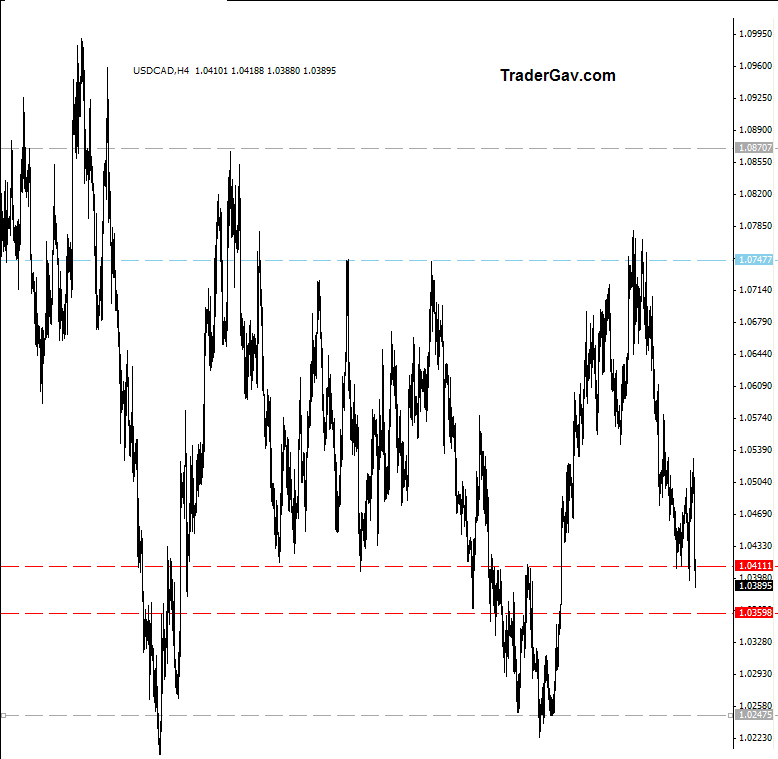

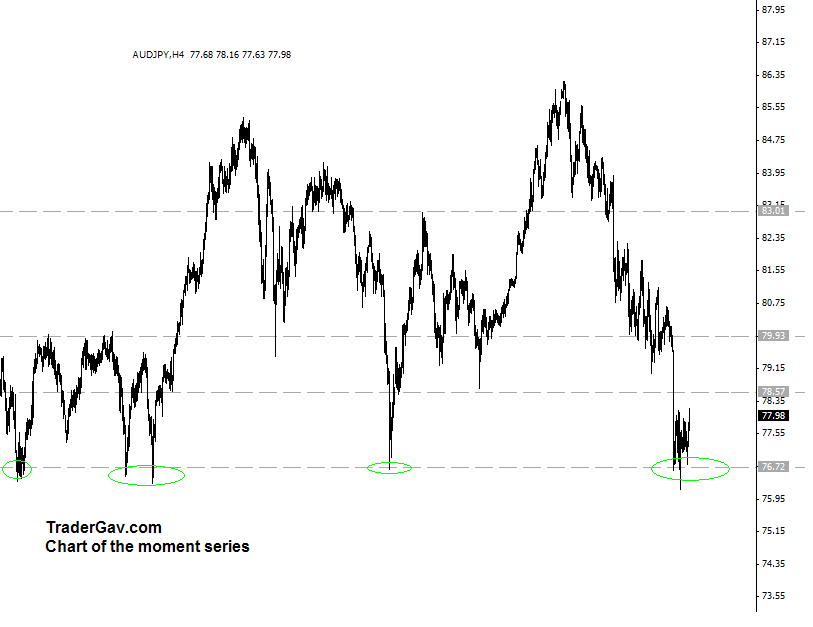

AUDUSD and AUDJPY start to confuse me now. I can’t see the clear picture, so I will leave them alone for now. Some of you might argue USDCAD is back to buy zone again. Well, this time, I am not so sure. I am not sure if we should jump in now. It does not convince me so much. Instead, we might see a run to mid 1.02-ish. Well, who knows? Let’s see.

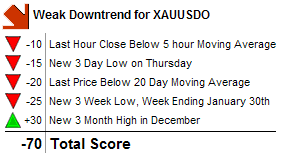

Here is the CHART!!!