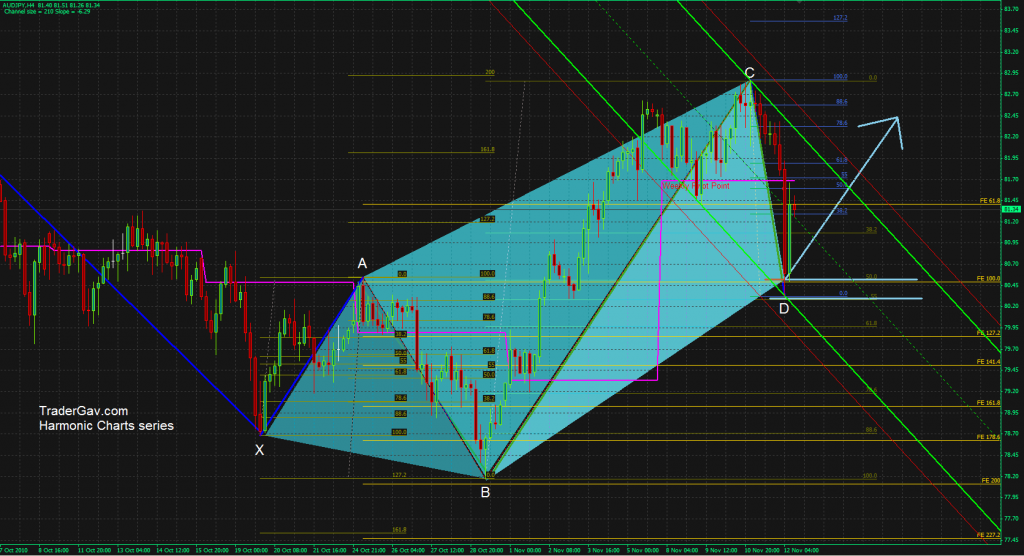

Here is the potential symmetrical movement I am watching while AUDJPY approaching 82.50/80 resistance zone. �Of course, market is never perfect, let’s see how this plan works out.

AUDJPY

A gap trade example 18 June 2012 : $AUDJPY

I have stopped posting my trade long time ago for various reasons. Anyway, I thought I might throw in an example today to show how I trade gap. In fact, I am not really sure if �I can call this a gap fill strategy, as it is basically a simple support/resistance trade. After all, everything […]

Weekend Charting 06 May 2012

Here are the charts with some ‘annoying lines’ that I am watching for the coming week. Hope they annoy you as well. $AUDUSD Hourly $AUDJPY 240min $EURUSD 240min $EURAUD 240min $EURJPY Hourly $GBPUSD 240min $NZDUSD 240min $USDJPY 240min $USDSGD 240min $USDCHF 240min $USDCAD 240min Good trading!

$AUDJPY 28 April 2011

Here is the setup I mentioned in my tweet. Looking at the swing trade with targets around 8770 and 87. Setup is invalidated if 90 level is broken. Here is the…. CHART!

$AUDJPY 12 Nov 2010

Here is the $AUDJPY chart I mentioned earlier on. I am holding long position, with some profit booked, and stop is now at break even. This is a text book 5-0 formation where all fib levels are nicely respected. [tab: Setup] Here is the chart to confuse you. Have a great weekend! [tab: Update 18 […]

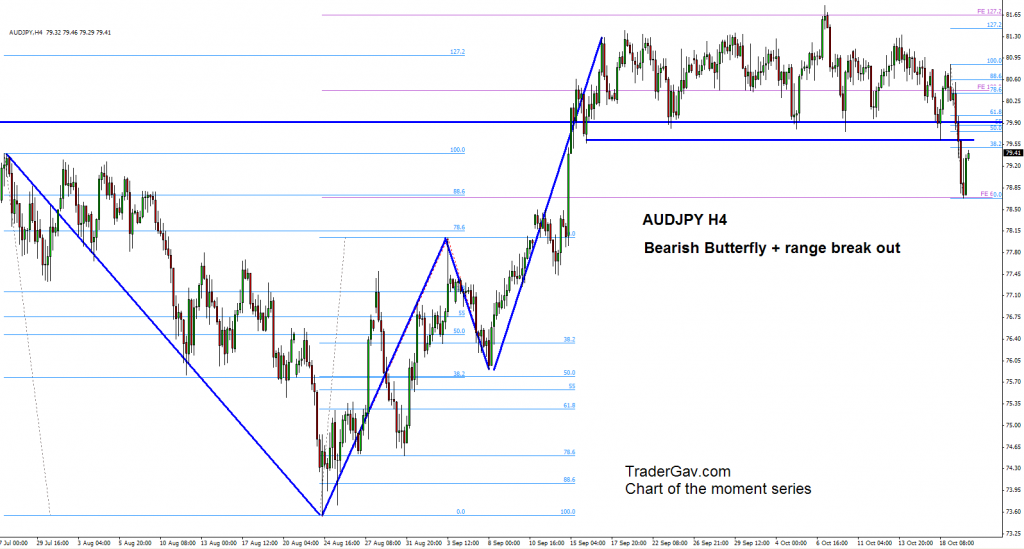

Something about $AUDJPY 20102010

I was watching AUDJPY. I thought it was going to invalidate the Bearish Butterfly formation. We had just broken out from the trading range yesterday, and now it renews my interest in shorting the pair. I am watching closely and preparing to build a swing short position. what do you see here? Here is the…CHART!