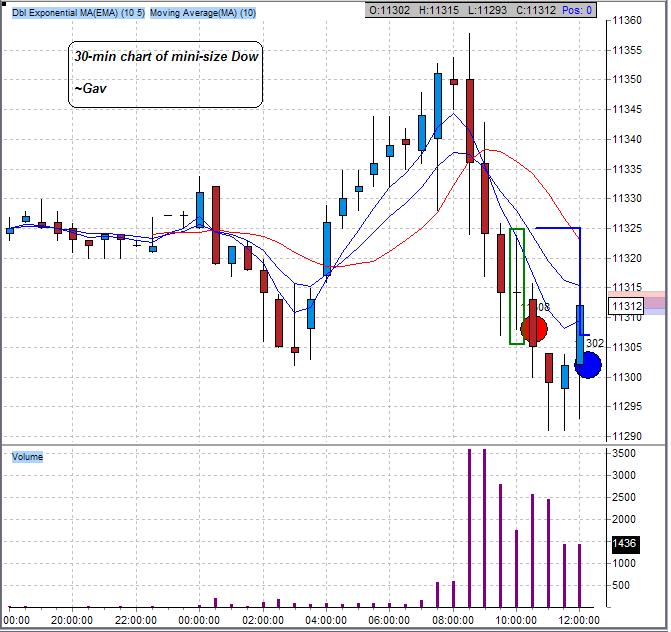

Time to review result of this week. Beautiful.. This is the first ever negative week for me. My performance curve started the week down and drifting down with no turning back until Thursday. Nice downtrend huh?

[photopress:Augustweek4.JPG,full,centered]

This is a tough week for me.

Overall, I am still in positive territory for August, but this week’s bloody performance has dramatically dragged down my performance.Anyway,

Another week to go.

One of these days,we will get them

[photopress:Augustweek1to4.JPG,full,centered]

This is the business we have chosen ~ The GodFather, the movie