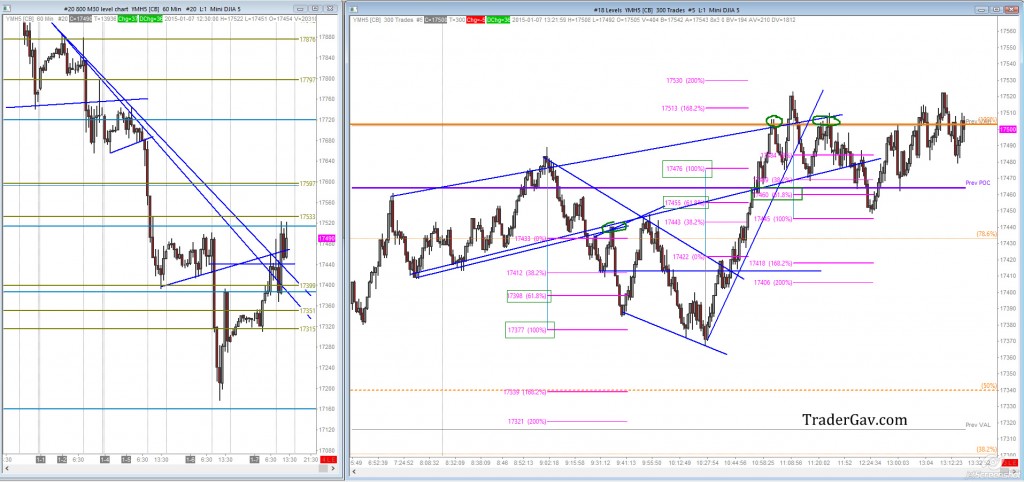

Major movement of the day was during pre-open when economic releases were scheduled. 3 setups were observed during RTH. Looking at at hourly chart, I was targeting the major swing low 17177 to be visited.

The first setup was when YM revisiting VWAP, and at the same time it was the first test of supply level around 17404. With price projection, I was targeting 17283 which was also near Globlex session low.

Second trade was a text book trend line retest with confluence of supply zone when YM traded back to developing value area low around 17382 . I expected price to go lower.

Third trade was when intraday downtrend line was broken. Over and under formation at the developing area low around 17281. This was a mean reversion trade, targeted to revisit VWAP.

That’s all for the day.

This series of ‘Day Review” posts will be completed this week, as I have pretty much outlined/showed how I trade index futures. I will still be posting daily review charts under “Chart-Folio” section, but without too much written explanation.