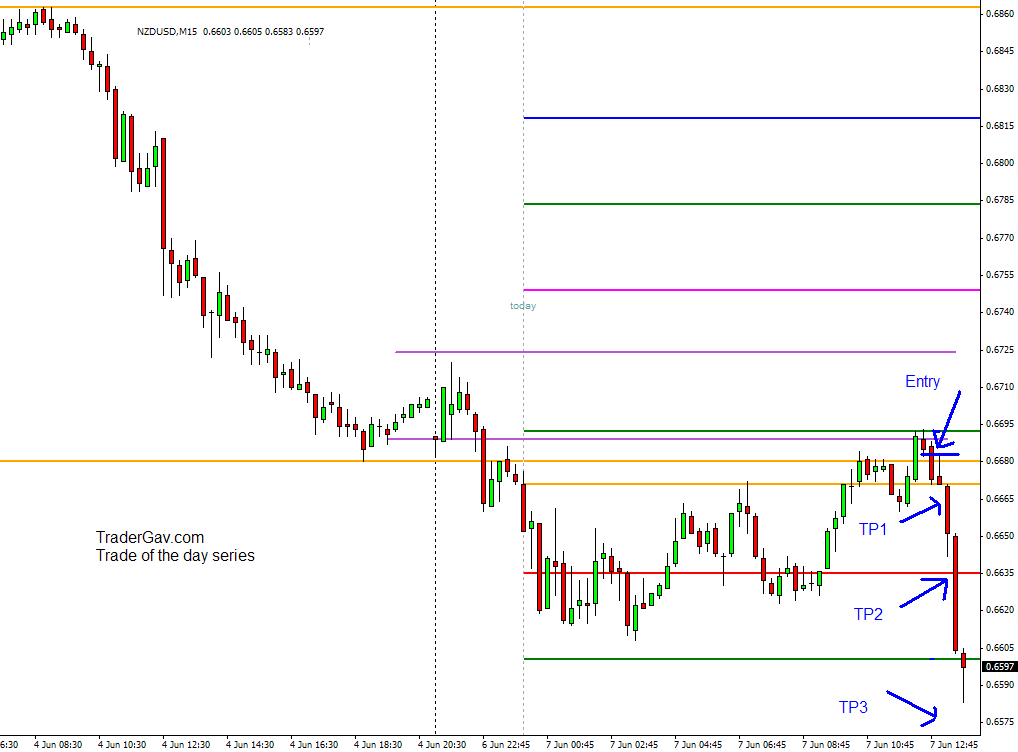

I opened few short positions during since early London session, and they came to fruition during early U.S session. I decided to share $NZDUSD trade, which was a fast, and aggressively sold off. I have waited for few hours for Kiwi dollar to pull back , and I decided to pull the trigger when it […]

NZDUSD

Are we there yet? $NZDUSD 10-May-2010

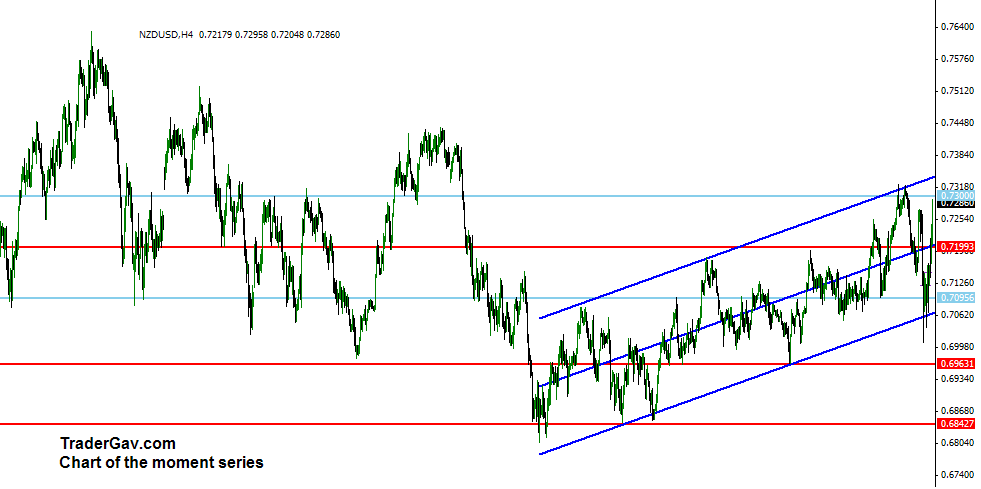

This is something that I am looking at, and thinking about. Will NZDUSD stop at 0.73 level? Probably. However, it might be a small pull back, and I am looking at mid 0.74 for a stronger resistance level. Well, let’s see. Here is the…. CHART!

A $AUDNZD trade

I received a couple of tweets asking about AUDNZD. The question is summarized : Is it UP or Down? or Bullish or Bearish? As usual, I don’t answer this type of question. If you have been trading for sometime, you know why I do not answer these questions. Have a look at AUDNZD daily chart, […]

Is it time now? A look at GOLD ($XAU)

I exited my AUDUSD long position earlier today with small loss. The entry was too early. However, I am still looking to build long positions of AUD, NZD and CAD (by Short USDCAD). Let’s see how this strategy works out. Basically, my approach is to test the market, if it does not work out, I run, […]

$NZDUSD :Catching the falling knife?

I start to buy some Aussie dollar and looking to buy Kiwi dollar soon. Oh well, you can say I am catching the falling knives. So what? What would be the worst case if I am wrong? Got stopped out, that’s it. What so tough about that? 🙂 Anyway, here is 4-hr chart of NZDUSD. […]

Weekly wrap up 15-May-2009

It is Friday! I managed to make some trades this week. CHFJPY, NZDUSD shorts are the winners of the week while I missed out some short term trades in AuDUSD, AUDJPY, NZDJPY. Having in the slightly ‘difficult’ situation recently, unpleasant day job, family issues, stress were building up faster than I imagined,this situation put me […]