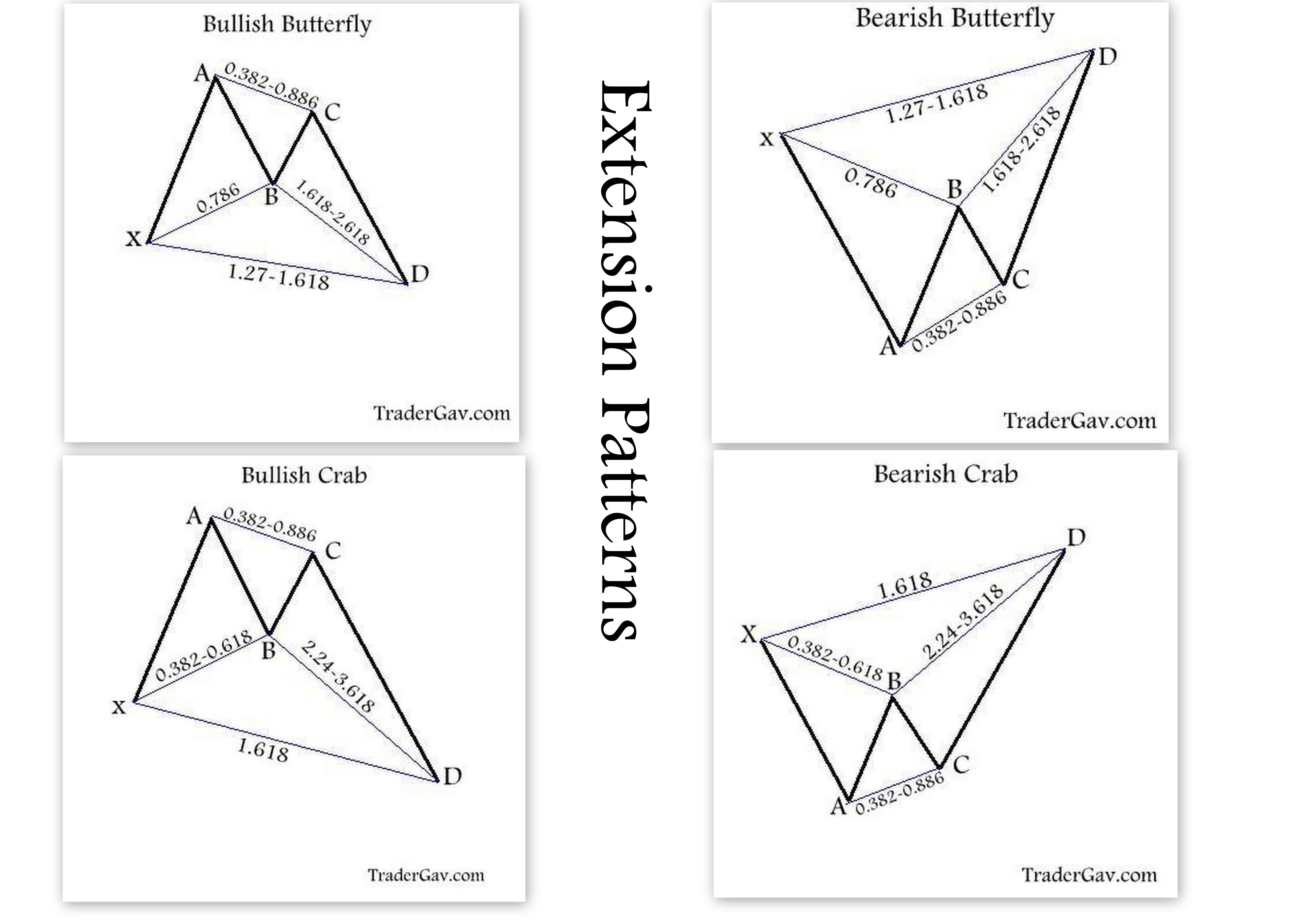

Here are the harmonic patterns that I trade and some guidelines I use in my trading.

Learn Trading

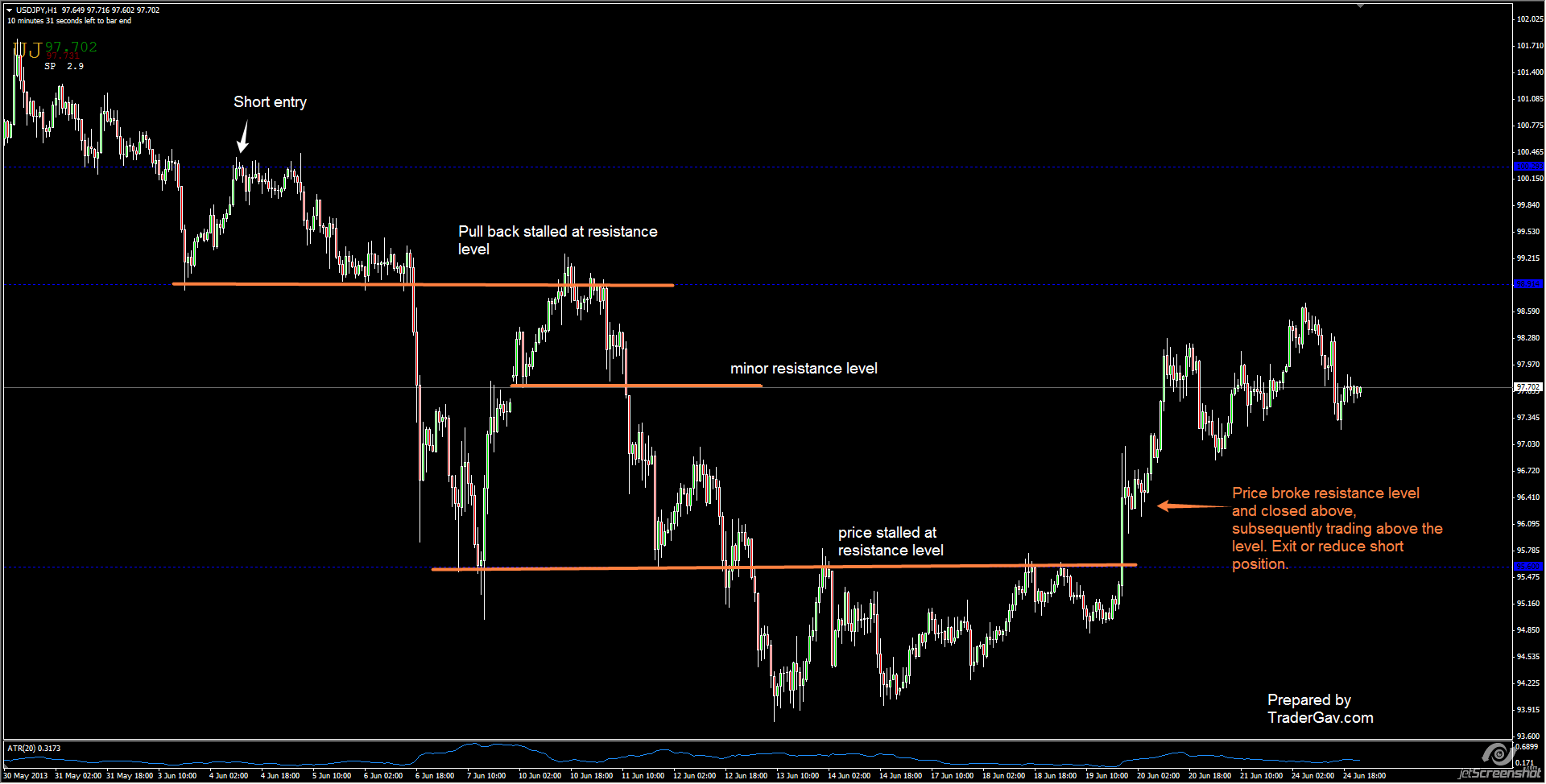

Trading setup: Immediate retest of broken support and resistance level

Very often, on twitter or forums, I see people posting some simple trading setups, and give them some odd names, then call it their inventions. Laughable indeed. Anyway, kudos to them for providing some amusements. One of the most commonly seen setup is Immediate retest of broken support/resistance level. Well, regardless of the names given […]

Managing your trade :Exit strategy

I am not the inventor of this strategy. It is widely available on the internet, and I have no idea who was the originator. I have found it to be effective when using simple support/resistance methodology to manage trades. The Simple Exit Strategy This is an exit strategy using a 5-min chart, however, it […]

Pre-market preparations by Linda Raschke

Found this clip on Youtube. Linda Raschke�discusses her pre-market preparations, technical and fundamental analysis, and important steps traders should take to prepare for each trading day.

Video: Trading Lesson of the Week – Trading is a Skill

This is a short trading lesson from Bella (@smbcapital), the author of One Good Trade: Inside the Highly Competitive World of Proprietary Trading (Wiley Trading) (I highly recommend the book). Trading is a skill. “The answer is, you develop your trading skill day by day”. Excellent point. Watch this after you have summarized your trading […]

Why and How to Use and Determine Stops by Linda Raschke

Here is another video clip of Linda Raschke. This time, she talks about Why & How to use and determine stops. Since today 31st May is observed as bank holiday in both London and U.S. I’d rather spend some time watching the video instead of the thin volume market. Here we go, enjoy.