I have been posting some harmonic setups over the years, I thought maybe a simple harmonic trading guide might help readers who are following this type of trading. For the harmonic patterns I am using, there are some Fibonacci ratios to follow. They might look complicated, but they are not. Once you get the hang of them, it is not too difficult to identify.

One of the important things to note is, I do not trading harmonic patterns exclusively. The patterns are used as an aid to my over analysis, an odd enhancer you may say.

Secondly, I prefer to look at harmonic patterns in higher time time frames, such as 4 hours and daily. This is not to say the patterns do no work in lower time frame, it is just personal preference. I found that the patterns work well in medium to longer term swing trading.

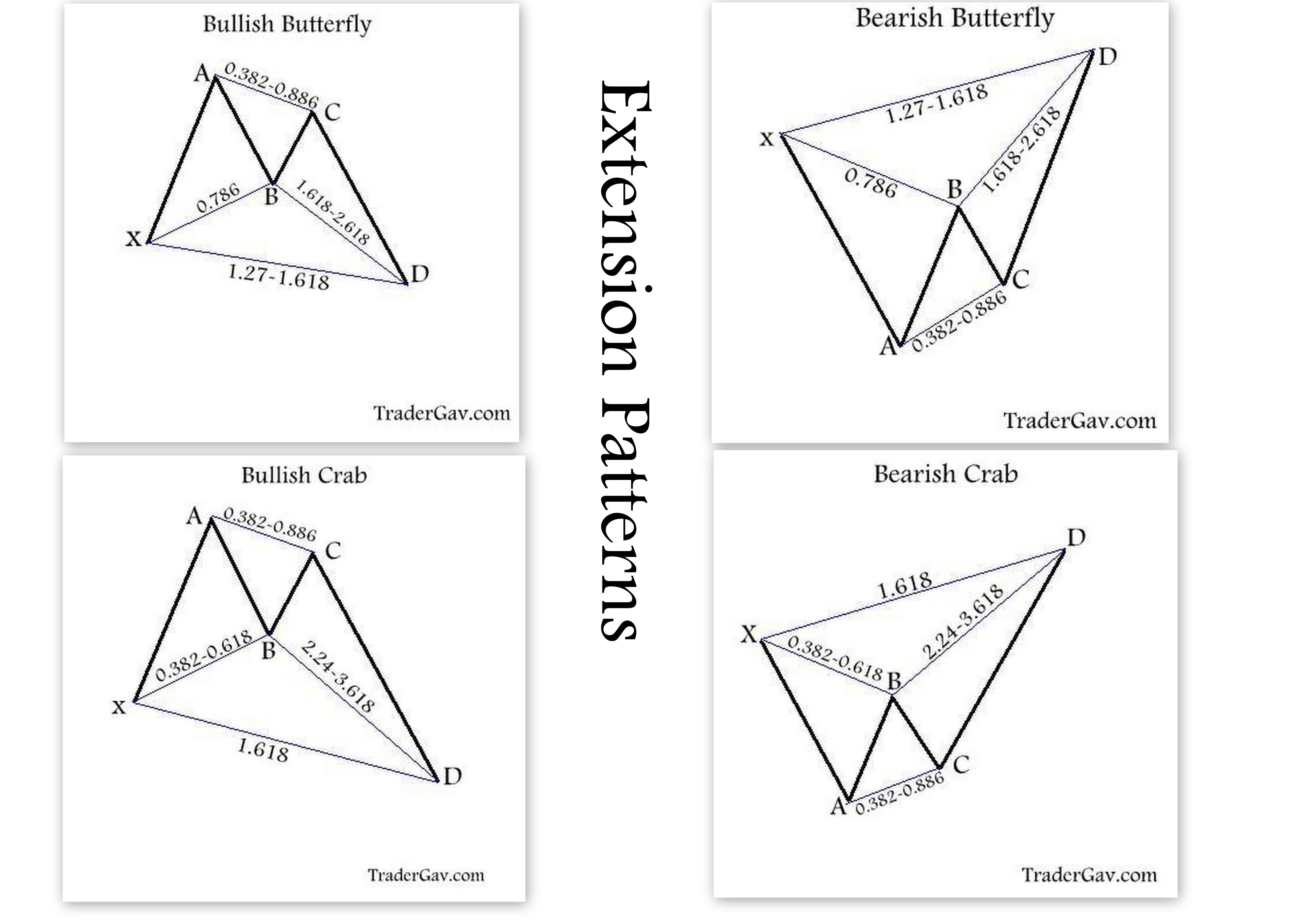

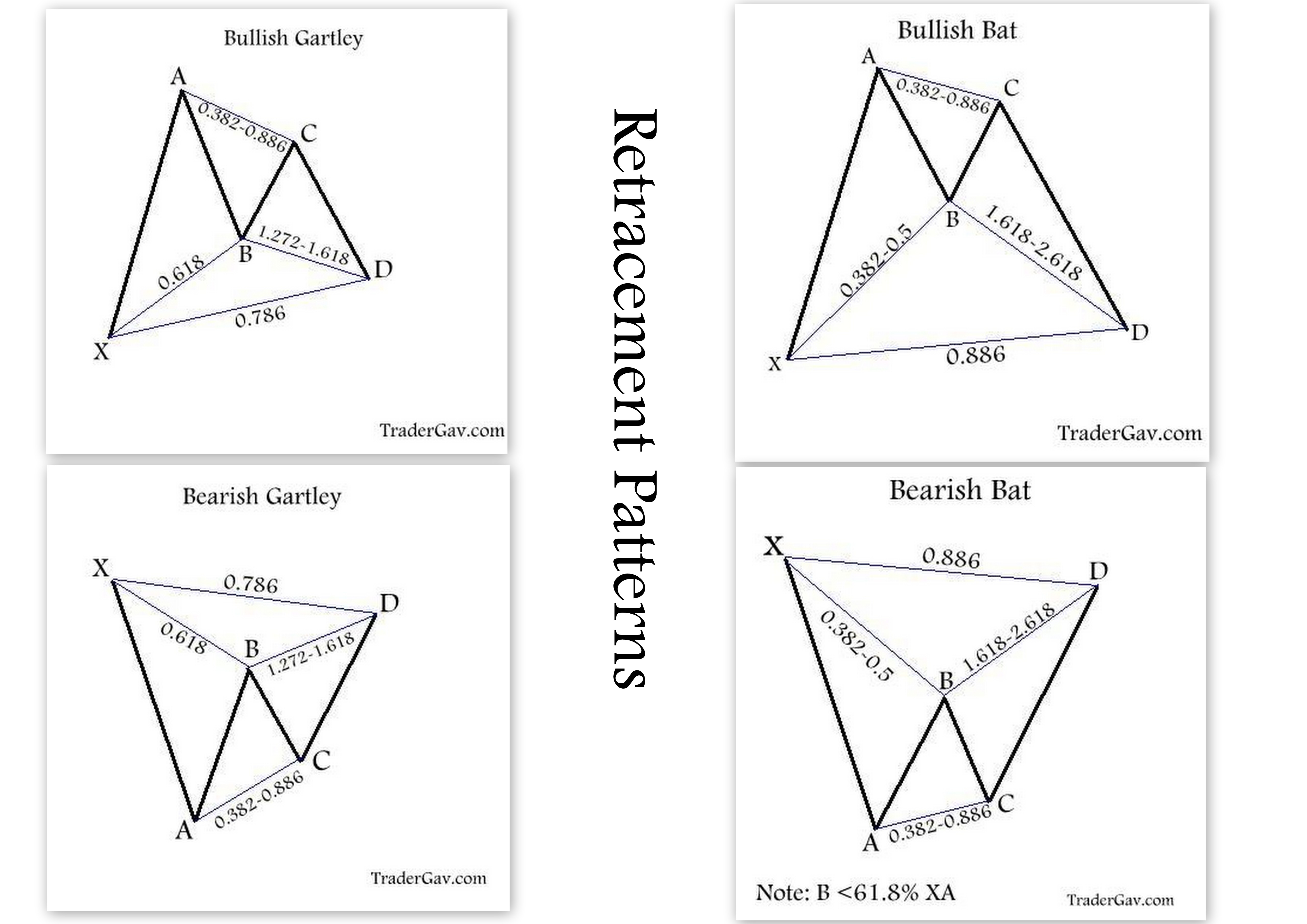

For the start, harmonic patterns are divided into two categories, Extension patterns and Retracement patterns.

- Extension patterns are Bullish Butterfly, Bearish Butterfly, Bullish Crab and Bearish Crab.

- Retracement patterns are Bullish Gartley, Bearish Gartley, Bullish Bat and Bearish Bat.

These are the patterns that I used, and the list is not exhaustive. The “hardcore” harmonic traders might look at more patterns such as 5-0, Shark etc and in more time frames.

So here are the key factors I am looking at when using harmonic patterns

- Identify key market levels, in other words, key support resistance levels. This one of the MOST important step.

- Identify established price channel. A channel also represent the current trend, applying the appropriate patterns to follow the trend.

Harmonic Trading Guide

Below are the patterns with respective Fibonacci ratios. I also prepared two simple cheat sheets in PDF forms for readers who would prefer to print it out.

My opinion about harmonic trading is, Do Not Complicate things. Keep it simple, be clear with what you are doing, are you using the patterns as entry trigger? or are you using them for directional bias setting (I will discuss more on this in the future posts), and, as always, make sure the patterns are forming in the right place, i.e key levels or channels.

Here are the cheat-sheets in PDF format that I have prepared in case you prefer a printout.

You can also find my harmonic setups/charts in Harmonic trading posts section

From the desk of TraderGav.com

I wish to learn more about harmonic pattern.

I am a newbie PSE Trader

Thank you Gav for sharing your info. Do you know anything about Gann square of nine?

Augustine

Hi Augustine,

The short answer is no. I’ve never studied Gann materials in depth. Read some during early stage of my trading (years ago), but did not pay any attention to it.