I am not the inventor of this strategy. It is widely available on the internet, and I have no idea who was the originator. I have found it to be effective when using simple support/resistance methodology to manage trades.

The Simple Exit Strategy

This is an exit strategy using a 5-min chart, however, it can be easily applied to any time frames. The basic idea is to use a lower time frame (about 4 to 6 times lower than the trading time frame) to manage a position and using support resistance to define a better exit. For example, if you are trading the hourly trend, you can apply this strategy in M15/M5 to manage your position. I’ve found this strategy to be useful in my Forex trading.

Rules:

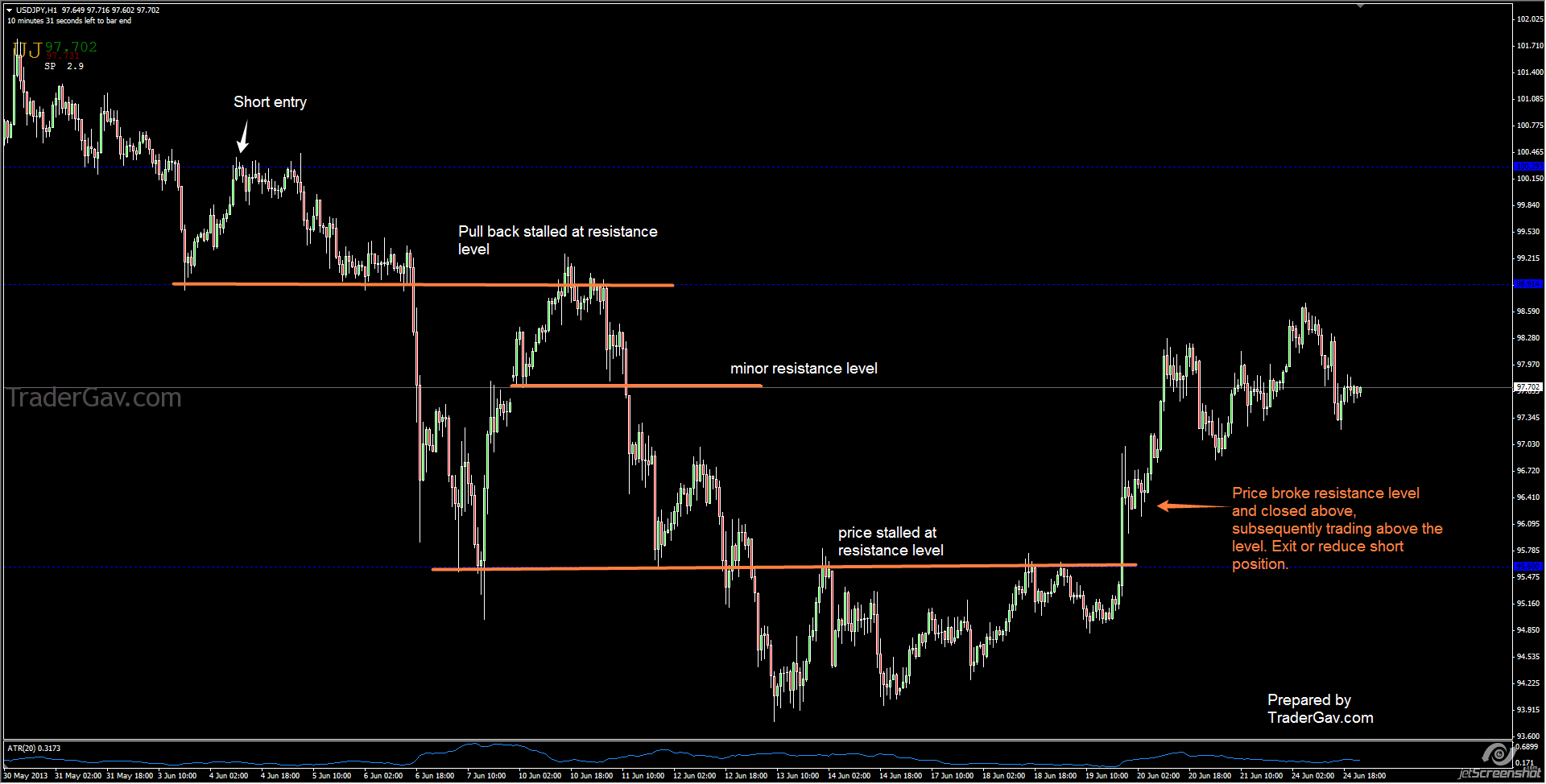

- When previous resistance becomes support, it is time to consider exiting a SHORT position.

- When previous support becomes resistance, it is time to consider exiting a LONG position

The EURUSD trade below is a good example to illustrate this strategy. Assuming we entered a short position at 1.27, and the market started to sell off, we decided not to set a hard profit target, instead, we follow the price action to decide when to exit. Looking at the chart below, without a planned strategy, where would you exit? chicken out when there were small price bounces?

Here is the idea. In a downtrend, prices will form lower highs and lower lows. And previous support acts as resistance. By following this principle, we let the profit run until the previous resistance level was violated and becoming a new support level. This signals a potential trend change.

Again, no strategy is perfect, we might still miss out on some even bigger profits. However, in my personal opinion, it is good enough to manage short term position. Have a look at this method.

Below is the hourly chart of USDJPY to illustrate this strategy:

The best forex trading strategies are the ones that know when to be aggressive (letting the profitable positions ride) and know when to exit promptly (to cut losses or take profit.) By using the simple concept of support and resistance, traders will be able to map the market and manage a position effectively.

This post was originally written back in 2010. I have updated with an up-to-date chart and refined the strategy.

Leave a Reply