Here is the NZDJPY setup I tweeted this morning. It is one of my favorite setups. There’s confluence of support level, Fib levels, and channel bottom. It is a bullish harmonic setup.

Here is the chart to confuse you.

Trade well.

Here is the NZDJPY setup I tweeted this morning. It is one of my favorite setups. There’s confluence of support level, Fib levels, and channel bottom. It is a bullish harmonic setup.

Here is the chart to confuse you.

Trade well.

We have a gap up during Monday Asian morning. I have two levels in my radar for potential short position. It is the confluence of resistance level, Fib extensions and channel median line.

[tab: Setup]

Here is the CHART to confuse you.

[tab: Update 24 Nov 2010]

This type of ‘fast-and-furious’ sell off does not happen very often, but I try to make sure I am in the market when it happens. Last piece of EURJPY short was closed few hours ago. Market seems to be a little messy now. I have no position at the moment, prefer to watch and wait for the market to settle for now.

Here is the CHART

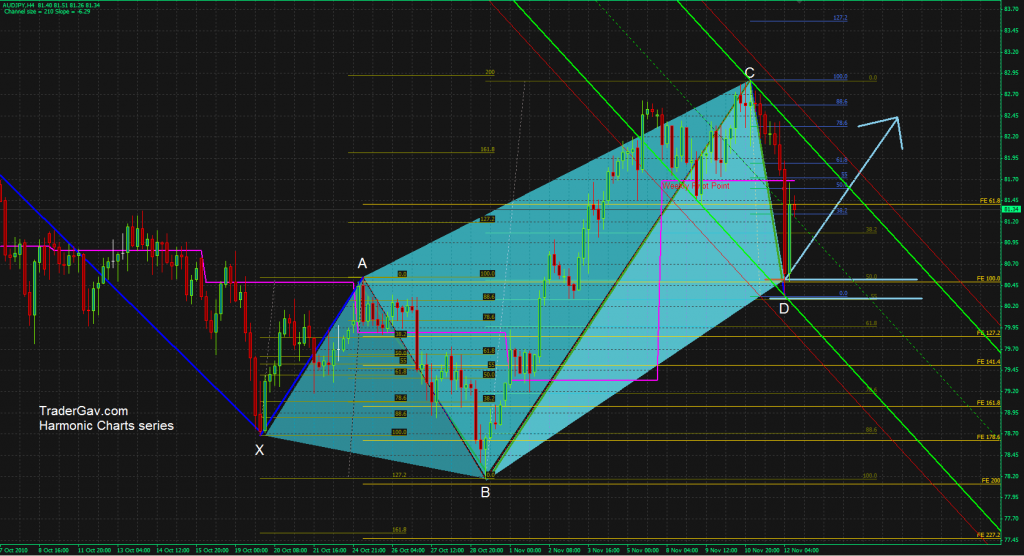

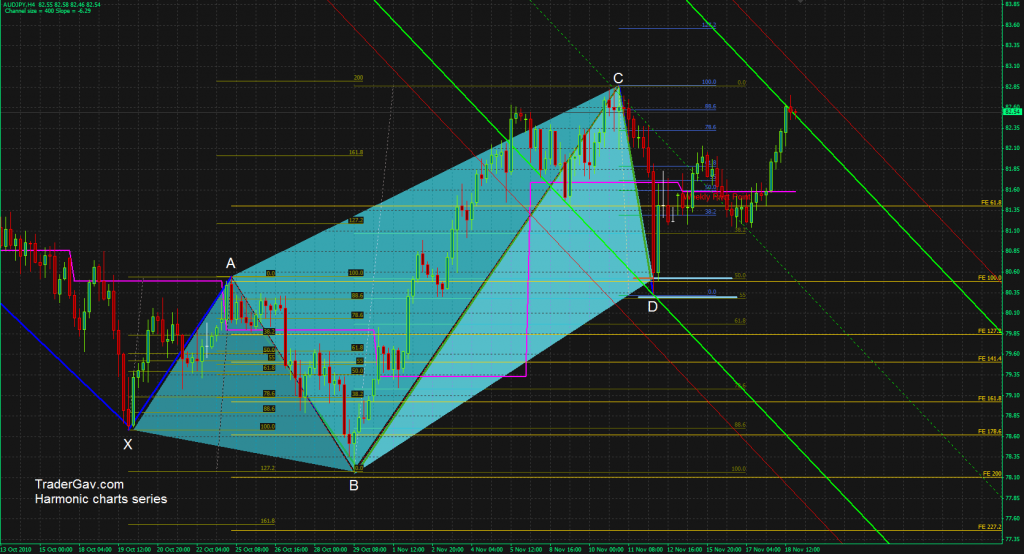

Here is the $AUDJPY chart I mentioned earlier on. I am holding long position, with some profit booked, and stop is now at break even. This is a text book 5-0 formation where all fib levels are nicely respected.

[tab: Setup]

Here is the chart to confuse you.

Have a great weekend!

[tab: Update 18 Nov 2010]

The pattern works now nicely. With the weakness of JPY at the moment, and AUD gaining some strength, the pair might stretch further. But, there is also a possibility of forming triple tops, and now it is trading at the top of channel as well…so..

Here is the updated chart.

I am looking at GOLD chart this morning, I got the feeling it might be the time to see some corrections soon. It is now trading around the top of the recent channel, and there are confluences of Fib extensions and harmonic patterns. I have two potential zones defined on my chart. Let’s see how it works out.

[tab: Setup]

Here is the CHART to confuse you.

Define your level, and trade the level.

Trade well.

[tab: Update 13 Nov 2010]

Here is the updated GOLD chart. We have a pretty nice pull back of GOLD (not without some initial shaking though)