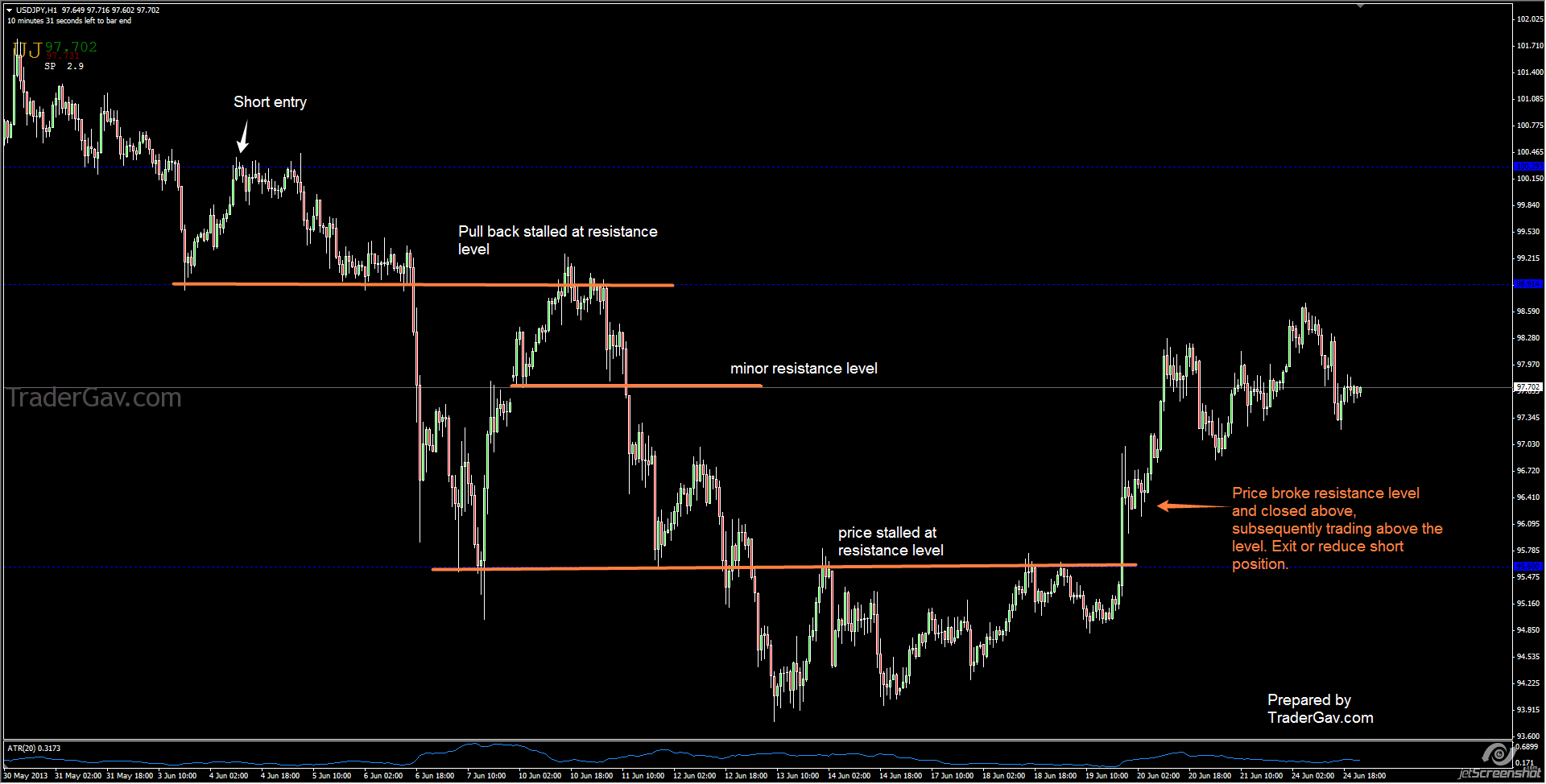

First of all, AUDUSD approached 0.9130/40 resistance level. This is a daily level, and price reacted and immediately pulled back to intraday (hourly) support level 0.9085. If you managed to get in short position at the first test of 9130 level, the setup should give you around 1 R at 0.9085. (Unless you used a ridiculous tight stop, then you might get more of it..but, heck, it doesn’t make too much sense to me)

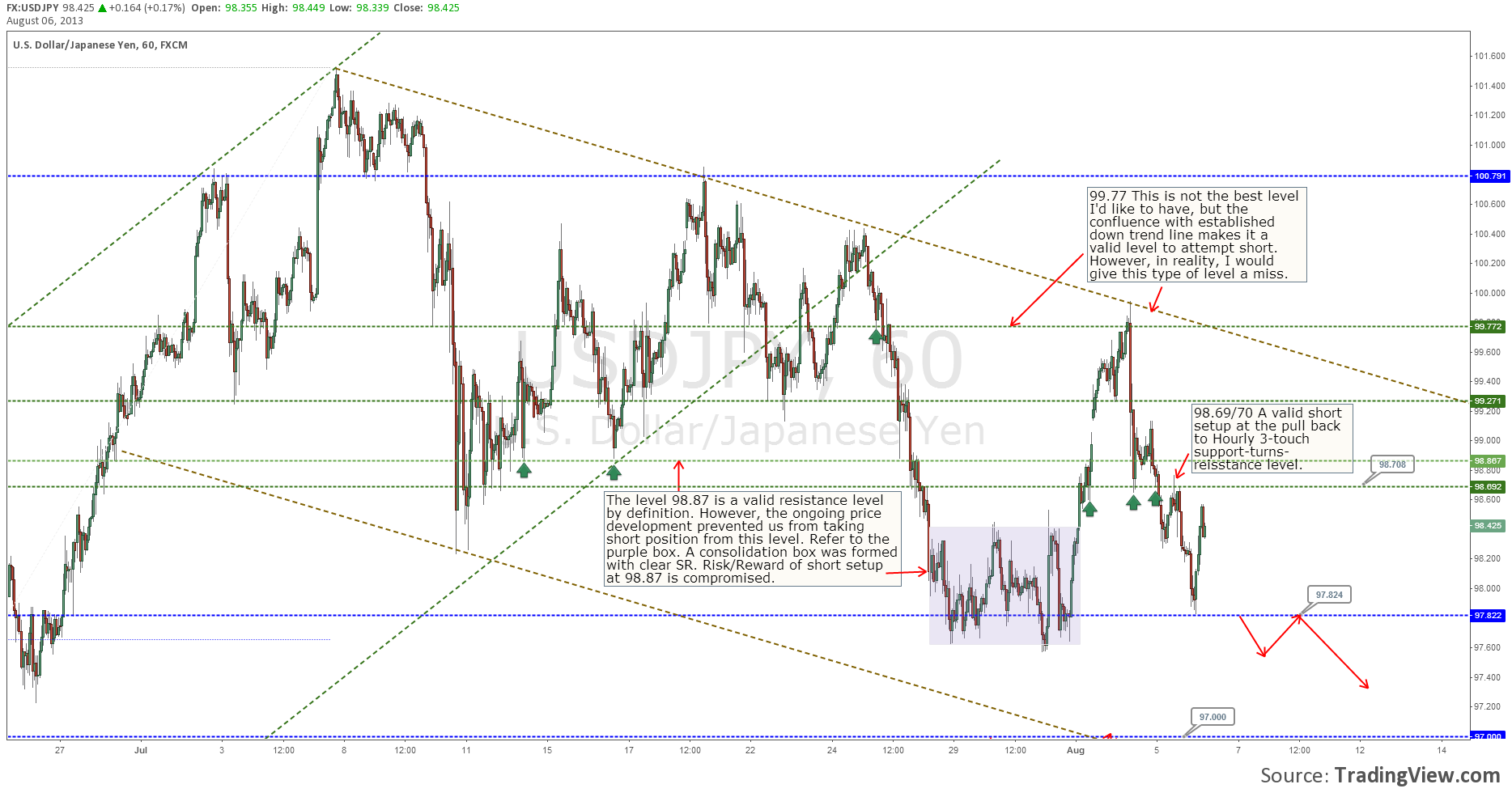

Here is the hour chart of AUDUSD

In case you’ve missed the first train of selling, I would prefer to wait for the break of 9085 and enter at the pull back to this level. It can be a rounded retest or immediate retest (read my butt kiss setup).

In addition, if you noticed starting from mid-0.89 down to mid-0.88 there was an accumulation/distribution pattern, and also can bee seen as multiple taps formation. Refer to the purple dash lines in the chart. 0.8943 was the decision level for this pattern, once it was broken, pull back to this level provided a valid long entry. With target set at slightly above 90 cents, it provided 1:2 risk reward ratio.

Our good friend, Steve at NoBrainertrades.com wrote an awesome blog post yesterday The Decision Making Plan – An Alternative Process to Trade Entry. In his PREP decision making process, the 1st action before starting a position is to identify profit target, identify where we are getting out of the trade. It makes total sense to me. Spend some time and read it.

We know price will normally react at the level, but the question is always, how far will it go. So, it is important to know where to enter a trade, it is even more important to have price projection, i.e where do you expect price to reach from here.

Hope you have a great week so far.

From the desk of TraderGav.com