I have been putting in a great deal of time and effort in futures trading lately. From refining strategy, writing plans (scrapping plans), back testing (not your fancy automated testing, I basically replayed markets), setting up accounts, negotiate commissions etc. The intensive process has almost burnt me out sometimes, but it is also a good […]

blogs

Levels trading tips from hindsight analysis

First of all, AUDUSD approached 0.9130/40 resistance level. This is a daily level, and price reacted and immediately pulled back to intraday (hourly) support level 0.9085. If you managed to get in short position at the first test of 9130 level, the setup should give you around 1 R at 0.9085. (Unless you used a […]

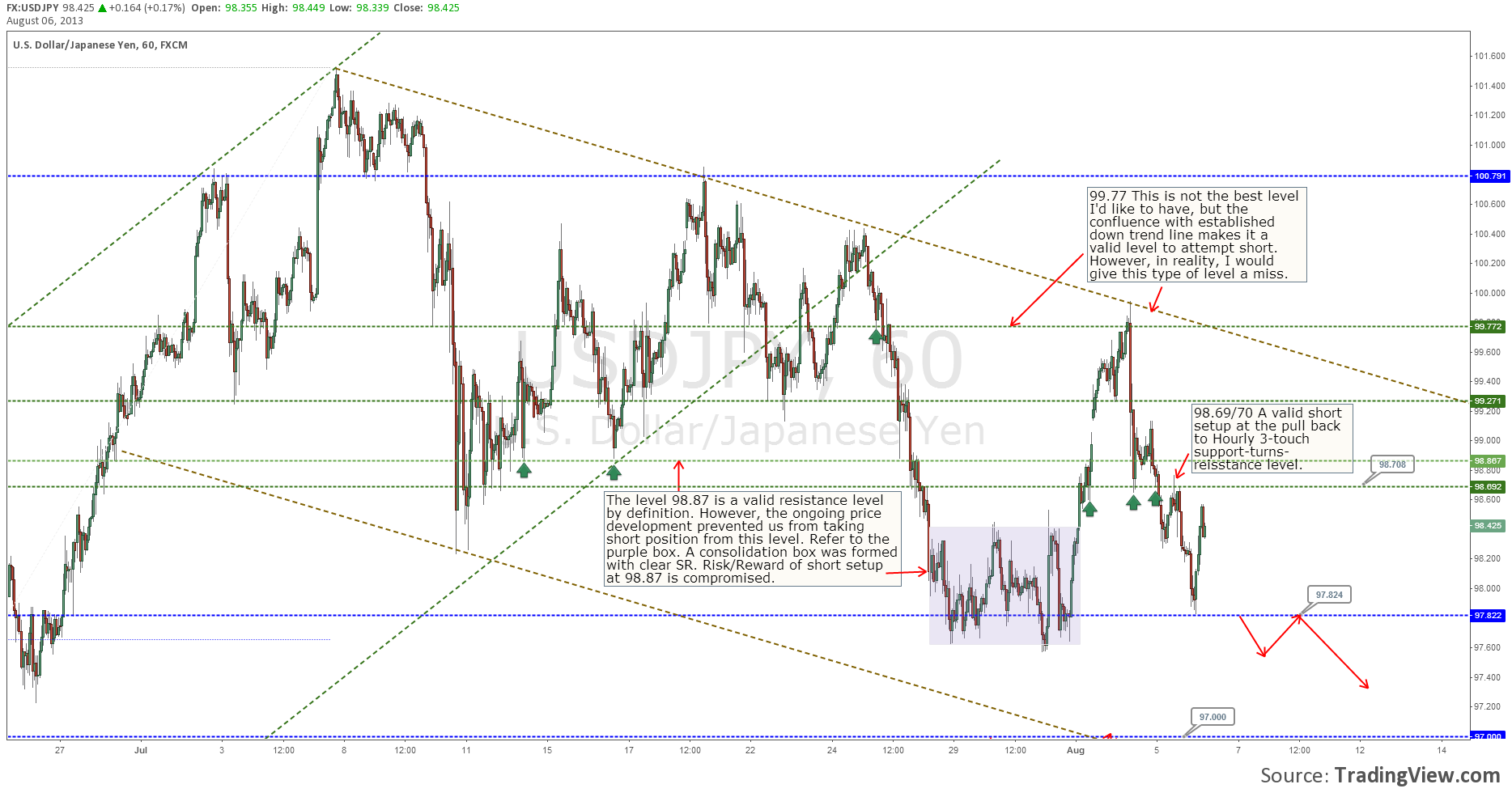

Some levels trading lesson from USDJPY

I thought I will write a quick follow up of the USDJPY development. Well, in the bigger picture, price is still trading within the channel as shown in my previous post Here and Here. However, there are some developments in Hourly time frame which I can use to show how I approach the levels. This […]

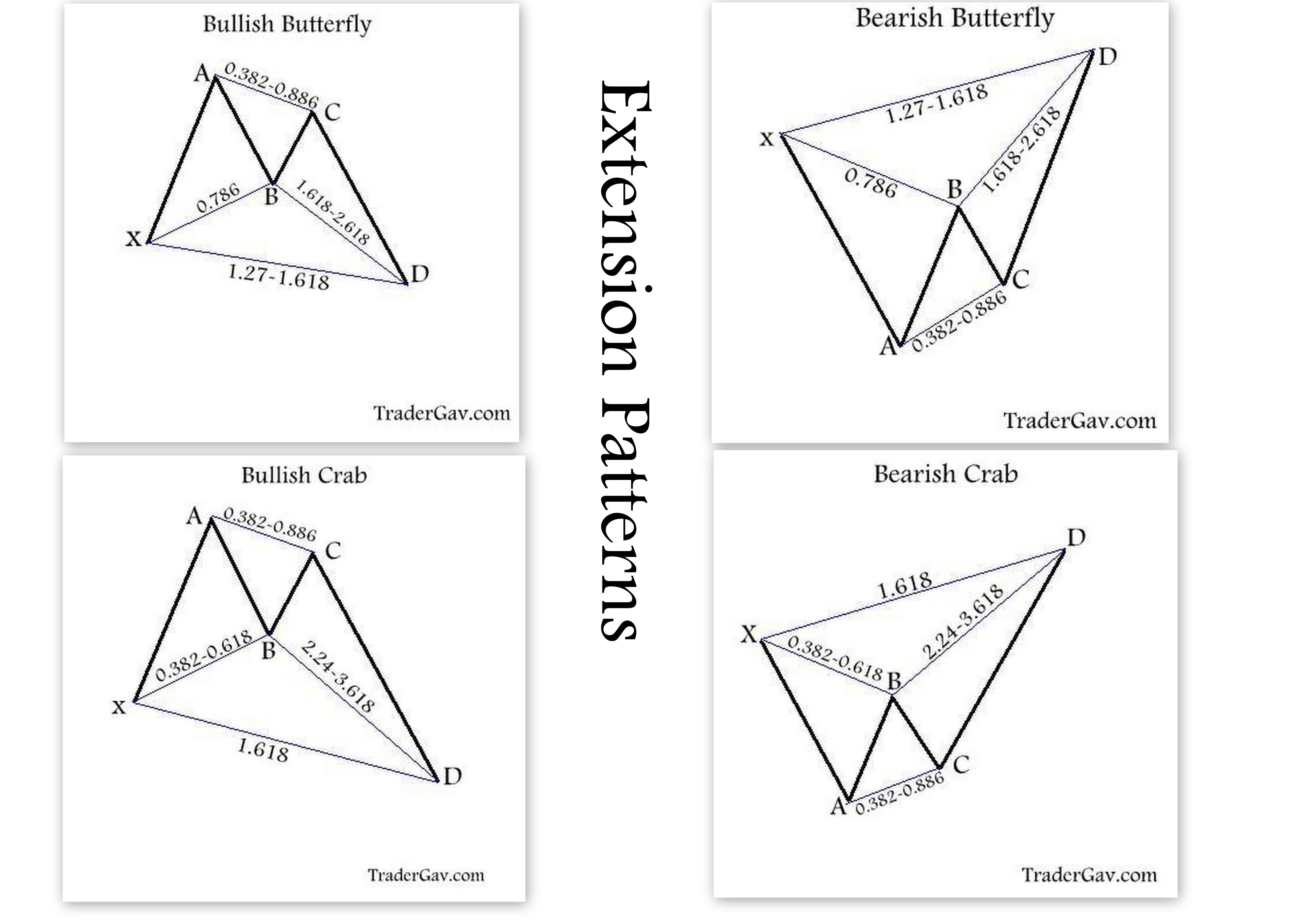

My Harmonic trading guide

Here are the harmonic patterns that I trade and some guidelines I use in my trading.

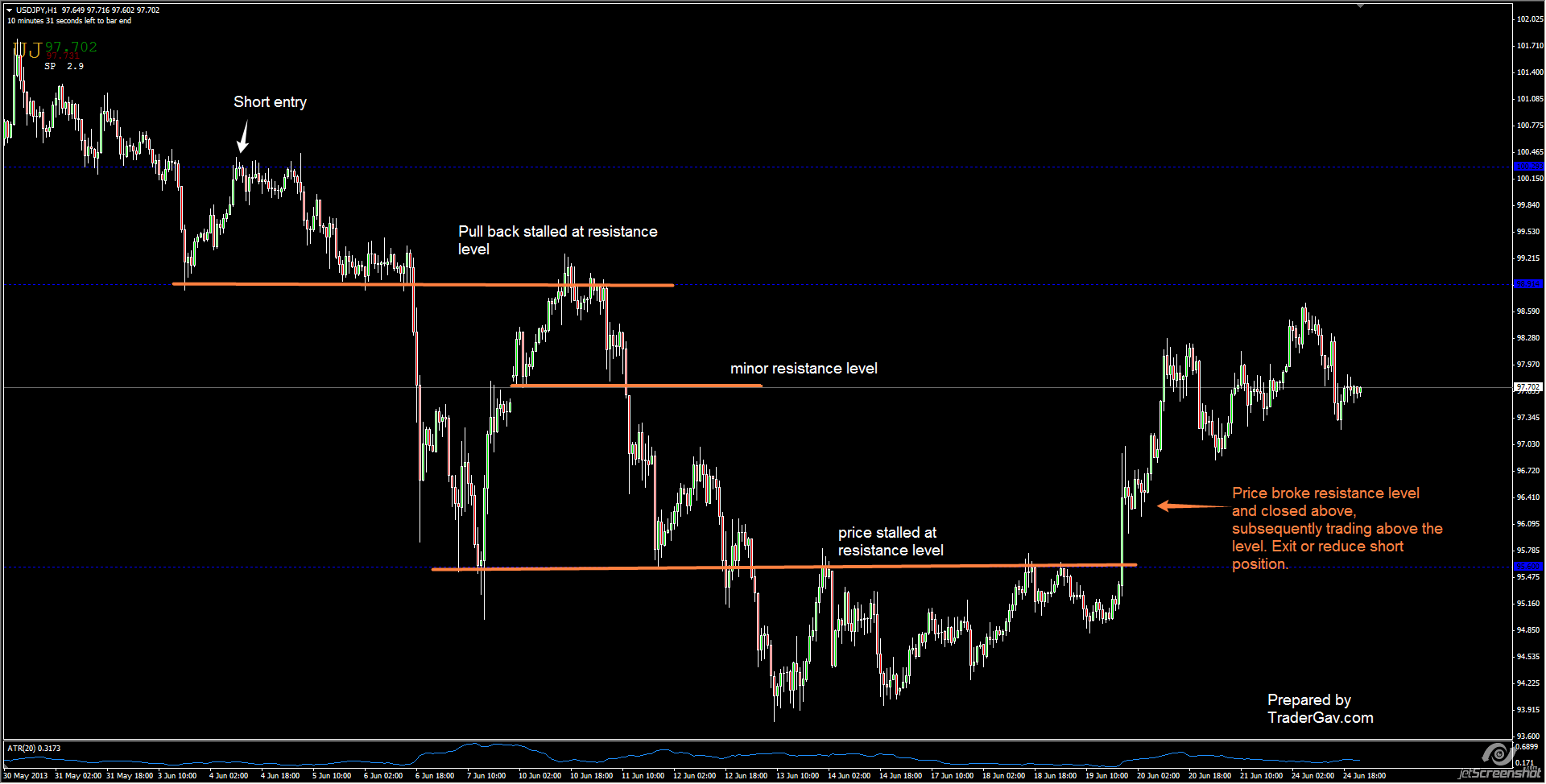

Trading setup: Immediate retest of broken support and resistance level

Very often, on twitter or forums, I see people posting some simple trading setups, and give them some odd names, then call it their inventions. Laughable indeed. Anyway, kudos to them for providing some amusements. One of the most commonly seen setup is Immediate retest of broken support/resistance level. Well, regardless of the names given […]

Managing your trade :Exit strategy

I am not the inventor of this strategy. It is widely available on the internet, and I have no idea who was the originator. I have found it to be effective when using simple support/resistance methodology to manage trades. The Simple Exit Strategy This is an exit strategy using a 5-min chart, however, it […]