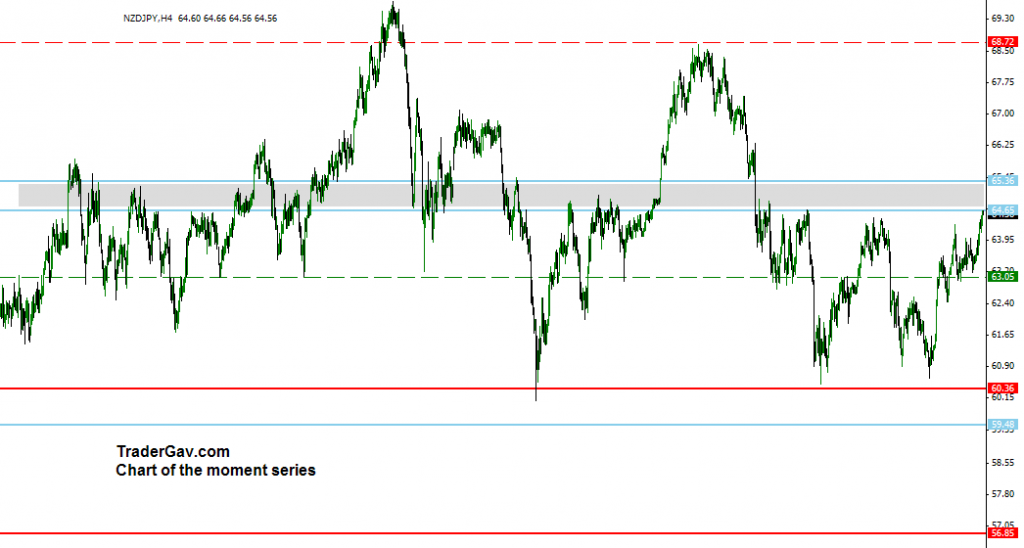

I don’t normally post detailed result of my trades. I just thought this chart is a beauty. Referring to the previous post for the short setup of NZDJPY. Target was hit. 63.05. And, maybe, this trade shows a little effort to plan your trade will reward you.

Here is the charts.