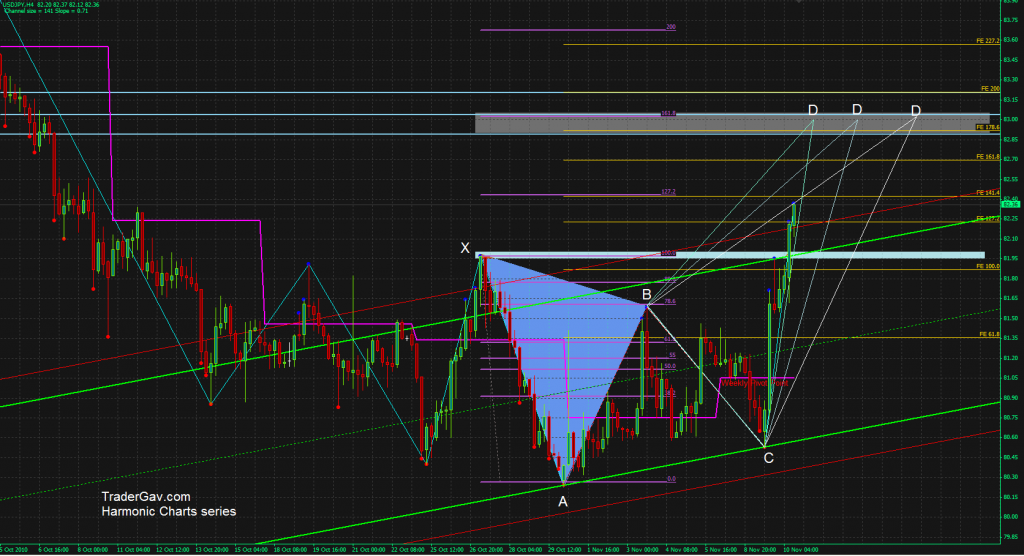

Here is the USDJPY chart. I am looking at 83 area for potential short trade. There are confluences of Fib extensions, harmonic patterns formation, and price resistance area.

Here is the chart to confuse you.

I am looking at GOLD chart this morning, I got the feeling it might be the time to see some corrections soon. It is now trading around the top of the recent channel, and there are confluences of Fib extensions and harmonic patterns. I have two potential zones defined on my chart. Let’s see how it works out.

[tab: Setup]

Here is the CHART to confuse you.

Define your level, and trade the level.

Trade well.

[tab: Update 13 Nov 2010]

Here is the updated GOLD chart. We have a pretty nice pull back of GOLD (not without some initial shaking though)

by Gav 4 Comments

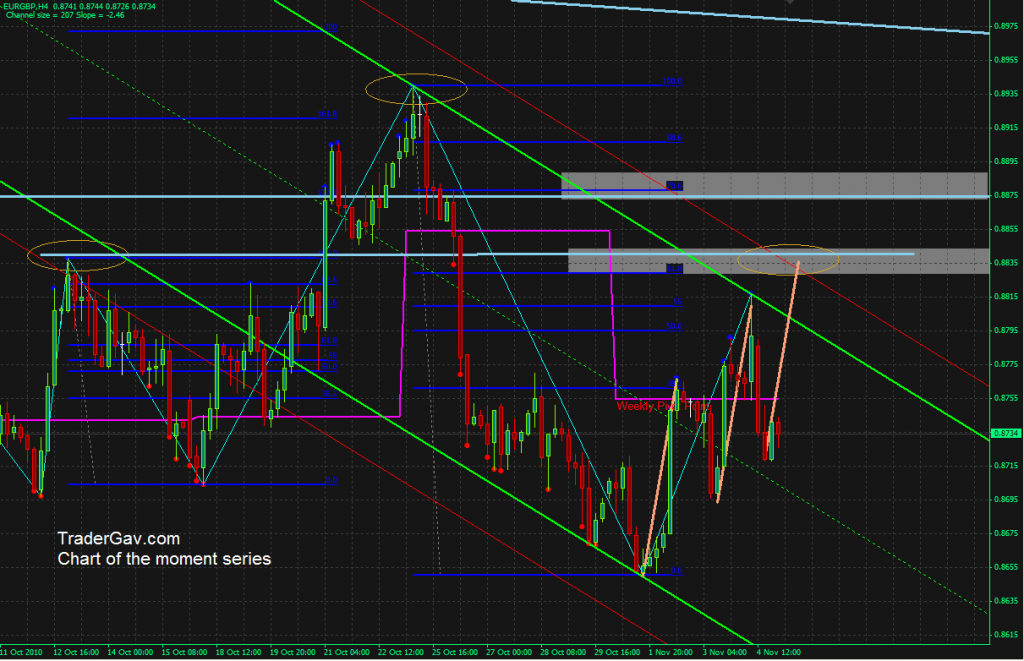

Here is what I see in $EURGBP. I am looking at the potential head and shoulder formation. Let’s see how it works out.

[tab: Setup]

Here is the CHART! (click on the chart to magnify)

[tab: Update]

EURGBP did not follow through, and it failed to reach the level to form H&S. No trade was taken.

by Gav 3 Comments

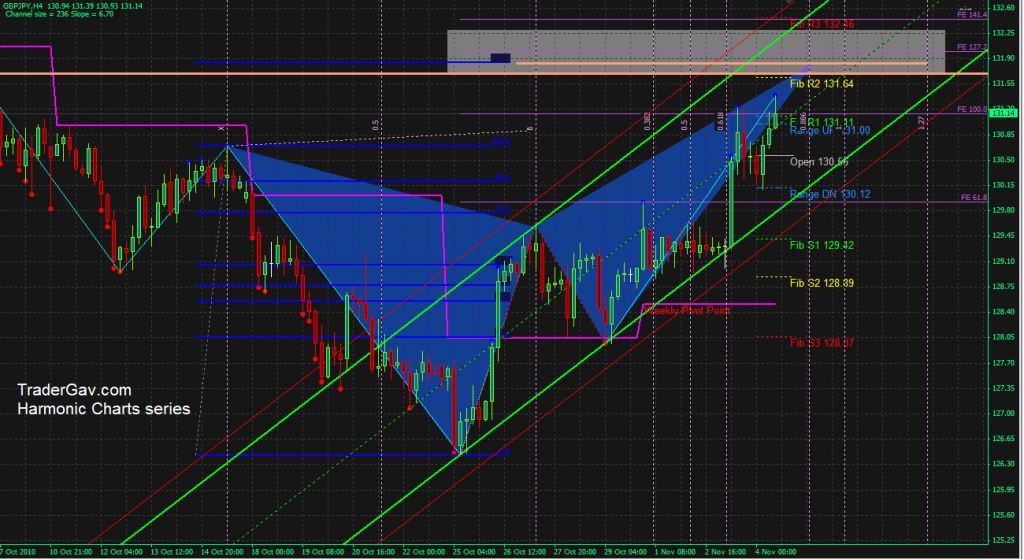

Let’s have a look at the beast, $GBPJPY. I see some confluences of Fib levels, resistance levels and harmonic pattern formation. I am interested in getting in some shorts around 131.80 level or slightly above this level. Let’s see..

[tab: Setup]

Here is the…. CHART!

[tab: Trade update]

No update at the moment, come back later.

[tab:END]

by Gav

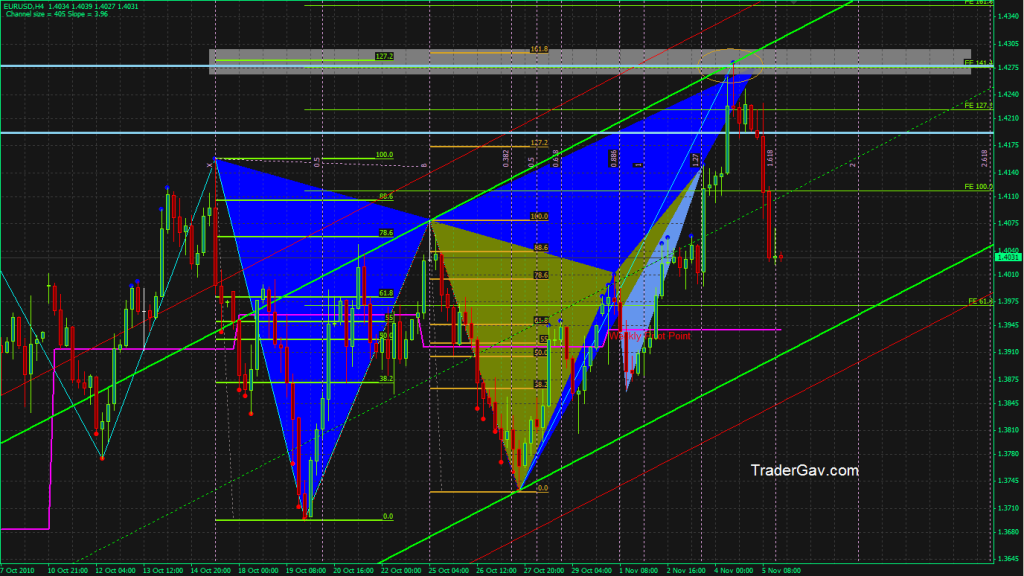

Here is what I see in $EURUSD now. I might be completely wrong and miss the move, but I would prefer to get in short position somewhere near 1.4250 to 1.43 level. I see the confluence of Fib levels, resistance zone in weekly chart, and a harmonic pattern. I’ll be looking at this setup closely next week, if NFP doesn’t destroy the technical picture.

Here is the CHART! (click on the chart to magnify)

[tab: setup ]

[tab: Update ]

EURUSD hit the zone, and reversed. Setup worked out nicely.

[tab:END]