It is very interesting to see SIMSCI opened low and moved higher in the first 45 minutes. It looks slightly positive. The drop was obviously contributed by reddish overnight DJ. It is an ambiguous situation now. SIMSCI refused to deep further. I would consider a long position or staying aside (no trade). There is a […]

Archives for June 2006

RE: SIMSCI 05-June-2006 : Potential Short: Trade closed

[photopress:simsci_12_min_full_day.jpg,full,pp_image] Trailing stop was moved to break even point when low of 284.6 is achieved. I was tempted to take profit, however, I decided to have a perfect execution of my plan without any emotional factor. Holding on the position with nearly 0 risk involved. I would admit that, it is tough to resist temptation […]

RE: SIMSCI 05-June-2006: Potential Short

Sell order was executed at 285.6 immediately after market reopen for afternoon session. However, selling force was not strong. It was hanging in the air with small flunctuation. U.S futures are in negative territory now. Watch out for Nikkei futures reopen at 330pm.

SIMSCI 05-June-2006: Potential Short

With negative biased sentiment. I am looking for price setup for possible short sell opportunity for intraday SIMSCI. Market seems to be very quiet at this point of time.

SIMSCI view ended 02-June-2006

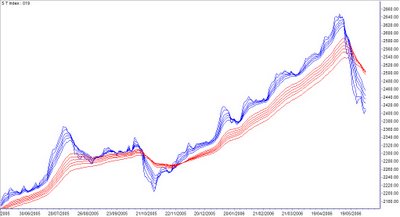

It does not look better even after last Friday’s rebound. SIMSCI futures is current stucked between support and resistance level. Immediate resistance level 289.5 while immediate support appears to be at 277.6 A downtrend channel is well formed. An analysis on SIMSCI futures can also be found at Traderswin Futures Trading Blog.

Trend analysis : STI & UOB Sesdaq

STI To evaluate market condition , I am always examining trend characteristics. Short term group moving averages continue drifting downward and stay below long term moving averages. There was a minimal rebound at the end of last week, however, it is still below trigger line. Directional analysis wise, downtrend strength is staying flat, while negative […]