A short Twitter discussion about the importance of a higher probability setup and risk/reward ratio. And I have found out…

Trading Lessons

My dinner conversation with a new trader

I had an interesting/harsh conversation with a new trader. I thought it might be useful to you.

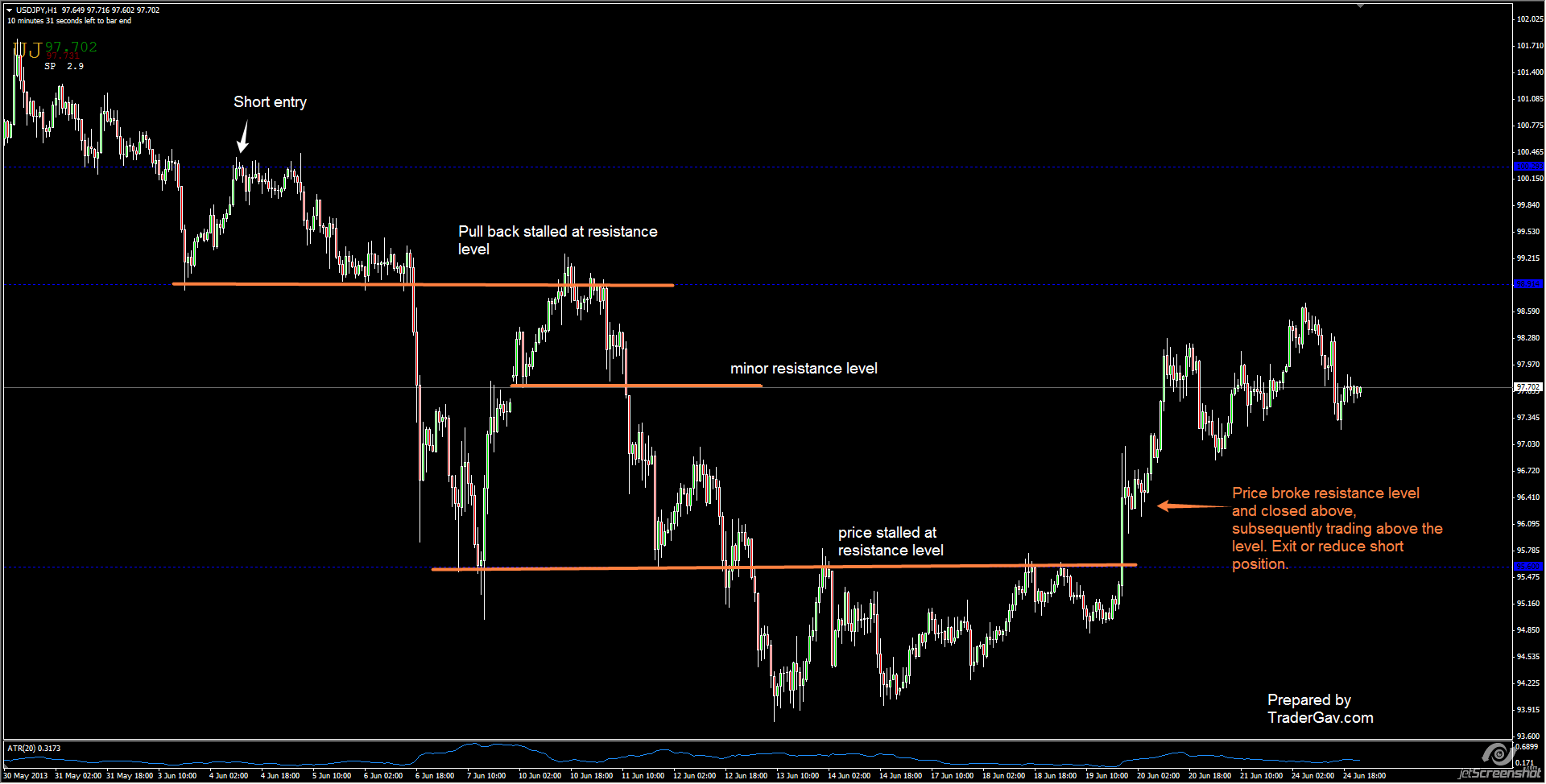

Managing your trade :Exit strategy

I am not the inventor of this strategy. It is widely available on the internet, and I have no idea who was the originator. I have found it to be effective when using simple support/resistance methodology to manage trades. The Simple Exit Strategy This is an exit strategy using a 5-min chart, however, it […]

Coffee Thoughts 04 Nov 2012

After a series of trades (more than 30 trades), if you� are having winning rate greater that 80%,� maybe it is time to look into your exit/profit taking strategy.

Coffee Thoughts 02 November 2012

Capital preservation is important. Risk management is important. But the trader’s job is to risk and make money, not sitting in the office to preserve capital. When it is time to trade, just trade. Capital is a tool for you to use to make more money, not for you to preserve. If you want to […]

Coffee Thoughts 31 Oct 2012

Looking out the window, you see it is raining. Put your hand out of the window, you know it is raining. And yet, you still feel the need to view the website or call Bureau of Meteorology to confirm if it is really raining. Some traders trade in this way. Is the the […]