The Silent Killer: How Inconsistent Trade Management Bleeds Your Account DryReal talk from the trenches Most traders obsess over entries.New setup? Screenshot it.Clean breakout? Love it.Indicator combo? Let’s backtest it for six months. Cool. But here’s the kicker… It’s not your entries that are killing your account.It’s your exits. The wildly inconsistent ones. The Setup […]

FX

My dinner conversation with a new trader

I had an interesting/harsh conversation with a new trader. I thought it might be useful to you.

$GBPJPY potential reaction zone 20 Feb 2013

So, big sell off of GBP. There are loads of retracement levels for GBP crosses. I am taking GBPJPY to show potential reaction zone. M30 – Around 143.90 zone. A retest of previous support turned resistance, with confluence of supply line, and the base of sell off. This zone should provide some reactions. M5- Detailed […]

$AUDUSD 20 September 2012

Here is the 4-hour chart of AUDUSD. Just like last week, everybody was watching/talking about the daily pin bar, now we are presented with a obvious Head and Shoulder formation� in H4 chart.� I like the fact that 1.04 support is now broken, I am looking at further downside. Here is the …. CHART.

$NZDJPY 20 September 2012

Here is the $NZDJPY daily chart after NY session close yesterday. Very nice reaction at 65.50 ish zone. The major roadblock is seen at 64.30 ish zone now. It is a strong support zone formed by previous highs. Here is the…..CHART!

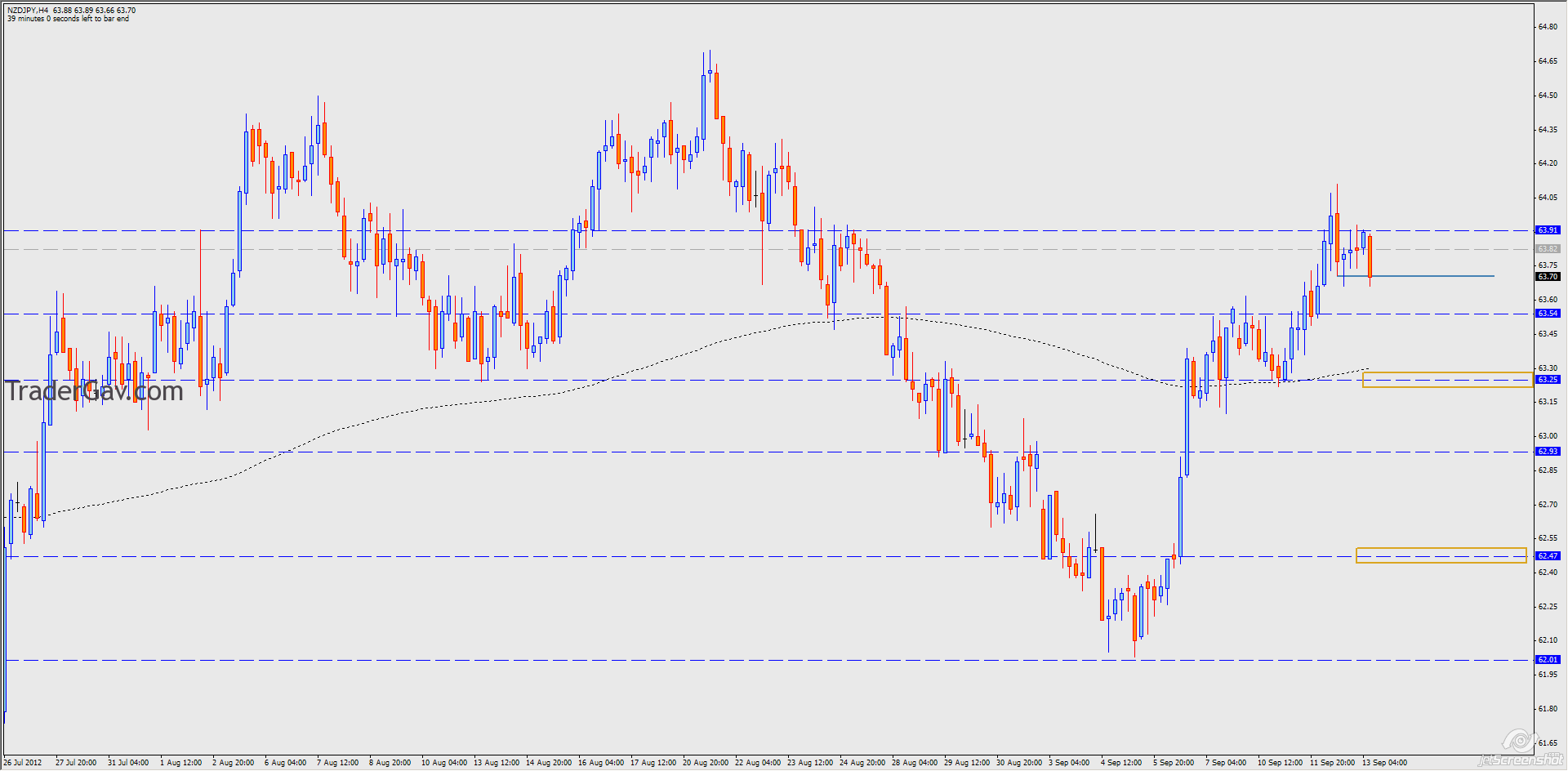

$NZDJPY 13 September 2012

NZDJPY looks interesting to me. A potential short. Just be aware high impact events (FOMC statement) later today.