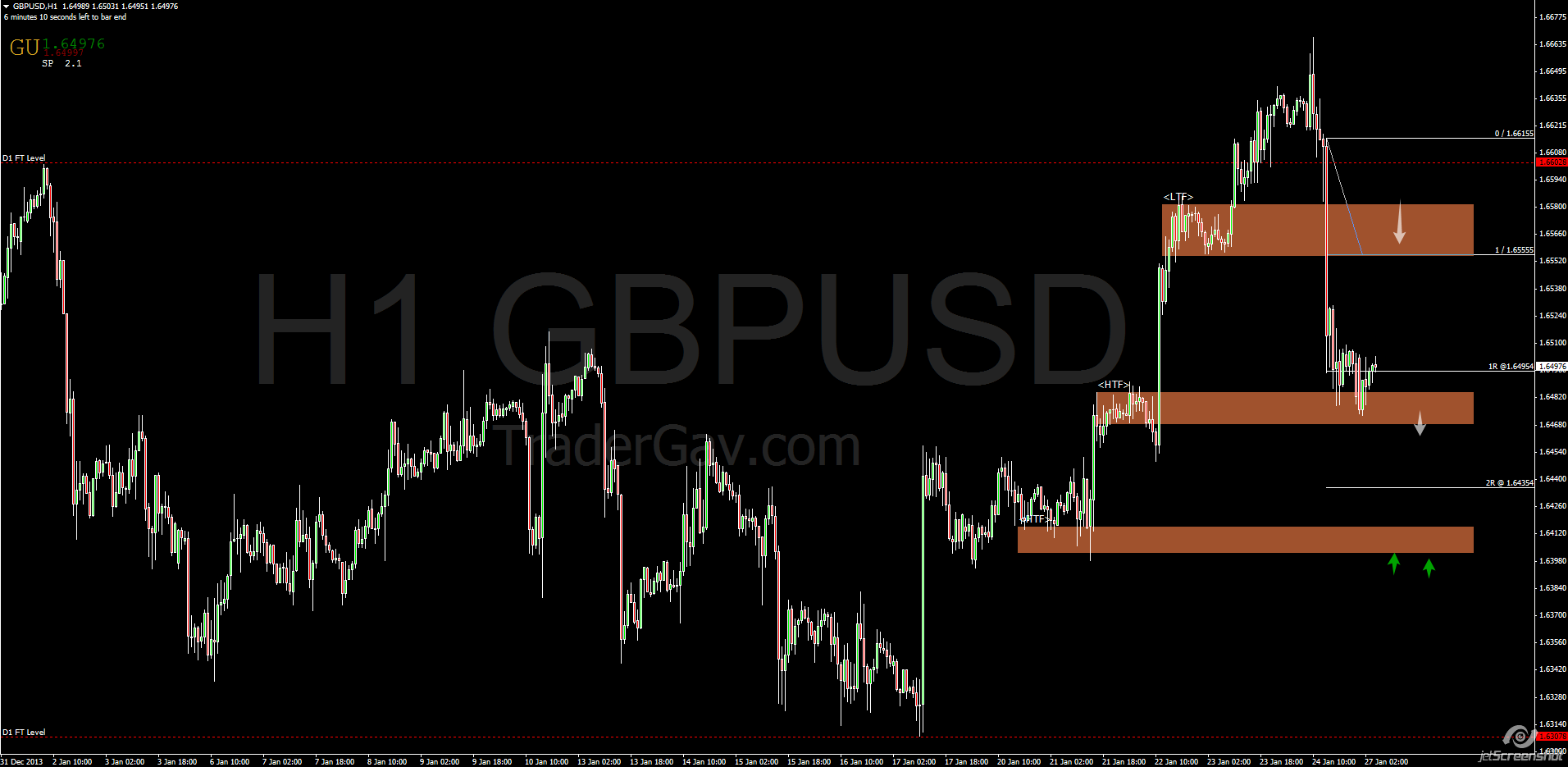

Here are some spot FX charts to start the week. Do shoot me a comment if you have any question.

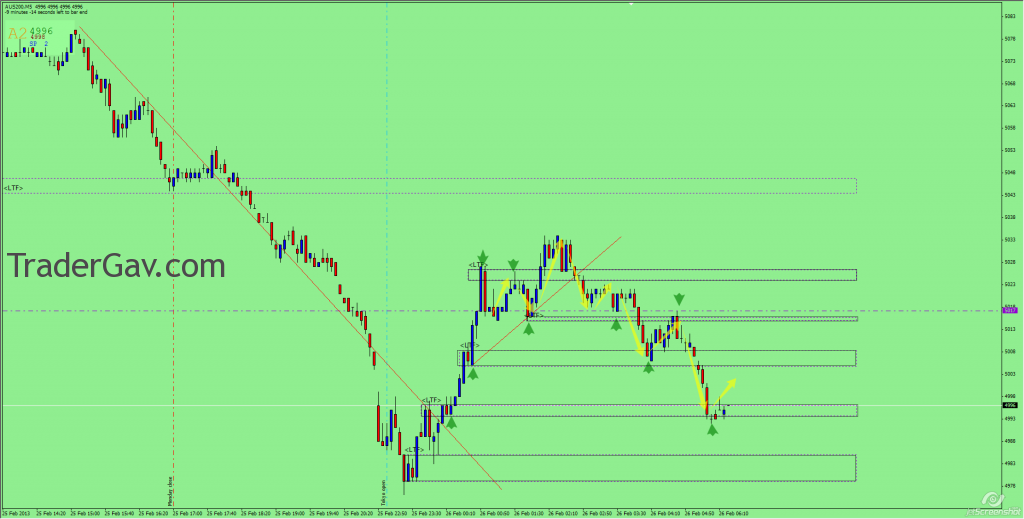

This is not a trade. I thought it might be helpful to post the intraday chart (5-min) of ASX200 index. If one pays enough attention to the chart, it is not too difficult to draw out the structure in terms of supply, demand zones.

First of all, I assume you have the knowledge to identify supply, demand zones. Support , resistance level is just the cluster of supply demand zones. The basis of this analysis is , price tends to rebound at the demand zone (reverse is true for short side), and the broken level tends to serve the opposite.

Have a look at the 5-minute chart below.

[tab: Setup 21 Feb 2013]

I am looking at the zone around 92.75 of USDJPY for some reactions. It is a retest of H1, H4 uptrend line and also the base of last spike. Let’s see how it goes.

[tab: update 22 Feb 2013]

It depends on the buffer you’ve set, or if you leave your order after the 1st rebound, you might have missed the entry by few pips. Annoying, it is. Anyway, here is the updated chart. Price reacted well at the demand zone. now heading to retest the back of inner trend line

.

[tab:Setup]

After RBA’s decision to leave cash rate on hold at 4.75%, I see an interesting setup in ASX200. This is an intraday trade setup. I am testing the idea with small risk. As long as the last low holds well, long bias remains. Let’s see how it works out.

Here is the …. CHART!

[tab:Update]

Support was broken. Pattern failed.