For some unknown reasons, I can’t tweet the chart I posted in Chart.ly. Anyway, here is the $AUDUSD chart I was talking about. A bearish butterfly formed within the bigger ABCD swing.

Trading Journal

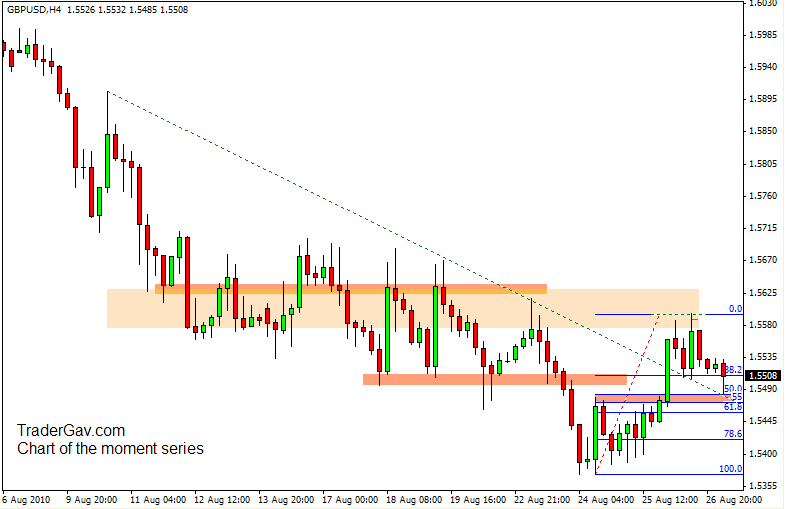

Updated Chart of $NZDUSD Bearish Butterfly

This is the quick update of my previous post of $NZDUSD. Kiwi dollar pulled back to 78.6% of the most recent down swing, the risk was back in town during the Wednesday session. And the bearish Butterfly pattern is still alive for now. I am watching the development of this pattern.

As always, it is easy to find a chart pattern or setup, but the essential skill is to learn how to manage a position. One setup, one pattern, can lead to different sets of result.

Here is the updated chart.

Again, here are some details of the pattern recognition I found it on FX360. Check out the website for details.

The bearish butterfly Pattern Rules

- The swing from A to D is a 127.2% or 161.8% extension of XA

- Note: D must be above X

- A valid ABCD must be observed in the extension move (AD)

- Additional confirmation may be attained when the times of the XAB and BCD triangles are in proportion

- A move beyond 161.8% negates the pattern and may suggest a potentially strong bullish continuation

ABCD $AUDUSD

AndrewUknown pointed out an ABCD formation in the comment section my $AUDUSD post few days ago. Now the bearish rising wedge might potentially be invalidated, well, it is too early to make the call now, if the bearish wedge failed to realize, we might see 0.9350. I thought I will post the chart here in case, some of my 12 readers are interested in Harmonic patterns.

Here is the Chart (click to view full chart)

Here are some guidelines or rules I took from FX360. They have been actively trading harmonic patterns, check out the website if you are interested in pattern recognition trading.

- Point A is a significant low, and point B is a significant high. In the move from A to B there can be no lows below point A, and no highs above point B

- Point C must be above point A. In the move from B to C there can be no highs above point B, and no lows below point C

- Ideally, point C will be 61.8% or 78.6% of AB. (Classic ABCD pattern)

- In strongly trending markets, BC may only be 38.2% or 50% of AB

- Point D must be above point B. In the move from C to D there can be no lows below point C, and no highs above point D.

- CD may equal AB. (AB=CD pattern)

- CD may be 127.2% or 161.8% of BC (Classic ABCD pattern)

- CD may be 127.2% or 161.8% of AB (ABCD Extension pattern)

- There may be additional confirmation when the time of CD is in ratio and proportion to AB

- CD may be equal to AB in time, or between 61.8%-161.8% of the amount of time it took the AB leg to complete

- Watch for price gaps and/or wide-ranging bars in the CD leg, especially as market approaches point D

- These may be signs of a potential strongly trending market. In this case, expect to see 127.2% or 161.8% price extensions of AB in determining CD completion