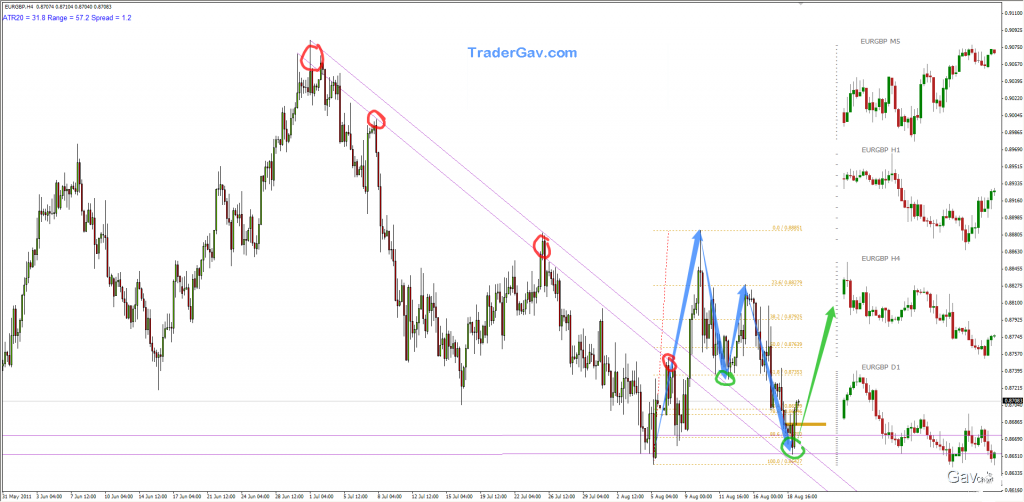

EURGBP pulls back to the previously broken down trend line, and also complete a bullish harmonic formation. This presents a potential long opportunity with first target around 0.8880. Here is the…..CHART!

Trading Journal

$NZDUSD 17 August 2011

I maintain my short bias of $NZDUSD for now after the established uptrend line was broken earlier this month. The broken trend line was retested and acted as resistance. I have been making some daytrades for the past couple of days. However, for the bigger picture, I am now looking at a potential swing trade, […]

$AUDUSD 12 August 2011

I am watching AUDUSD during Asian session. I thought we might have some interesting setups forming soon. Let’s see. Here is the….CHART!

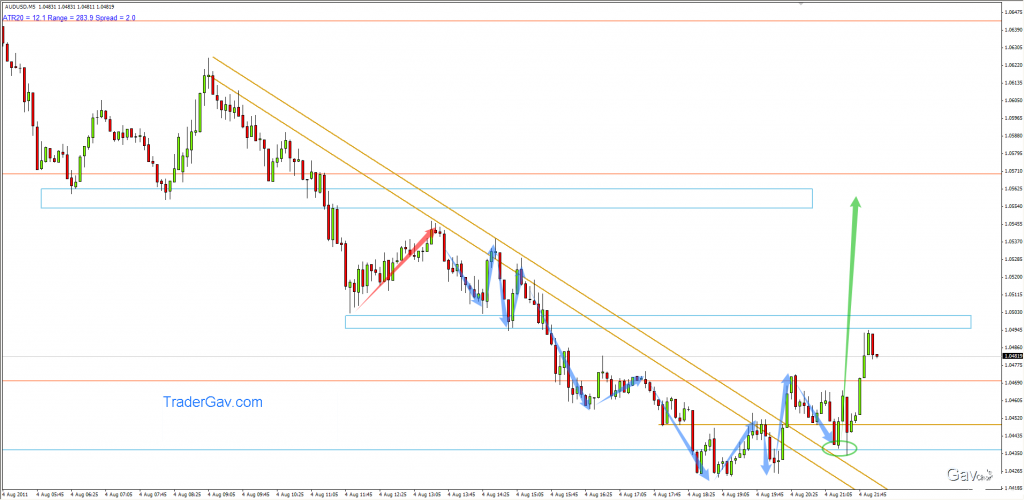

$AUDUSD 05 August 2011

Went long of $AUDUSD this morning (Australian time). Trying to bank some panic money from the market. I saw AUDUSD stalled around mid 1.04 area, and it shows a pretty clear technical setup to me. As I tweeted earlier on, I had banked half of the position,and leaving the remaining to run. That’s pretty much […]

$EURUSD 29 Jul 2011

Here is the short term position I am holding. $EURUSD broke the recent uptrend line, and now previous support turns into resistance. 1st profit target is achieved, position is now risk free, let’s see where the market is going to bring us.

$EURGBP 22 June 2011

Trade completed. Click on tabs for setup and update. [tab: Setup] Here is the potential swing setup I mentioned in my tweet. $EURGBP is moving symmetrically into resistance level. I am watching closely. Pretty straightforward setup, I don’t think I need to write too much here. Here is the… CHART! [tab: Update 28 June 2011] […]