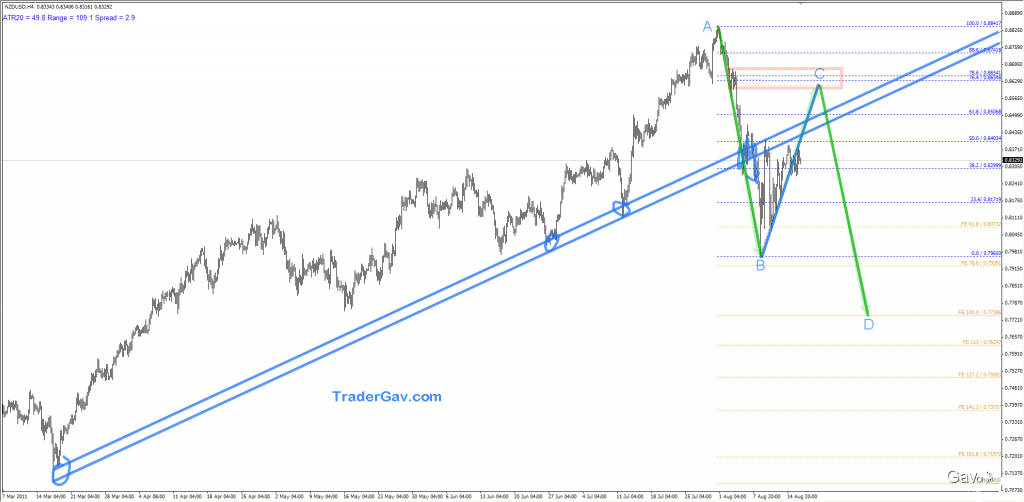

I maintain my short bias of $NZDUSD for now after the established uptrend line was broken earlier this month. The broken trend line was retested and acted as resistance. I have been making some daytrades for the past couple of days. However, for the bigger picture, I am now looking at a potential swing trade, should Kiwi dollar retrace above 86 cents. More aggressive entry for this setup is around 85 cents, well, it depends on one’s risk appetite. For the purpose of this post I will stick to above 86 cents.

Around 8630, I expect $NZDUSD to meet resistance, and, if you are into the Fibo numbers, it is also 76.4% retracement. This would give me a potential ‘C’ point of my planned ABCD formation. Although this will see price trade above the previous broken uptrend line again, I am trying to ride the selling momentum here. Again, 85 cents is also a valid ‘C’ entry of ABCD formation if one decides to go aggressive.

Here is the …. CHART!

Leave a Reply