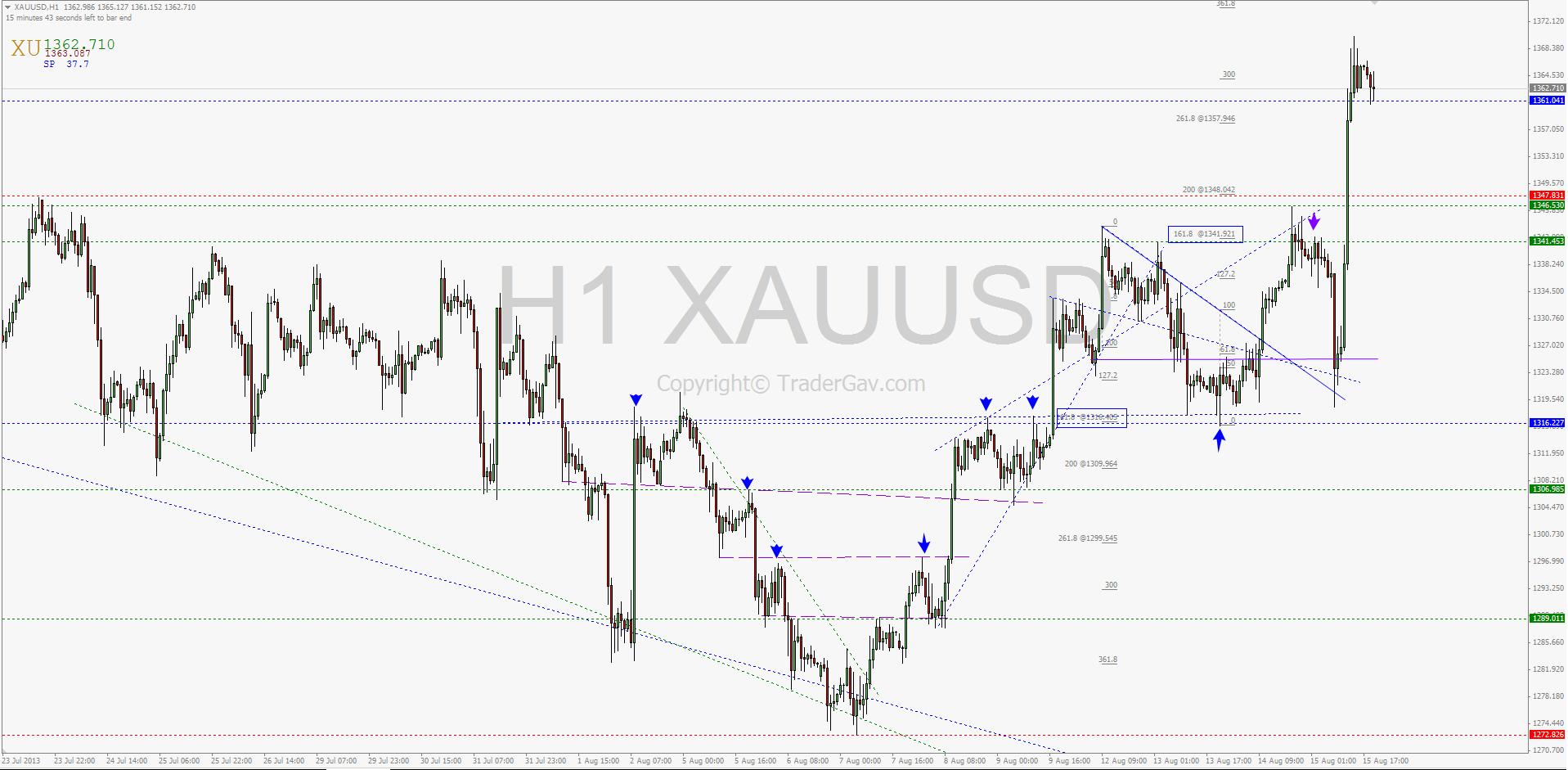

Here is the quick chart review of spot GOLD XAUUSD. You can also find last week’s chart review here. The best way to understand the movement is to look at the charts in multiple time frame. The charts basically explain everything. I will just try to give brief descriptions. On Thursday, Gold broke away from […]

Trading Journal

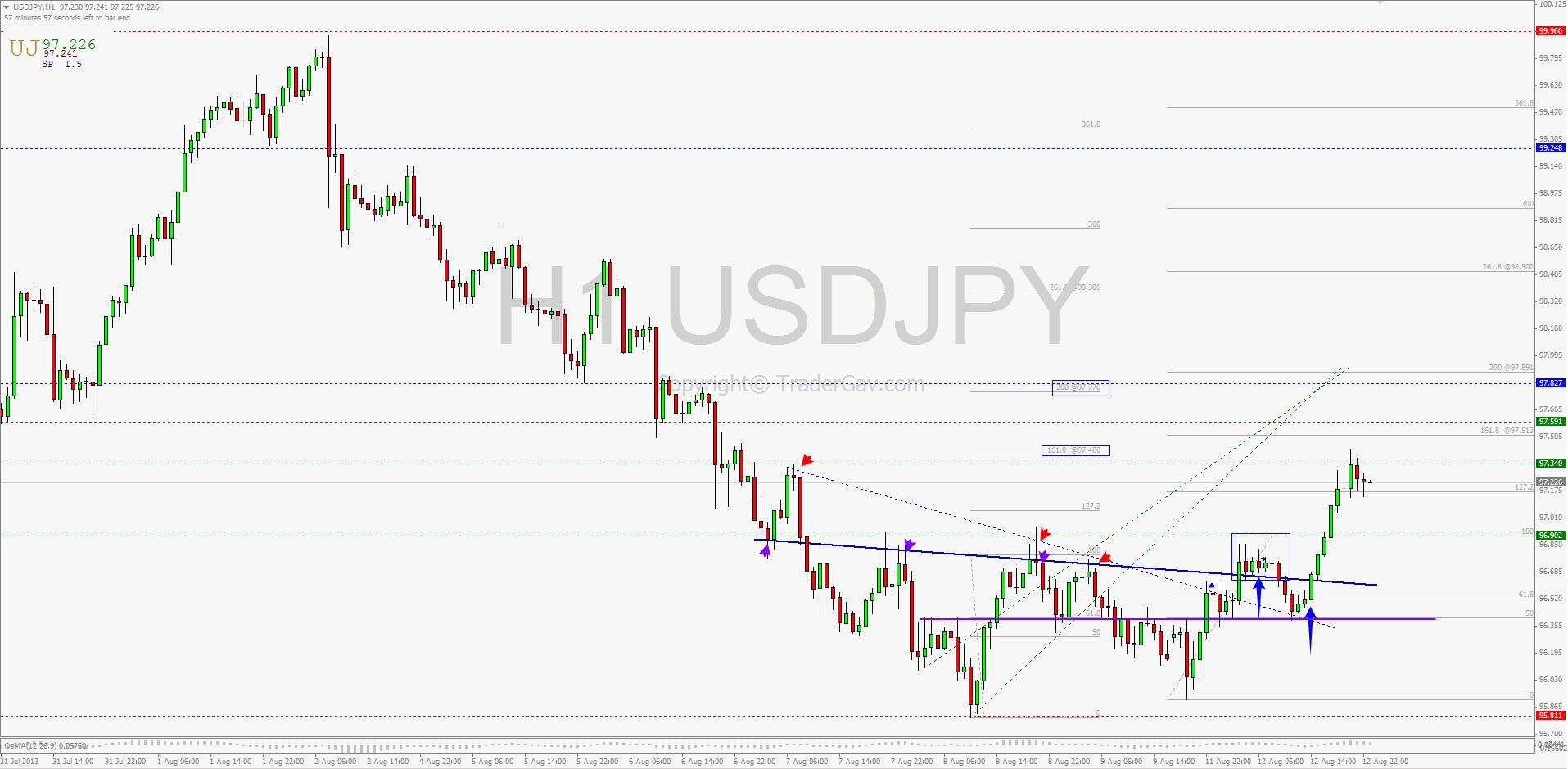

One USDJPY trade 12 August 2013

Just a quick post of one of the trades I made yesterday. I thought it might provide some educational value to my now 13 readers. I went long of USDJPY around mid London session yesterday. My entry was not the best I would like to have. I saw a small consolidation cluster around 96.75 , […]

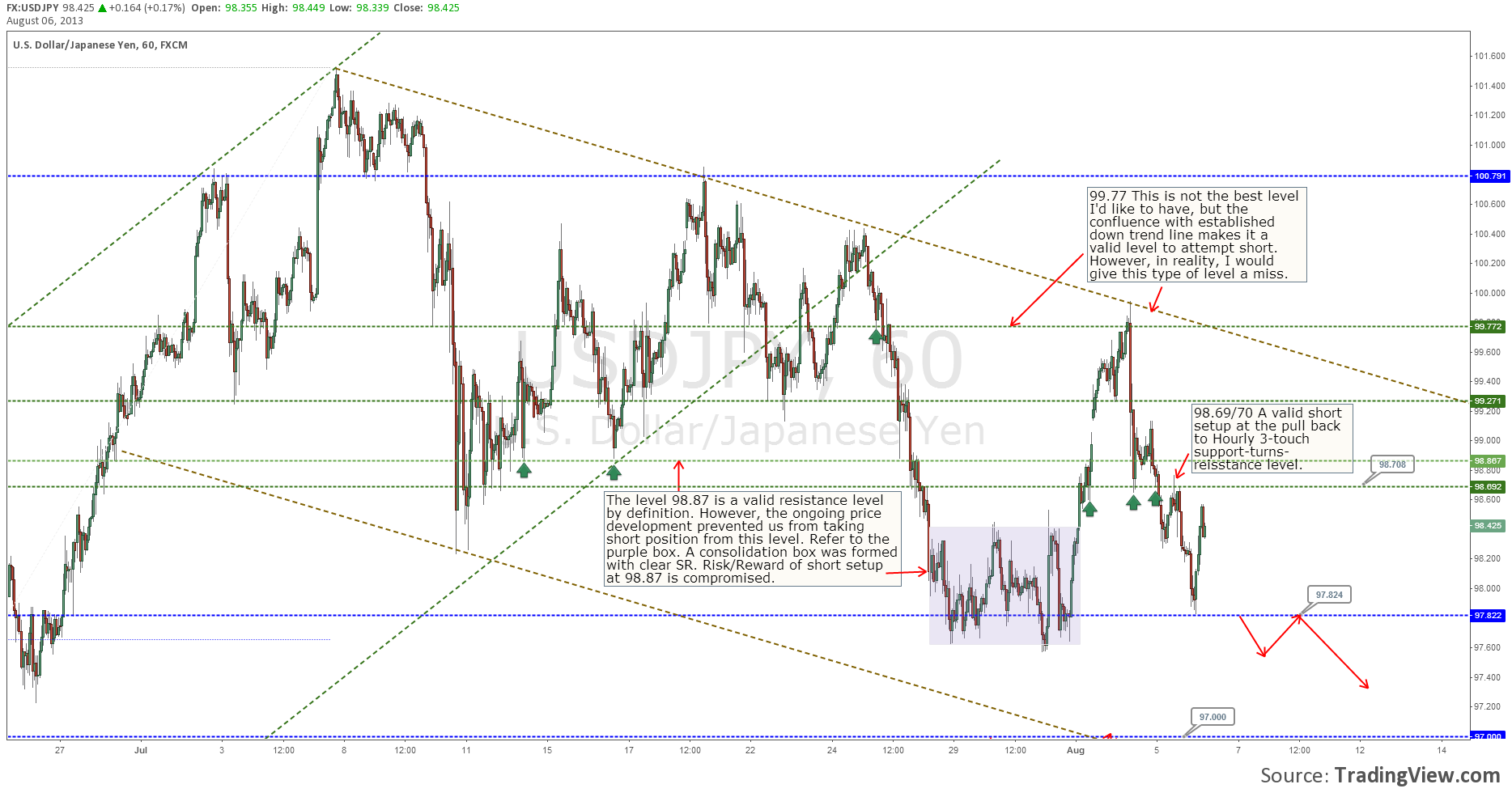

Levels trading tips from hindsight analysis

First of all, AUDUSD approached 0.9130/40 resistance level. This is a daily level, and price reacted and immediately pulled back to intraday (hourly) support level 0.9085. If you managed to get in short position at the first test of 9130 level, the setup should give you around 1 R at 0.9085. (Unless you used a […]

Weekly Review of GOLD (XAUUSD) 08 AUG 2013

GOLD reacted to resistance level and remain moving within daily down channel. There are some details to watch in lower time frame. Here is the weekly review of Spot Gold XAUUSD levels 05 August 2013

Some levels trading lesson from USDJPY

I thought I will write a quick follow up of the USDJPY development. Well, in the bigger picture, price is still trading within the channel as shown in my previous post Here and Here. However, there are some developments in Hourly time frame which I can use to show how I approach the levels. This […]

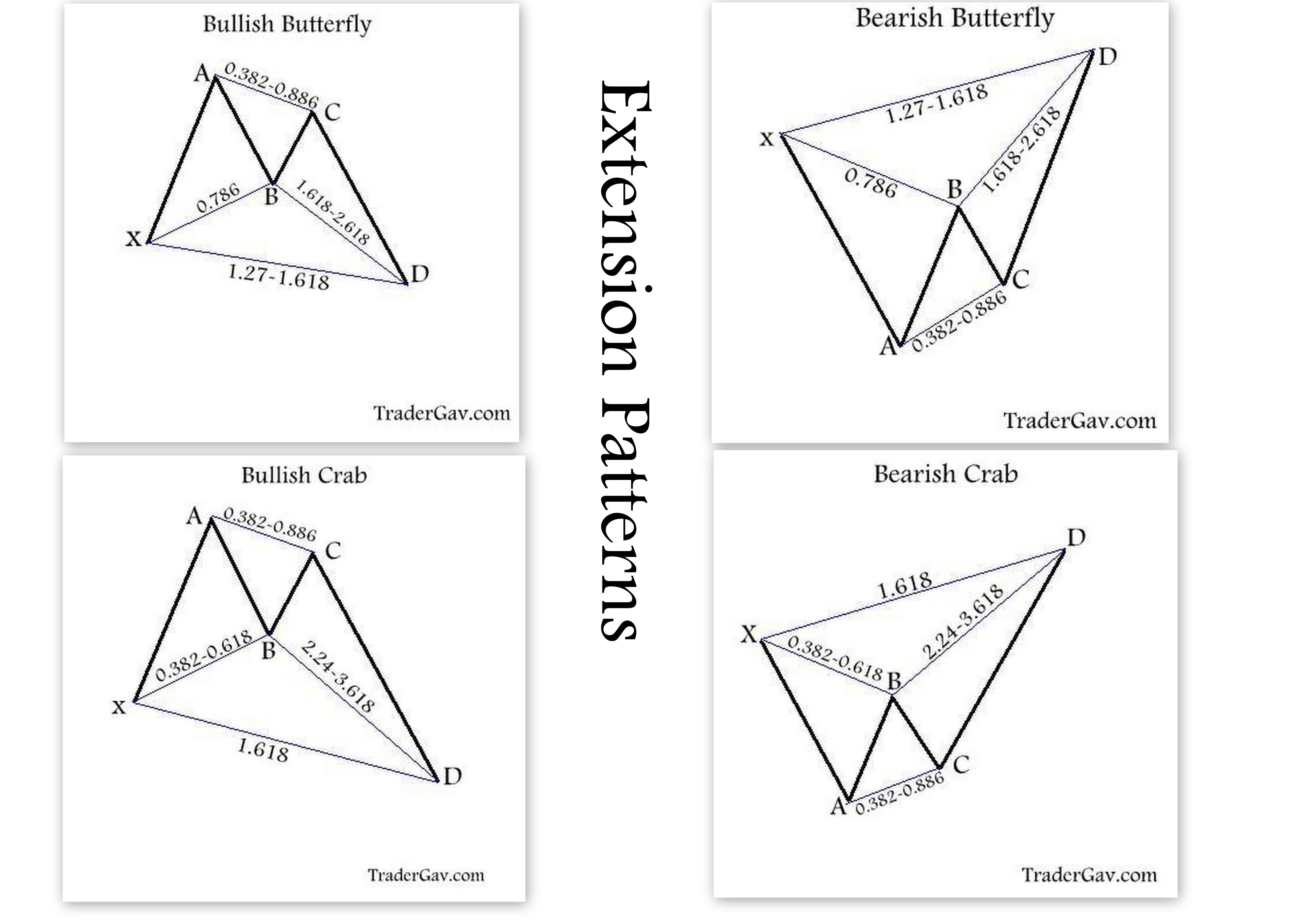

My Harmonic trading guide

Here are the harmonic patterns that I trade and some guidelines I use in my trading.