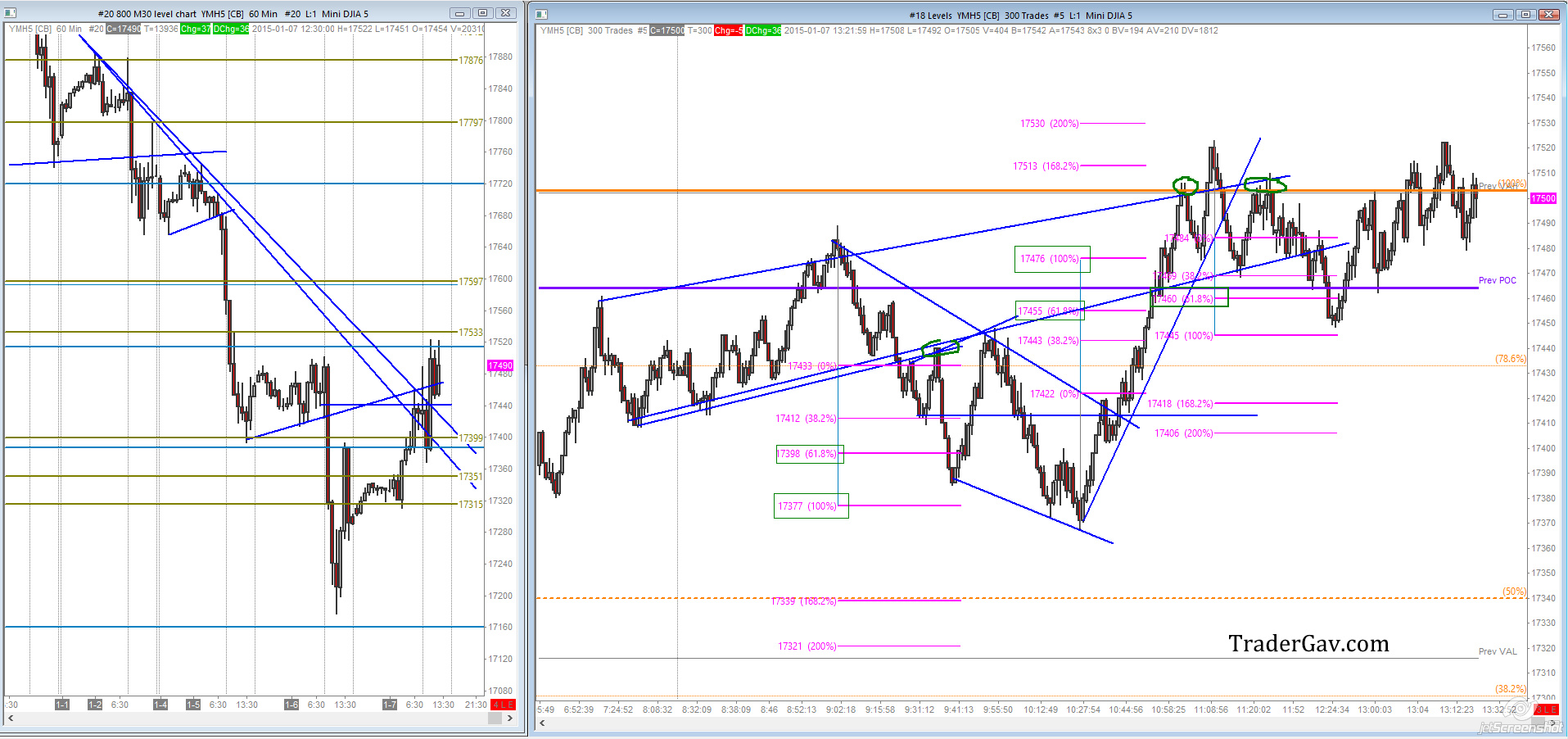

There were a couple of entry setups formed during Asian session (if you even watched this market during that hours), otherwise, YM was grinding up in the RTH morning, patience was required to wait for entry opportunity (well, at least for my type of trading). Looking at the context in hourly chart on the left, […]

Trading Journal

Day review: YM 07 Jan 2015

Here is a quick review of YM for the past day

GBPUSD trade the obvious?

Just thought I would post a chart here. This is a text book style support-resistance setup. Trade the obvious?

Have a look at larger time frame to set your bias. This setup might be provide you a good entry.

A small writing project : “Combine”

Combine: a harvesting machine that heads, threshes, and cleans grain while moving over a field I am planning to write a series of blog posts to list out each elements that I use in my trading. While I am not sure how long will it take me to write all into blog posts, I will try […]

FX charts Week 27 Jan 2014

Some spot FX charts for week 27 Jan 2014. Charts include EURJPY, USDJPY, GBPUSD

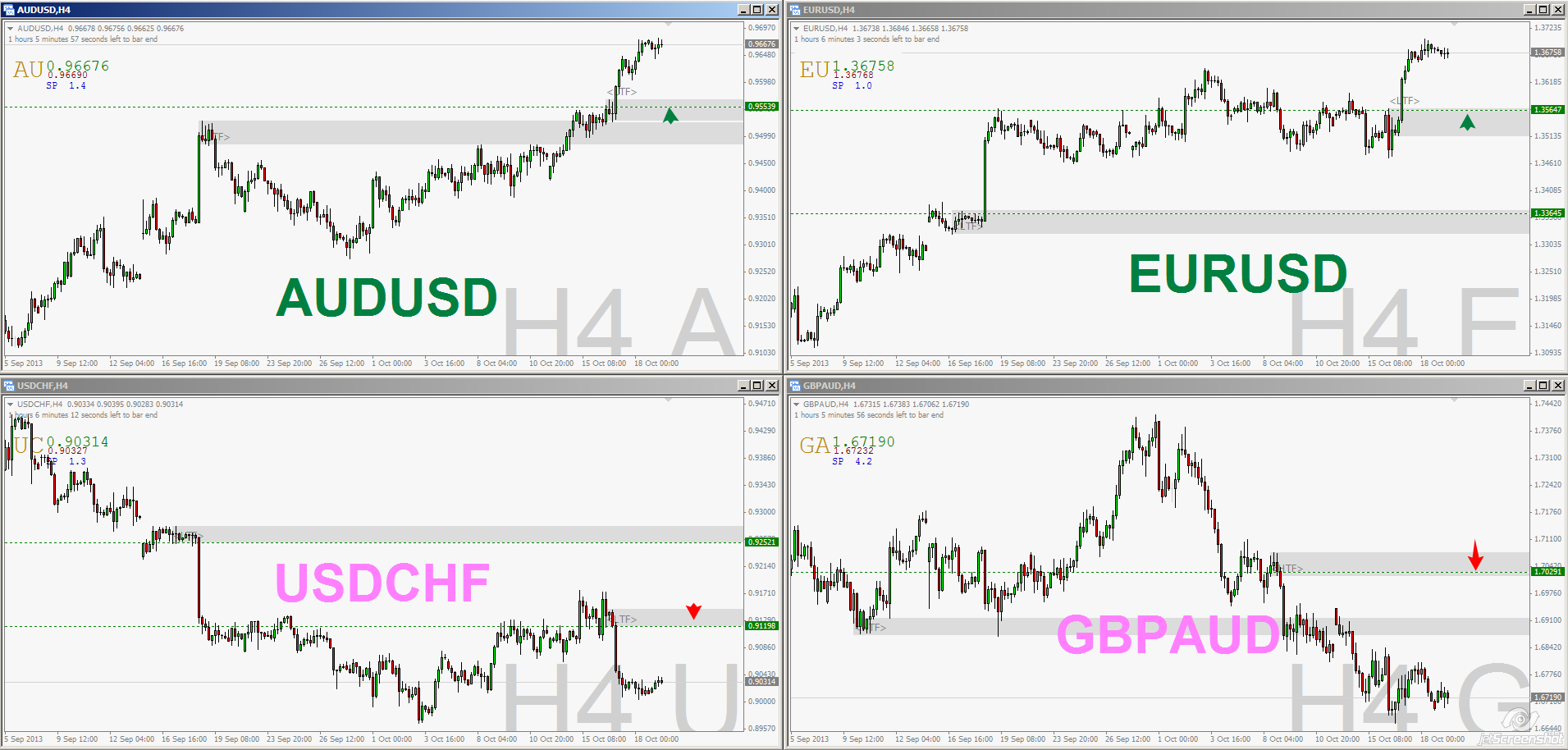

FX charts for week 21 Oct 2013

While my main focus is in Futures trading, I am still keep an eye on spot FX for swing trading ideas. Just thought I would share some FX charts which I am watching. I hope these charts help. You can always click on the charts to view in original size. AUDUSD: Still looking at buy […]