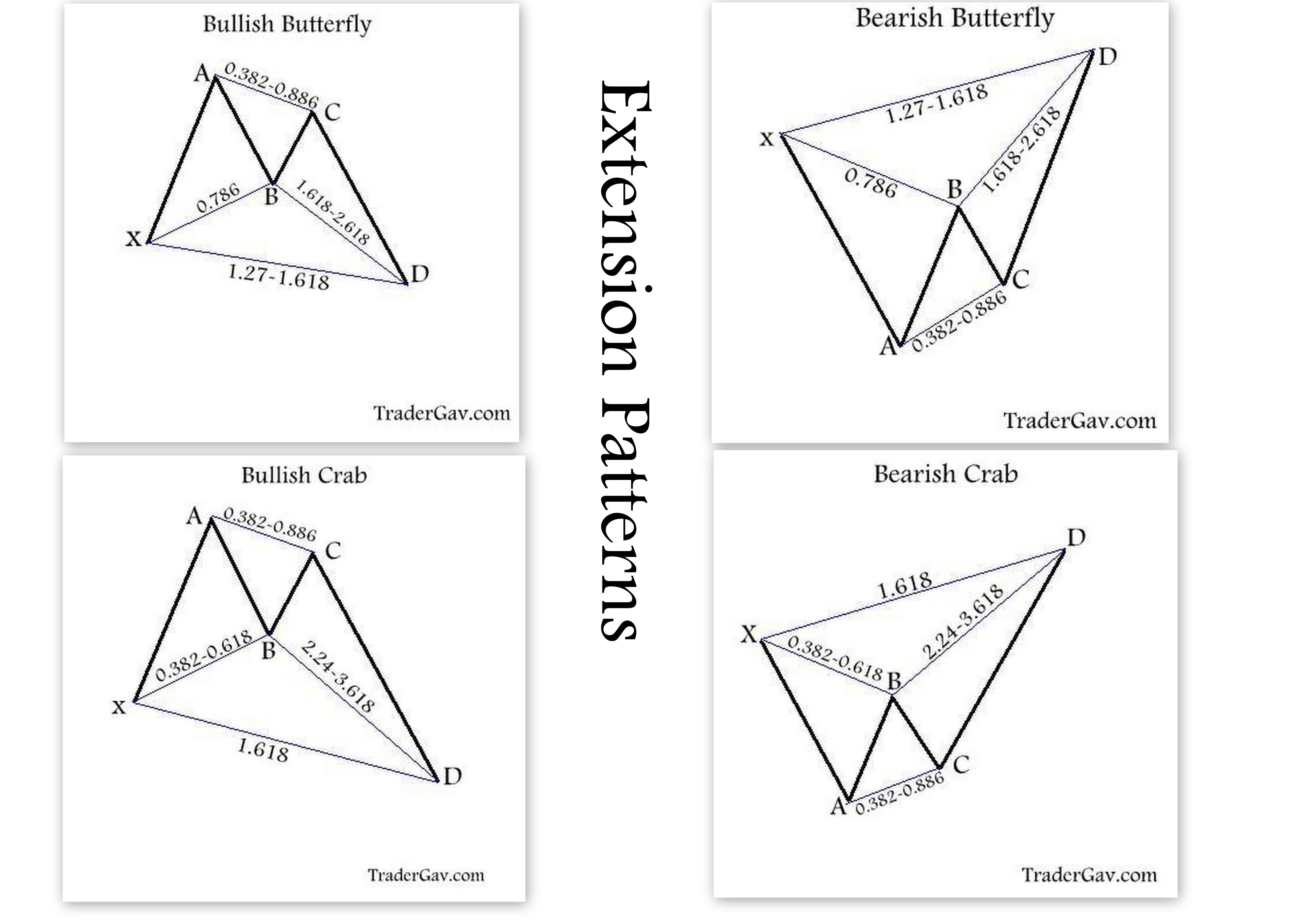

Here are the harmonic patterns that I trade and some guidelines I use in my trading.

Harmonic setups

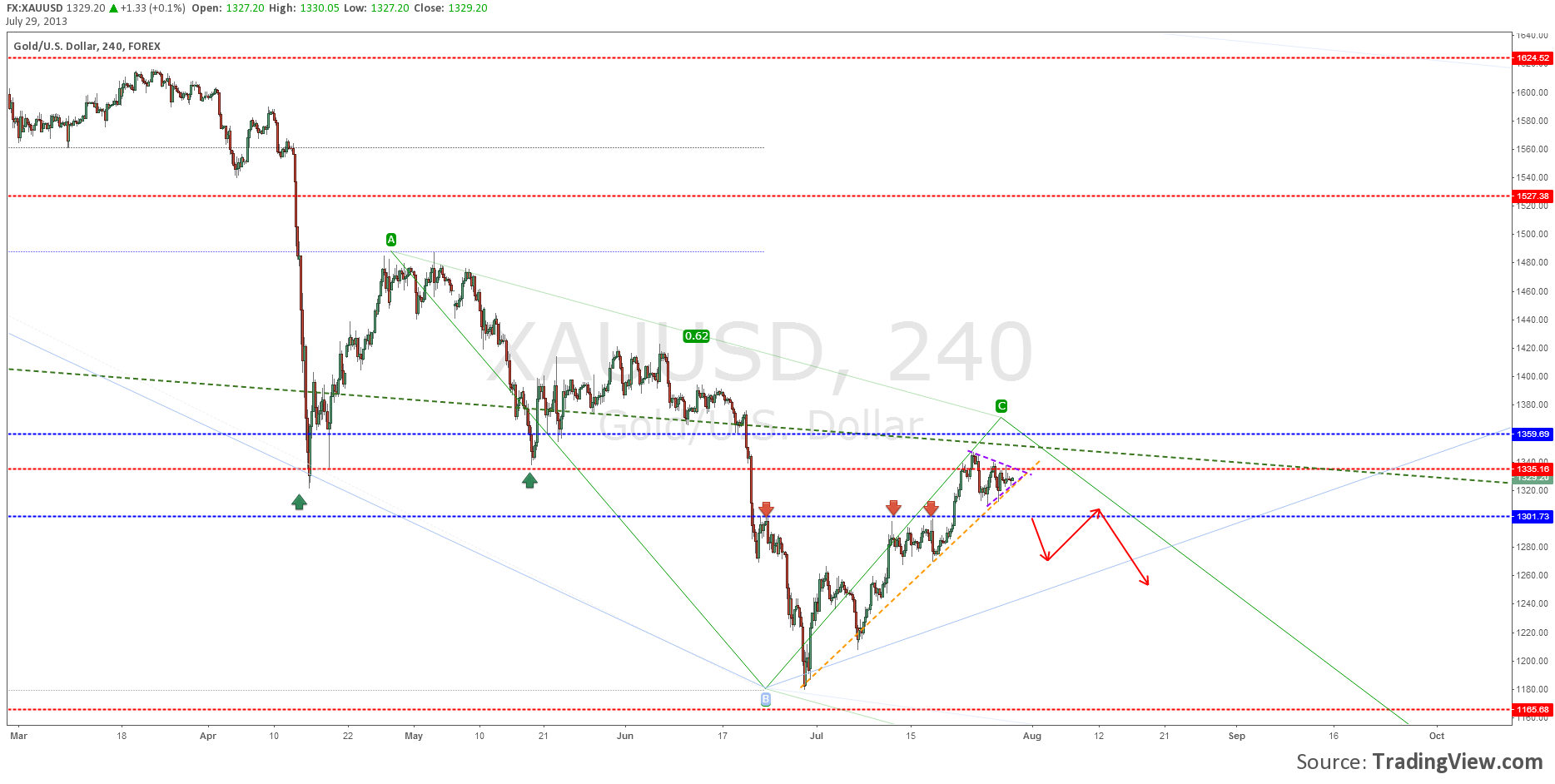

Weekly Review of GOLD (XAUUSD) 30 JUL 2013

In my previous post, we have identified the potential resistance zone around 1335. We are right there now. I would like to see a turn at this area, and projected target is at 1000 should the selling resumes. But, it is not as simple as it sounds. There are road blocks in front of us. […]

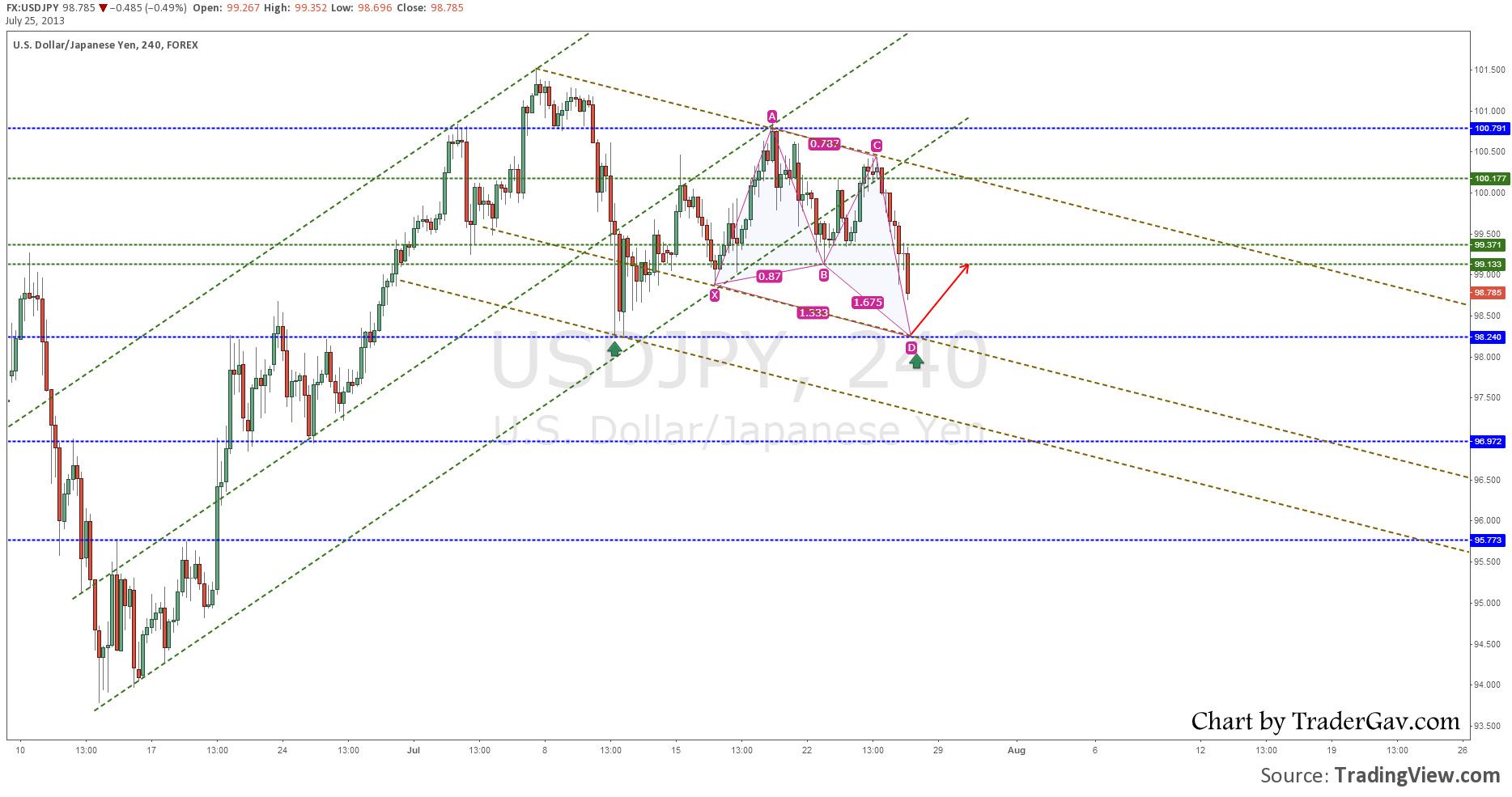

USDJPY level to watch 26 Jul 2013

USDJPY 98.25 is the immediate target for now. And this is also the level to watch for any potential bounce. I am interested in watching this level for potential false break before attempting long position.

Chart Review GOLD (XAUUSD) 17 Jul 2013

I always prefer to look at GOLD chart at the bigger time frame. It gives me a better picture. Let’s have a look at Spot GOLD (XAUUSD). Here is the Daily chart of Spot GOLD (XAUUSD). It is trading slightly below 1300 area. My immediate upside target is around the 1337ish which is also the […]

$AUDUSD 30 JUL 2012

Not trying to call a top, I just thought it might not be the best time to jump into LONG position now. Anyway, just a small observation, ABCD completion at the top of the channel. Here is the…. CHART!

$EURJPY 27 JUL 2012

EURJPY H4. Maybe, just maybe above 98 is a better zone for short. Ignore the harmonic stuffs if they are not your things.