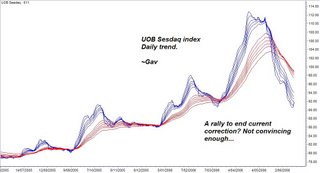

So we have seen a strong rally last Friday. It was expected to hear some voices in forums discussing ‘Bull is back to action’. Well, I have decided again to do some analysis on the trend. And this time, I want do something interesting. Firstly, I am looking at daily trend of UOB Sesdaq index. […]

SIMSCI 16-June-2006: Market close

[photopress:simsci_12_full_day.PNG,full,pp_image] There was a second entry opportunity to Long SIMSCI. Due to some personal commitment , I gave up the trading opportunity. Anyway, second entry was at 283.9 with potential exit at 284.8. It was a strong day for SG market, which in turn provides SIMSCI day trading profit oppportunities. I closed the day and […]

RE:SIMSCI 16-June-2006: Potential Long:Trade Closed

12-min SIMSCI Futures [photopress:simsci_morning_12.PNG,full,pp_image] I have closed Long position at 283.1. After watching price action at the area of day high (283.4), uptrend seemed to be getting weaker. This does not mean a reversal is kicking in, it just prompts me for profit taking. Notice about DI+, similar weakness was observed as well. To confirm […]

RE:SIMSCI 16-June-2006: Potential Long

Long position of SIMSCI has been established at 281.9. SIMSCI seems to be gaining strength again. Sentiment remains positive.

SIMSCI 16-June-2006: Potential Long

Another three digit gain for DJ again. Positive opening of Nikkei , SIMSCI as well as Hang Seng is just expected. In the first hour of trading, SIMSCI, in fact, drifting down from open price. With both Nikkei and Hang Seng stays more than +300 points gain, I am looking for opportunity to establish Long […]

Swing Trade for 16-June-2006: No candidate

Given yesterday’s positive closing of STI and recent rally of U.S indices, I did a scan on my stock list for potential swing trade candidate. Few china counters appeared in rally with volume scan. However, none of them passed the directional and trend test for the time being and most of them are actually trading […]