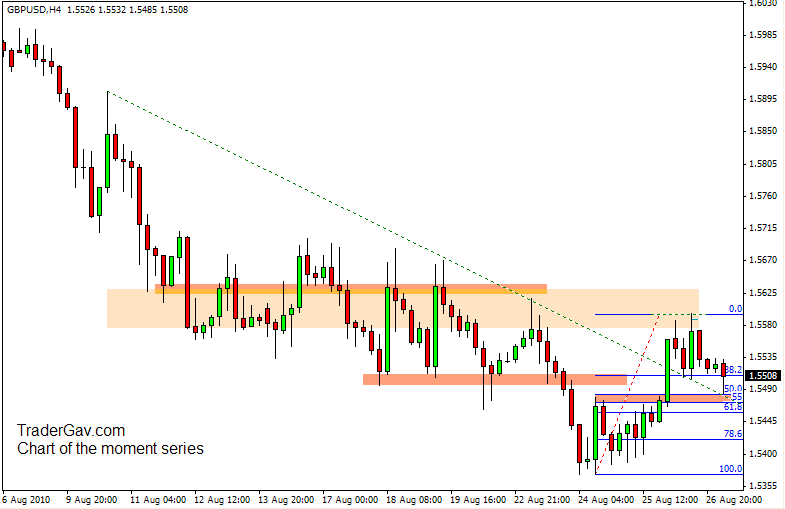

Are we looking at something big here? I am not keen in shorting cable at the moment. What do you think?

Trading Journal

Some quick updates and showing off

This is going to take some time. I am still interested in staying at the short side of $EURUSD, $GBPUSD, $AUDUSD, $NZDUSD etc…Basically I expect Dollar to get a little stronger. However, I am sitting on my cash now to wait for the moment to pull the trigger. Patience is required here. Well, I might […]

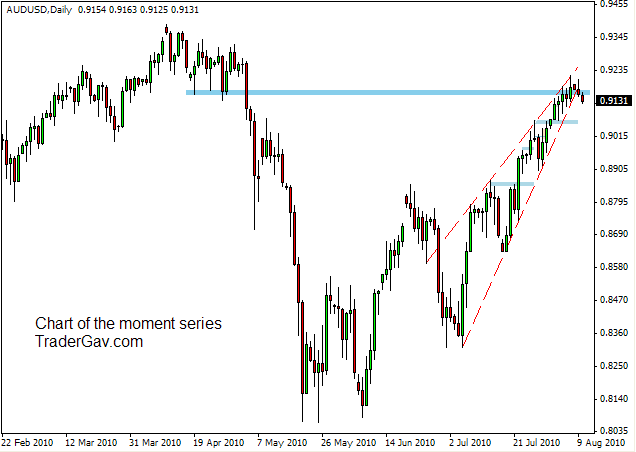

Chart of the moment: $AUDUSD 10 August 2010

Here is another interesting chart that pops up on my screen this morning. Is AUDUSD falling off the cliff now? Hmm…. Here is the daily chart, have a look at shorter time frame for your ‘insight’. 🙂 Here is the…. CHART!

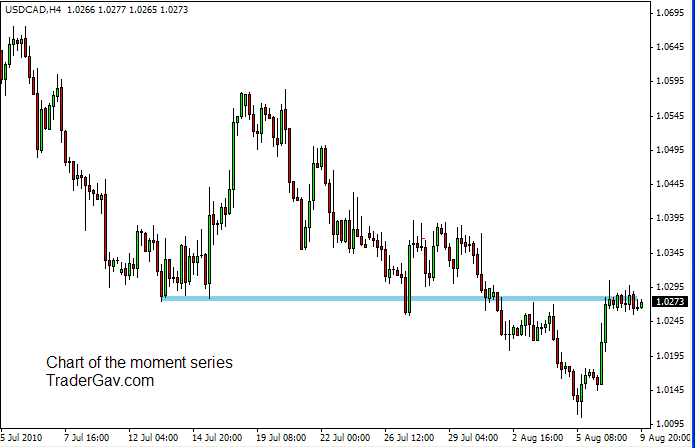

Chart of the moment: $USDCAD 10 August 2010

This is the chart that I am looking at. We had a slow, choppy start of the week. Looking at the USDCAD, are we expecting something big soon? Here is the CHART!

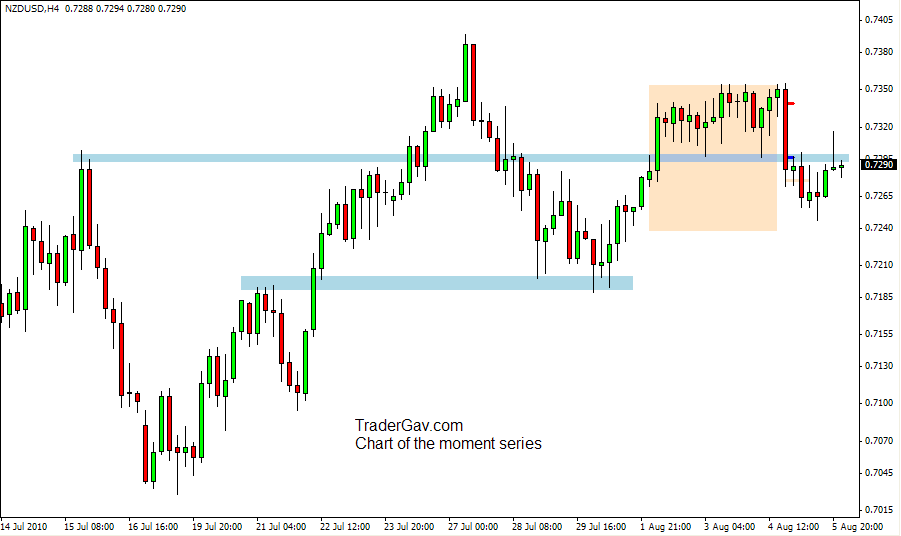

Chart of the moment: $NZDUSD 06 August 2010

I am not trading today, but still watching the markets. During my morning chart reading, NZDUSD again pops up. I shorted it yesterday, and position was closed. Kiwi dollar was back to 73c during Thursday U.S session. And, again, 73 cents blocked it. Here is the CHART. Do you see anything interesting? Enjoy! I am […]

Trade of the day 20 Jul 2010: $GBPUSD short

This is a pretty straightforward trade. Looking at hourly chart, cable was coming to a resistance level and price rejections was observed. I went short around 1.5283 (though I wanted to get 1.53 as entry..but..anyway..). Two profit targets were achieved with last portion of position was closed at 1.517 level. Potentially, cable might head to […]