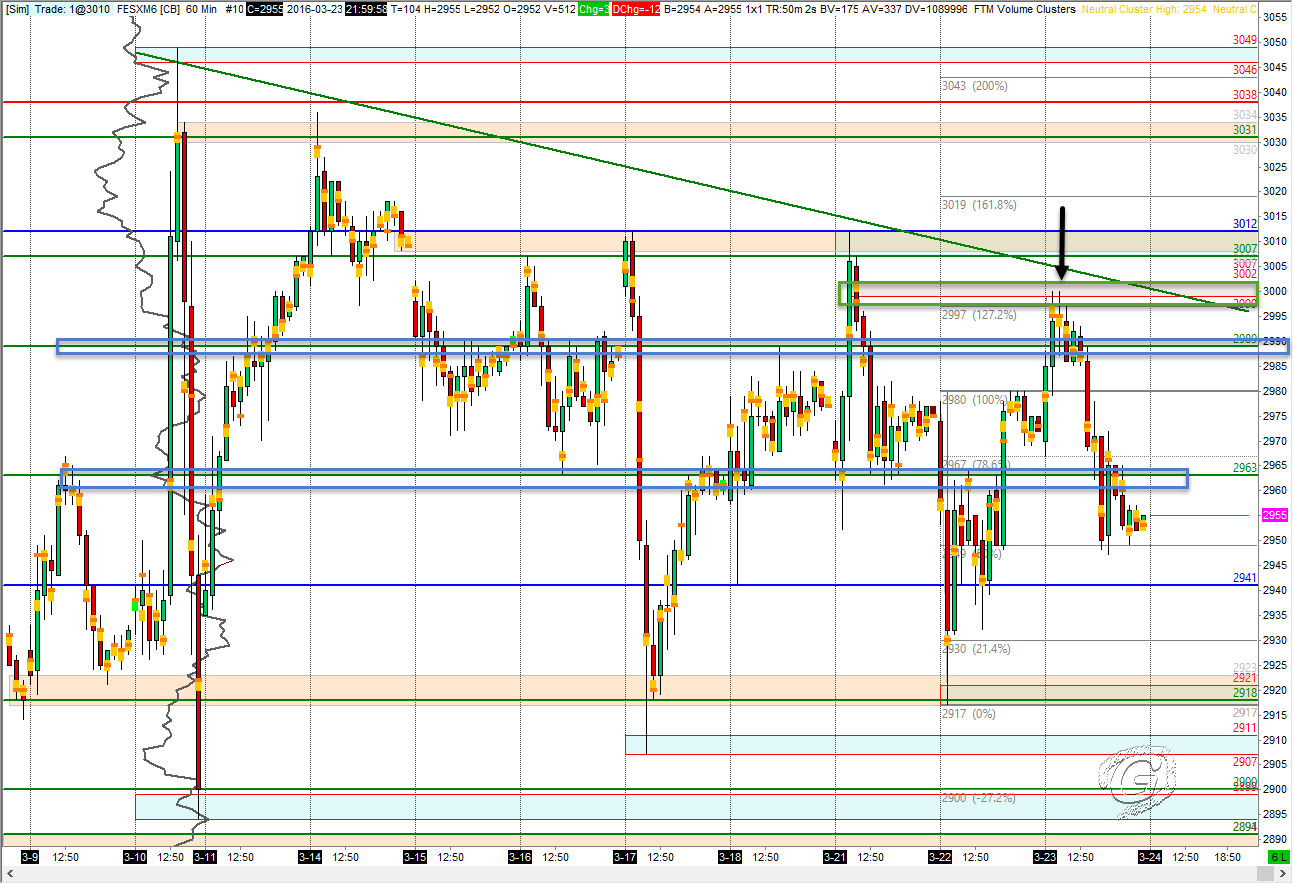

Refer to Pre Market post for key levels. Yesterday’s poor high was retested in the morning session, and stoxx reversed around 3000 which was also 127.2% extension of previous day’s range. It was a slow grinding morning session as you might have read from my tweets. #stoxx since open .. pic.twitter.com/fpSP78Vbrg — Gavin M™ (@tradergav) […]

Trading Journal

AUDUSD 23 March 2016 levels to watch

Here are the levels of interest for AUDUSD. Chart prepared using Sierra Chart.

Pre market FESX 23 March 2016

Yesterday, stoxx closed with poor high.

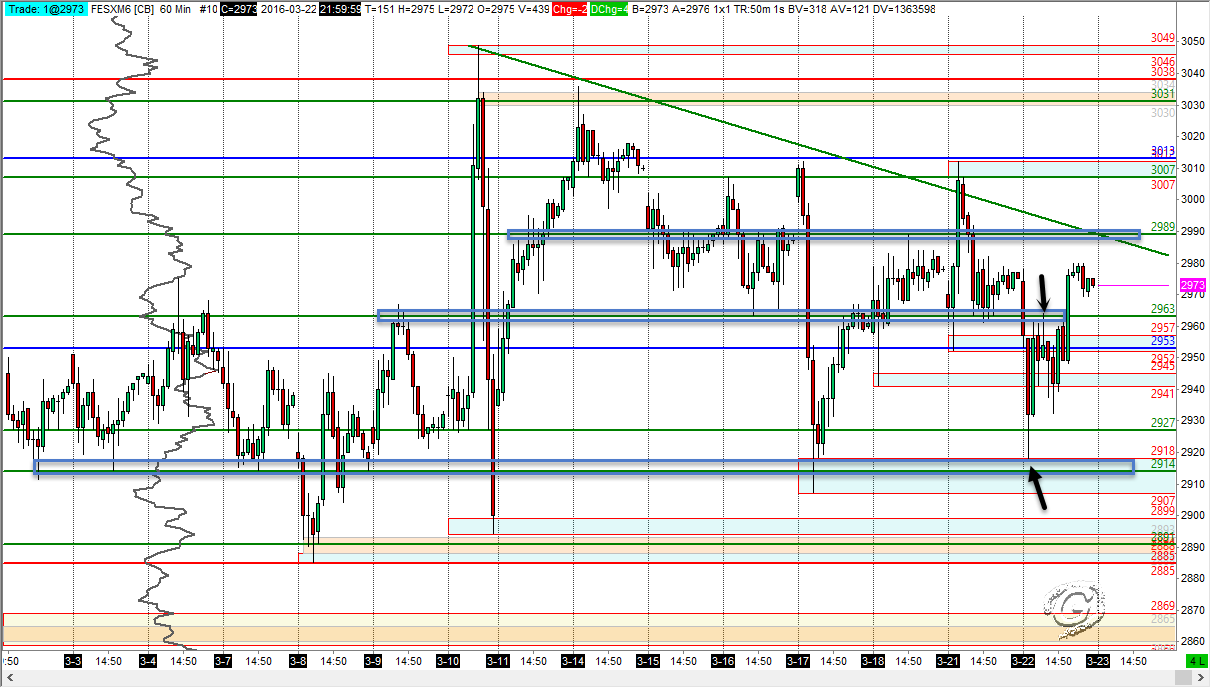

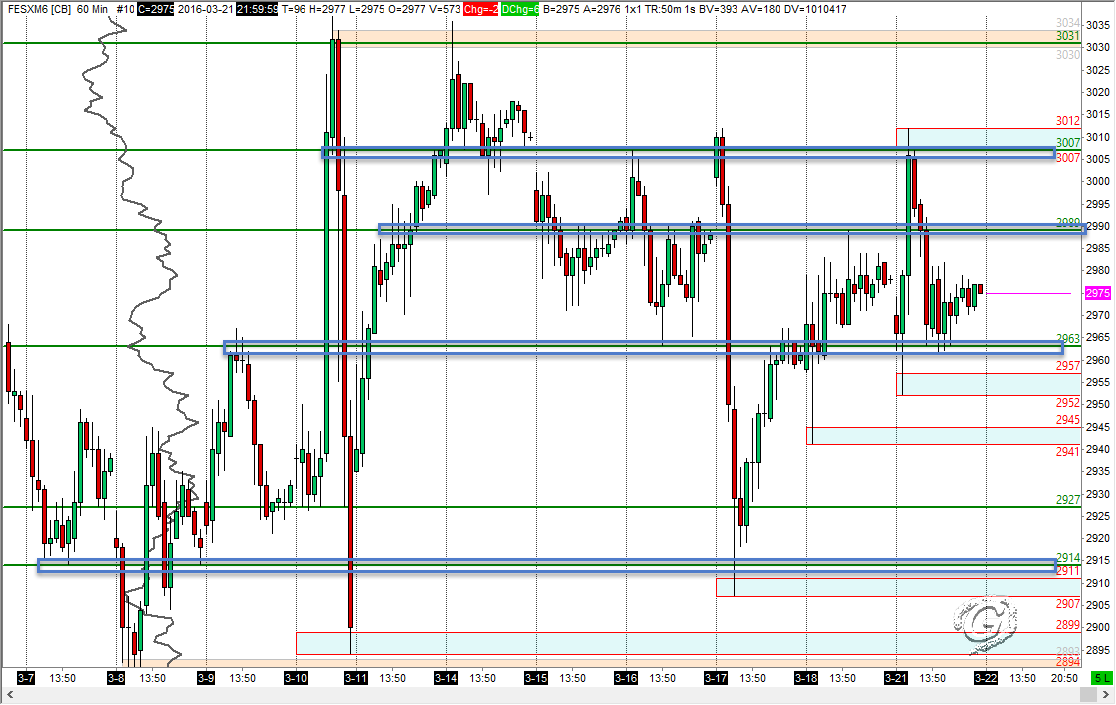

FESX 22 March 2016 EOD review

Previous day’s failed inside day break, and Brussel terrorist attack, stoxx was sold off initially, and recovered most of the day’s lost at the end of the day. Refer to pre market post. Here are the end of day Hourly chart.

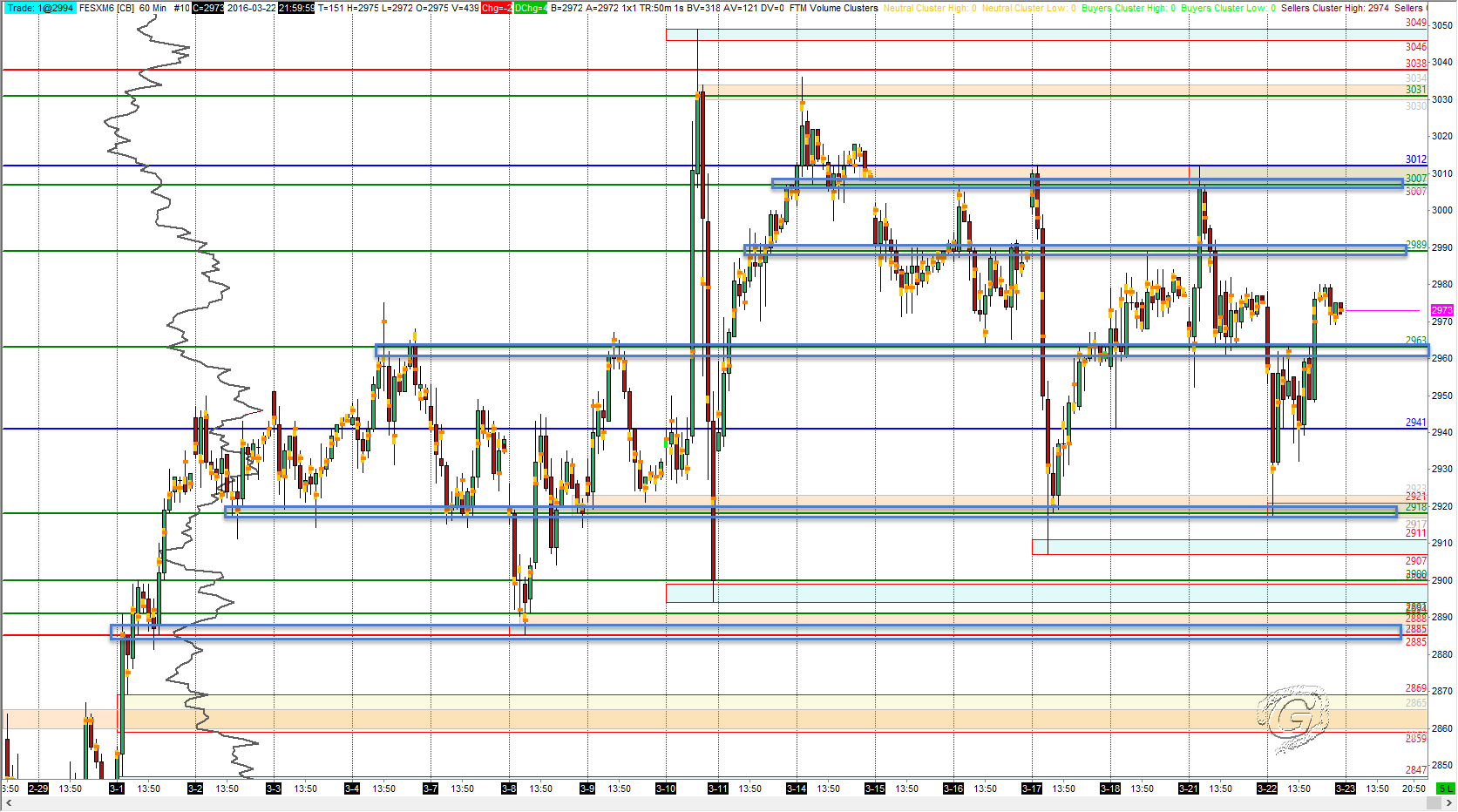

Pre market FESX 22 March 2016

Here are the levels I am looking at for today’s session. Time constraint, I will start with FESX for now, and with limited description. Charts prepared using Sierra Chart.

Day Review: YM 14 Jan 2015

Major movement of the day was during pre-open when economic releases were scheduled. 3 setups were observed during RTH. Looking at at hourly chart, I was targeting the major swing low 17177 to be visited. The first setup was when YM revisiting VWAP, and at the same time it was the first test of supply […]