It’s Sunday afternoon. I’m not trading, but I’m doing something just as important. I’m cleaning the kitchen. The counter’s a mess. Crumbs under the toaster. A drip trail of coffee from this morning. A few dishes that “look clean enough” until you hold them up to the light. So I wipe. I rinse. I reset […]

Trading Journal

Sabotaging Your Own Trades? Here’s the Execution Routine That Separates Pros from Amateurs

This one hurts to admit. A few months back, I had a clean setup. NY low taken. Liquidity grabbed. Price snapped back. Textbook. But I hesitated.Second-guessed myself.Chased it 10 seconds later… and got rinsed. Not because the setup was wrong.Because I messed up the execution. You ever done that?Fumbled a high-probability setup, then sat there […]

How to Do a Daily and Weekly Trade Review: A Step-by-Step Guide

Most traders don’t review their trades properly. They think they do, but staring at a chart after a loss, shaking your head, and moving on doesn’t count. If you’re serious about improving, you need a structured, no-BS process. Here’s how to review your trades properly so you stop making the same mistakes and actually improve. […]

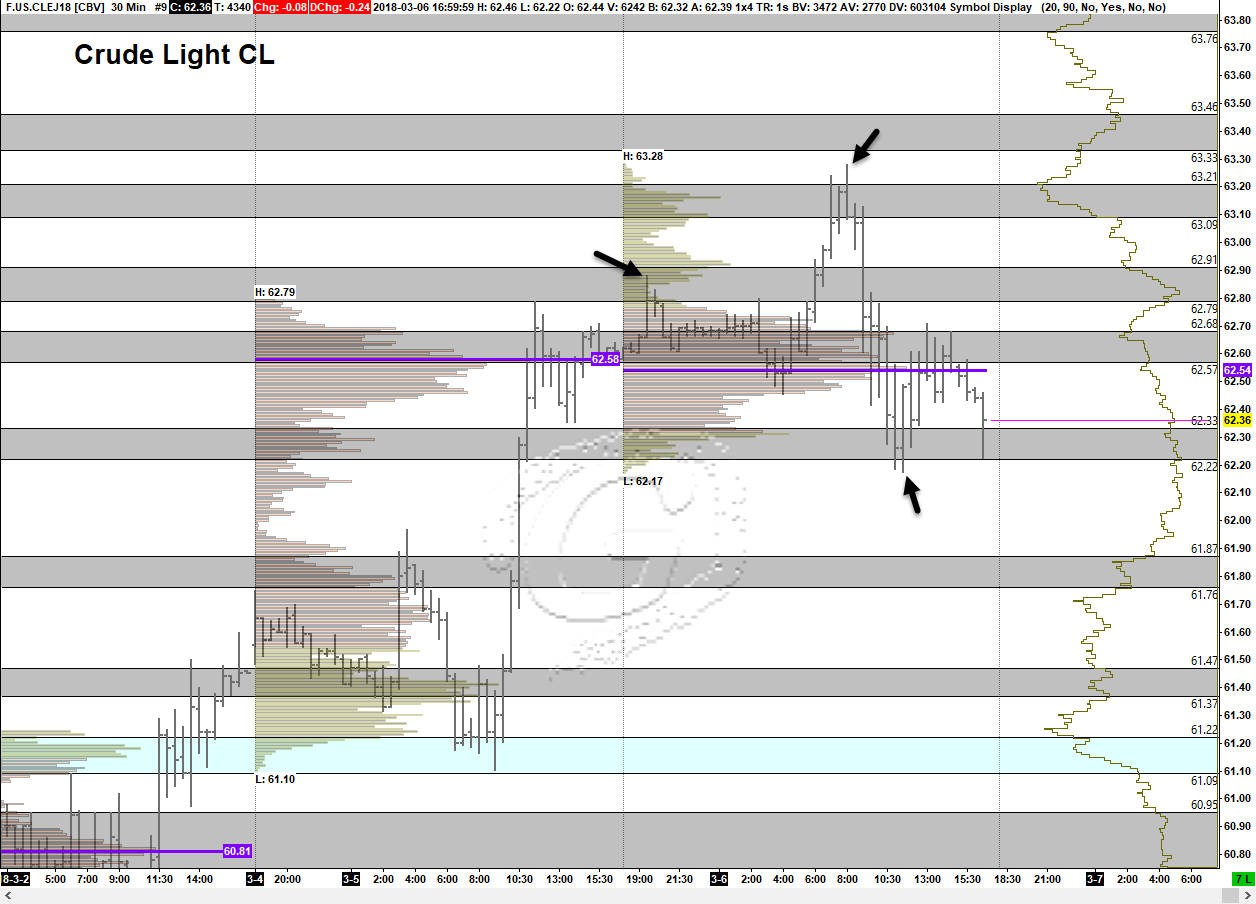

EOD Recap 06 March 2018

Refer to pre market prep post here. Here are the EOD reviewed Charts. Markets covered: Crude Light – CL June 18 Contract 30yr US Treasury Bonds – ZB June 18 Contract 10yr US Treasury Notes – ZN June 18 Contract Ultra 10yr Treasury Note – TN June 18 Contract

Market Prep 05 Mar 2018 zone of interest

These are the zones /levels I am watching today. I reviewed everyday before Asian session get started. These zones serve as trade location. Order flow analysis is employed for exact trade entry. The only purpose of posting these charts is for my own daily review. Markets included 30yr US Treasury Bonds – ZB June 18 […]

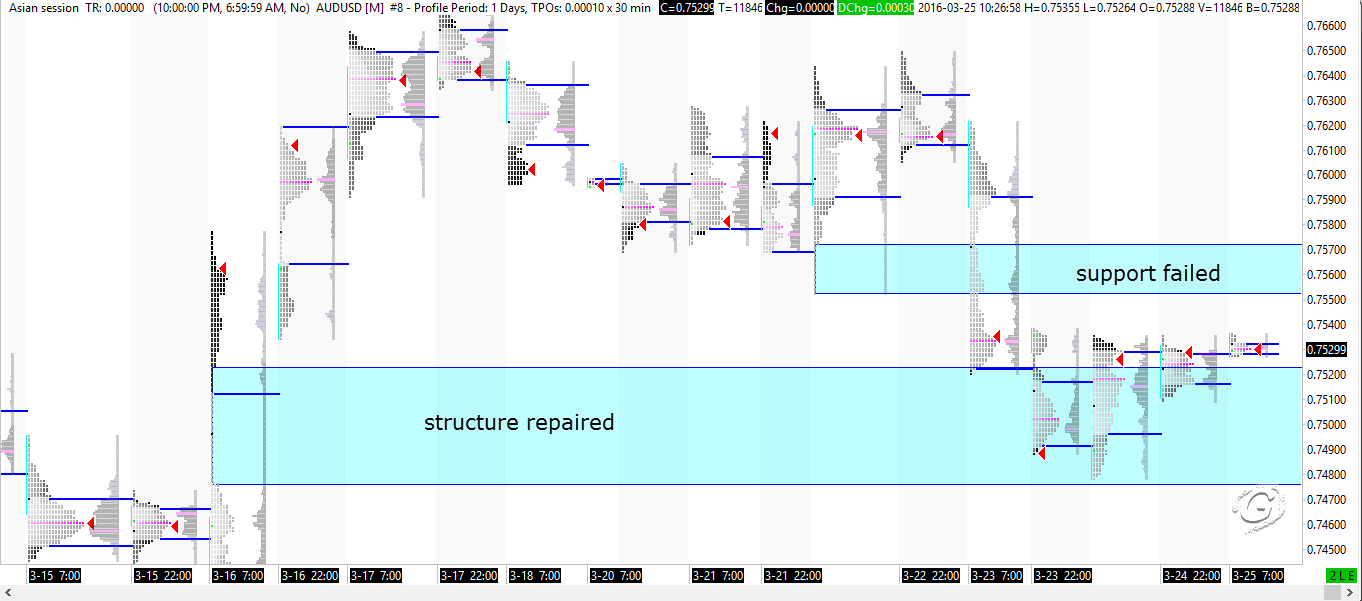

AUDUSD chart update 23 March 2016

Refer to previous post for levels and structure identified. 7476-7528 single prints was repaired. Charts prepared using Sierra Chart.