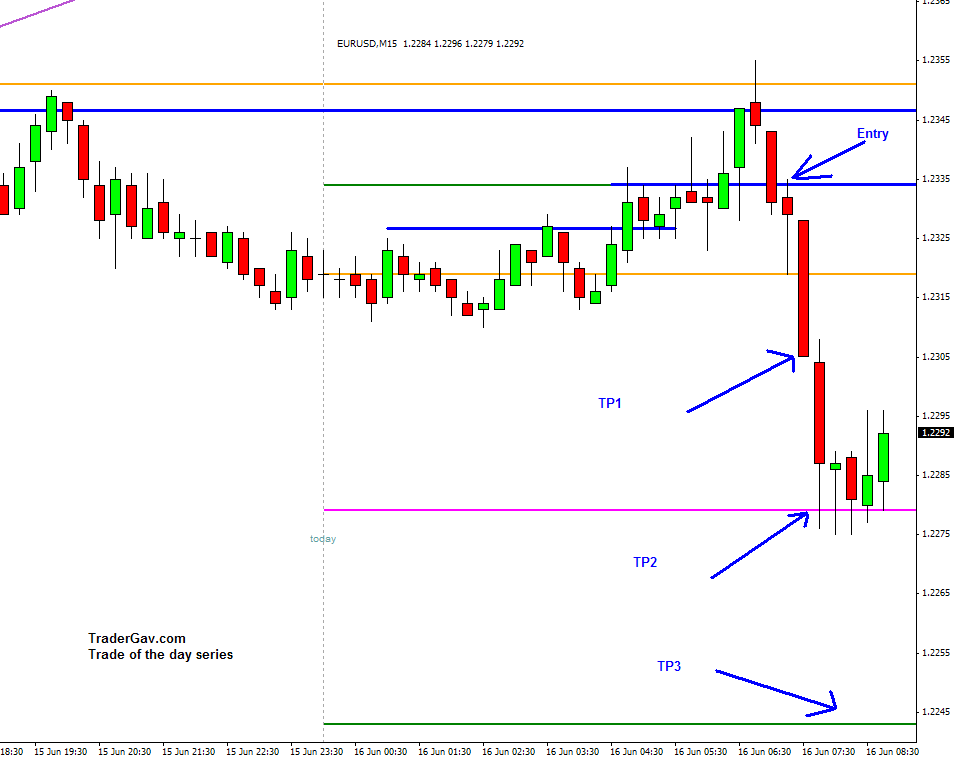

It was a busy London open. Pullback of EURUSD provided some good shorting opportunities. Price action was slow during Asian hours, and failed to test yesterday’s high. I was a little bit late, short was made at the lower limit of my entry range. It was a quick profitable trade. Two profit targets were achieved, with 1 still trailing. This is just another simple technical trade.

Here is the chart…