Well , I do not have a great start for the month. Short position of mini-sized Dow was established below 9:30am (chicago time) candle. 1-R gain was achieved and stop loss was moved to break even point, and it was triggered. Well, too bad. One trade closed with loss of commission. 1) Why would you […]

Dummy Trading Mini Dow

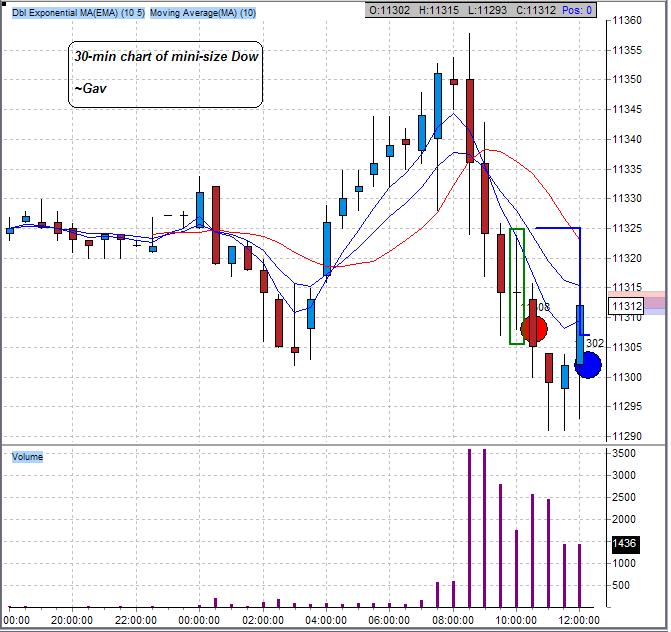

Dummy day trading #22 29-August-2006: mini-sized Dow: Short trade closed

Another lousy day. Short position of mini-sized Dow was established below 10am(chicago time) candle. Dow mini did move in my favour and it was 2-ticks away from my 1-R break even point. AGAIN?!?!?! So near, yet so far…. I am especially cautious this week. After seeing position stalled for an hour and FOMC meeting is […]

Dummy day trading #21 24-August-2006: mini-sized Dow: Short trade closed

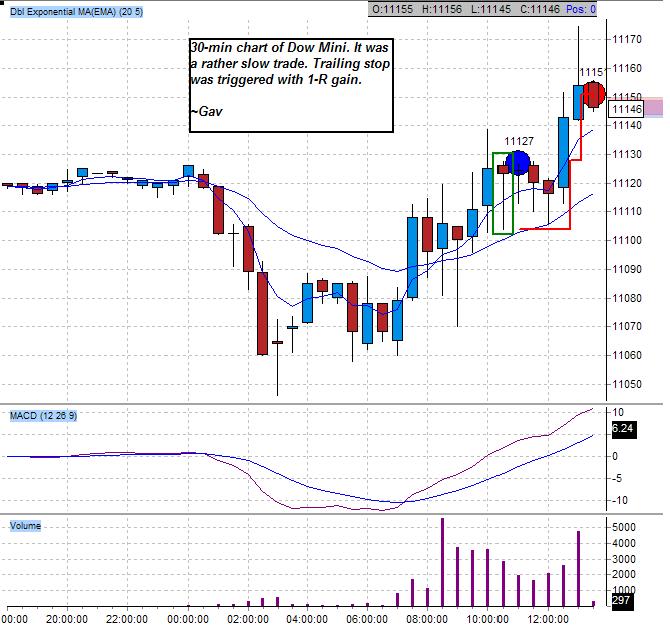

This is a slow trade. Short position of mini-sized Dow was established below 10am (chicago time) candle. Due physical tiredness, I decided to close the trade with small gain. Time to catch some sleep. Postmortem will be posted tomorrow. At least, I stopped the bleeding week. [photopress:mini_dow_30_min_trade_close_1.JPG,full,centered]

Dummy day trading #18 22-August-2006: Mini-sized Dow: Long trade closed

Long position of mini-sized Dow was taken above 10am (chicago time) candle. And I was stopped out with 1-R loss. [photopress:mini_dow_30min_trade_close.JPG,full,centered]

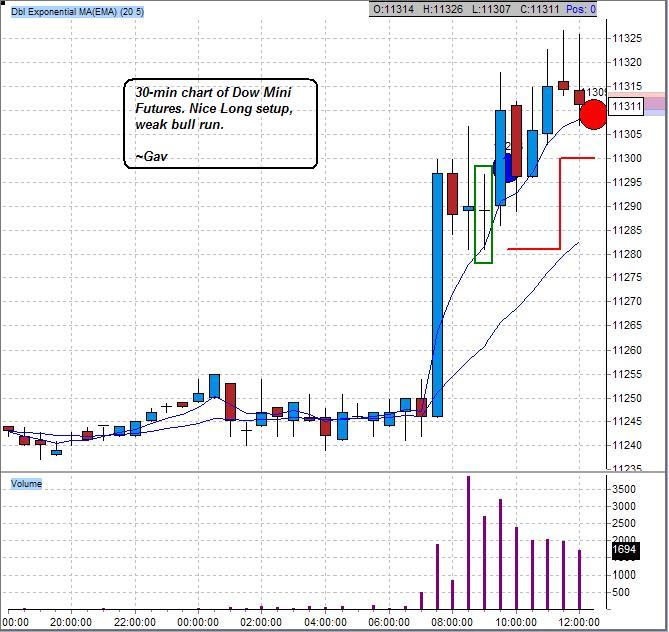

Dummy day trading #14 16-August-2006:Dow Mini:Long trade closed

It was another bullish day, and it was indeed a repeat of tuesday’s session. S&P, Dow Mini as well as Nasdaq were having nice dummy set up. Long position of Dow mini was established above 9am(chicago time) candle. It was a very slow trade. Position was closed at 11309, and I have left E-mini Nasdaq […]

Dummy day trading #12 15-August-2006:Dow Mini:Long trade closed

Long position of Dow Mini was established above the 9:00am (chicago time)reversal down candle. I decided to closed the trade at break even point as I do not like to see a doji immediately after the initial entry candle. Secondly, given the consideration of Core CPI report which is due tomorrow, it might limit the […]