This is a swing trade setup. Cable is moving closer to retest previous broken trend line, and a bullish harmonic pattern is forming. It depends on one’s risk tolerance, I prefer to build entry near trend line. Still watching for now. I expect some reactions at the trend line retest. Here is the … CHART!

ABCD

$NZDUSD 31 August 2011

A bearish harmonic setup is observed while NZDUSD is retesting the broken trend line. Bias remains short for now.

$AUDNZD 19 August 2011

Here is another potential swing trade setup I have been looking at. $AUDNZD is testing the established down trend line, and with completion of bearish ABCD formation. I expect price to face resistance at this level. I’ll be watching price action closely next week to confirm my thought. Here is the….CHART!

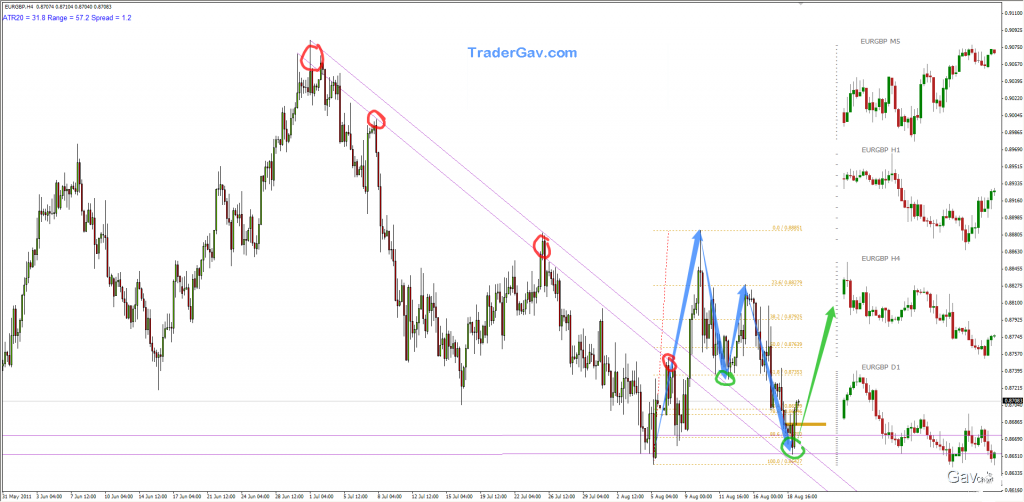

$EURGBP 19 August 2011

EURGBP pulls back to the previously broken down trend line, and also complete a bullish harmonic formation. This presents a potential long opportunity with first target around 0.8880. Here is the…..CHART!

$NZDUSD 17 August 2011

I maintain my short bias of $NZDUSD for now after the established uptrend line was broken earlier this month. The broken trend line was retested and acted as resistance. I have been making some daytrades for the past couple of days. However, for the bigger picture, I am now looking at a potential swing trade, […]

$EURGBP 22 June 2011

Trade completed. Click on tabs for setup and update. [tab: Setup] Here is the potential swing setup I mentioned in my tweet. $EURGBP is moving symmetrically into resistance level. I am watching closely. Pretty straightforward setup, I don’t think I need to write too much here. Here is the… CHART! [tab: Update 28 June 2011] […]