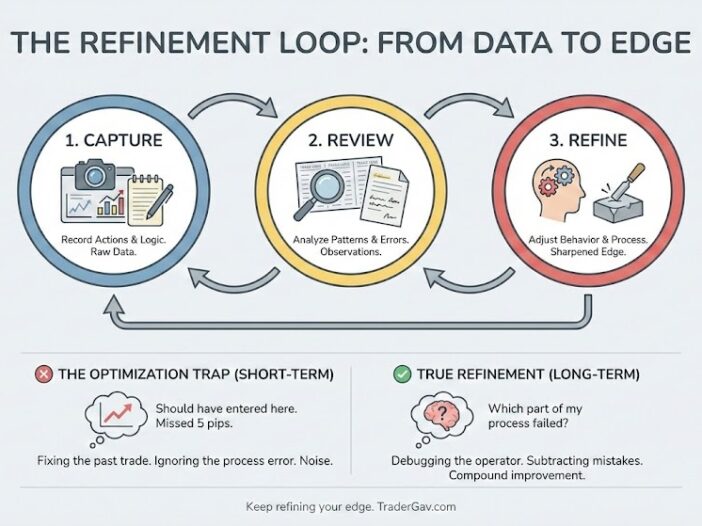

We established the capture system. The folder is now full of trade screenshots. The document is full of daily observations. But data alone provides no edge. It is just a record of history. A journal full of logs is only useful if it alters future behavior. The final step in the loop is refinement. This […]

Back to Basic

From Records to Refinement

So, here we are! It’s the last part of my ‘Trading as a Feedback System‘ series. We have built the structure to capture our thoughts. We have the daily logs and the trade records. But a journal on its own changes nothing. It is just an archive of what happened. If the data sits there […]

Key Lessons from Trading Risk by Kenneth Grant

I recently finished reading Trading Risk by Kenneth L. Grant. It is not a book about technical patterns or finding the perfect entry. It is a manual for the business side of trading, the unglamorous math that keeps you alive long enough to win. Most traders treat risk management like a set of brakes. They […]

Building Your Trading Knowledge System

We often treat our trading journal as a storage unit. We take a trade. We capture a screenshot. We write down the entry and exit price. Then we close the file and look for the next setup. Over time, this creates a graveyard of data. You have hundreds of logged trades, but they are disconnected […]

Trading the Frame, Not the Candle

How refocusing on the right timeframe restores clarity and discipline I noticed something last week.The tighter I zoomed in, the more I lost the plot. Each time I stared at the five-minute chart, pressure built, that quiet urge to act, to fix, to catch something. The smaller the chart, the louder the noise. I started […]

Flat Isn’t Failure

Last week, there were two days, I didn’t take a single trade. This post is to share the lessons I learned from those two days. Tokyo sessions offered no structure. London teased setups that never completed.Each day, I logged in, mapped the anchors, and walked away flat. By Friday, frustration crept in. That quiet feeling […]