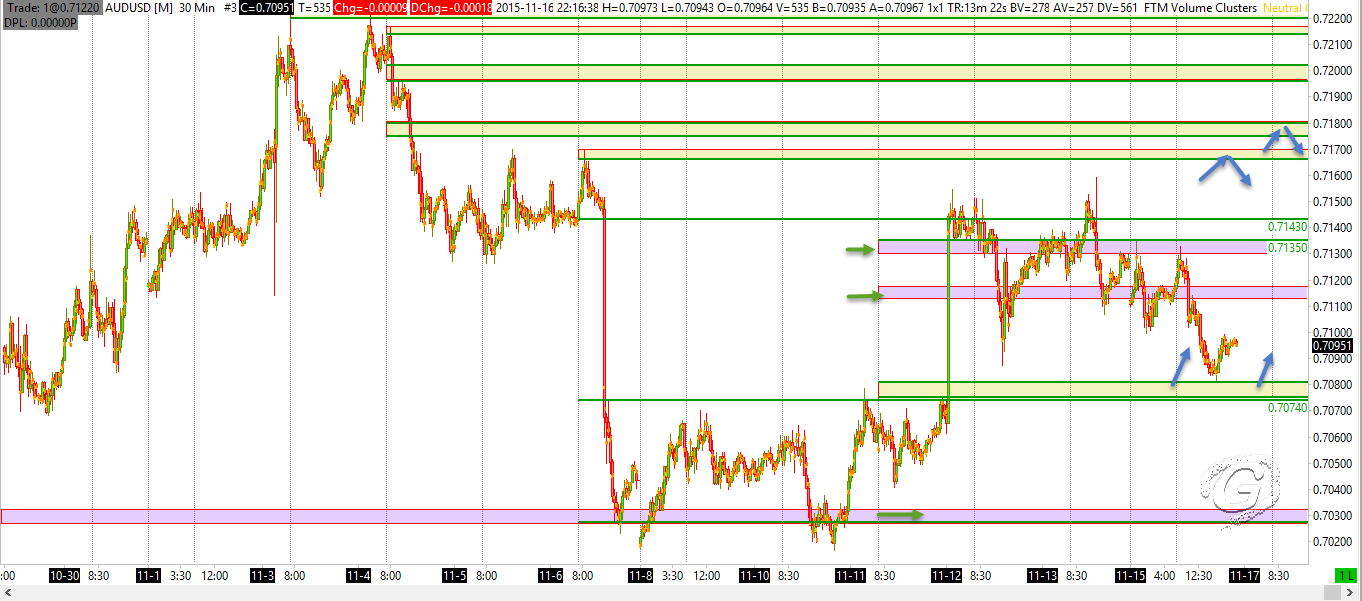

Yesterday, I tweeted about $AUDUSD ‘s structure prepare. Here is the updated chart. I expected market to fill the single prints between 7074 and 7143. $AUDUSD looking at the potential of repairing the structure between 7074/7143 — Gavin (@tradergav) Nov. 16 at 11:13 AM Updated chart Looking ahead, here are some zones I am […]

Support Resistance

GBPUSD trade the obvious?

Just thought I would post a chart here. This is a text book style support-resistance setup. Trade the obvious?

Have a look at larger time frame to set your bias. This setup might be provide you a good entry.

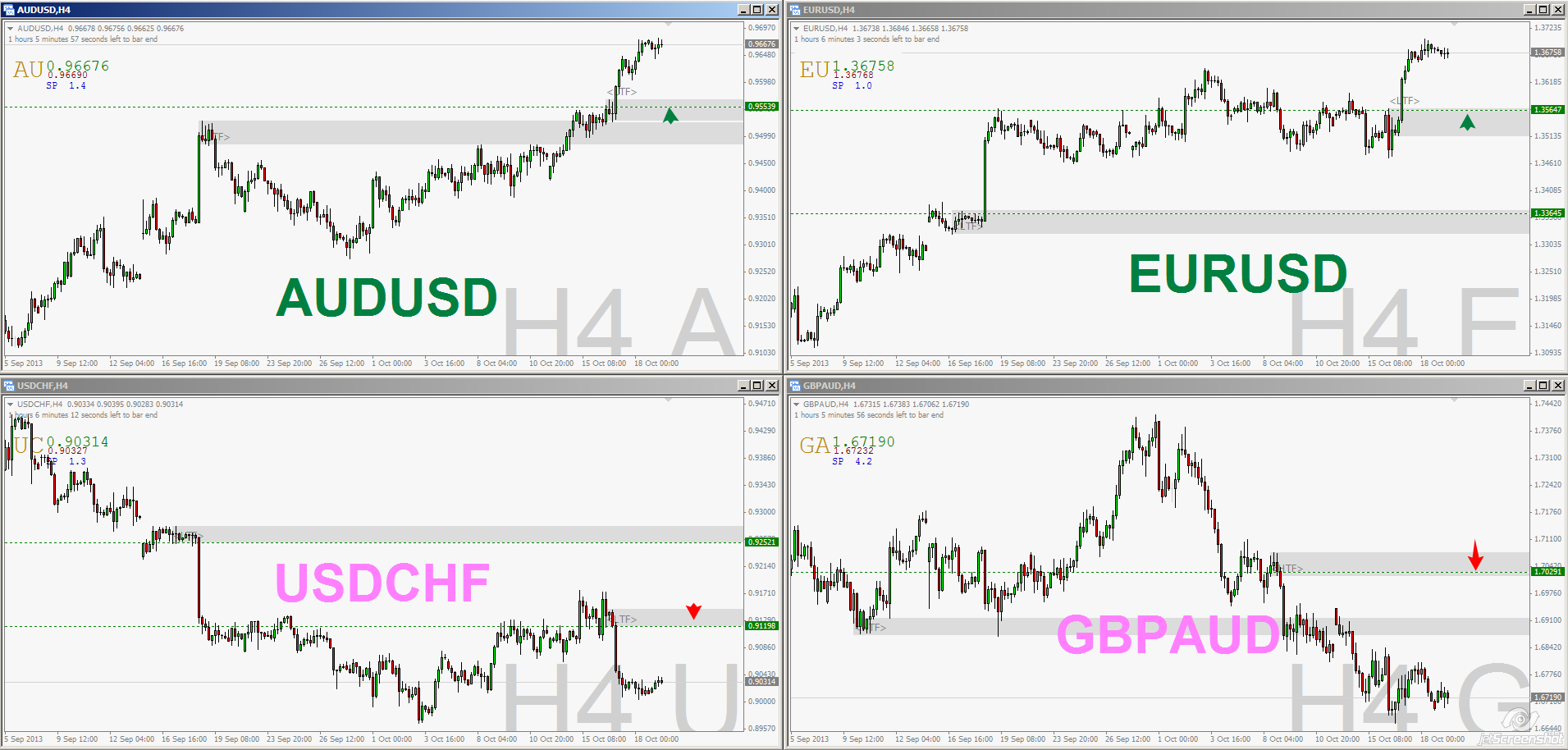

FX charts for week 21 Oct 2013

While my main focus is in Futures trading, I am still keep an eye on spot FX for swing trading ideas. Just thought I would share some FX charts which I am watching. I hope these charts help. You can always click on the charts to view in original size. AUDUSD: Still looking at buy […]

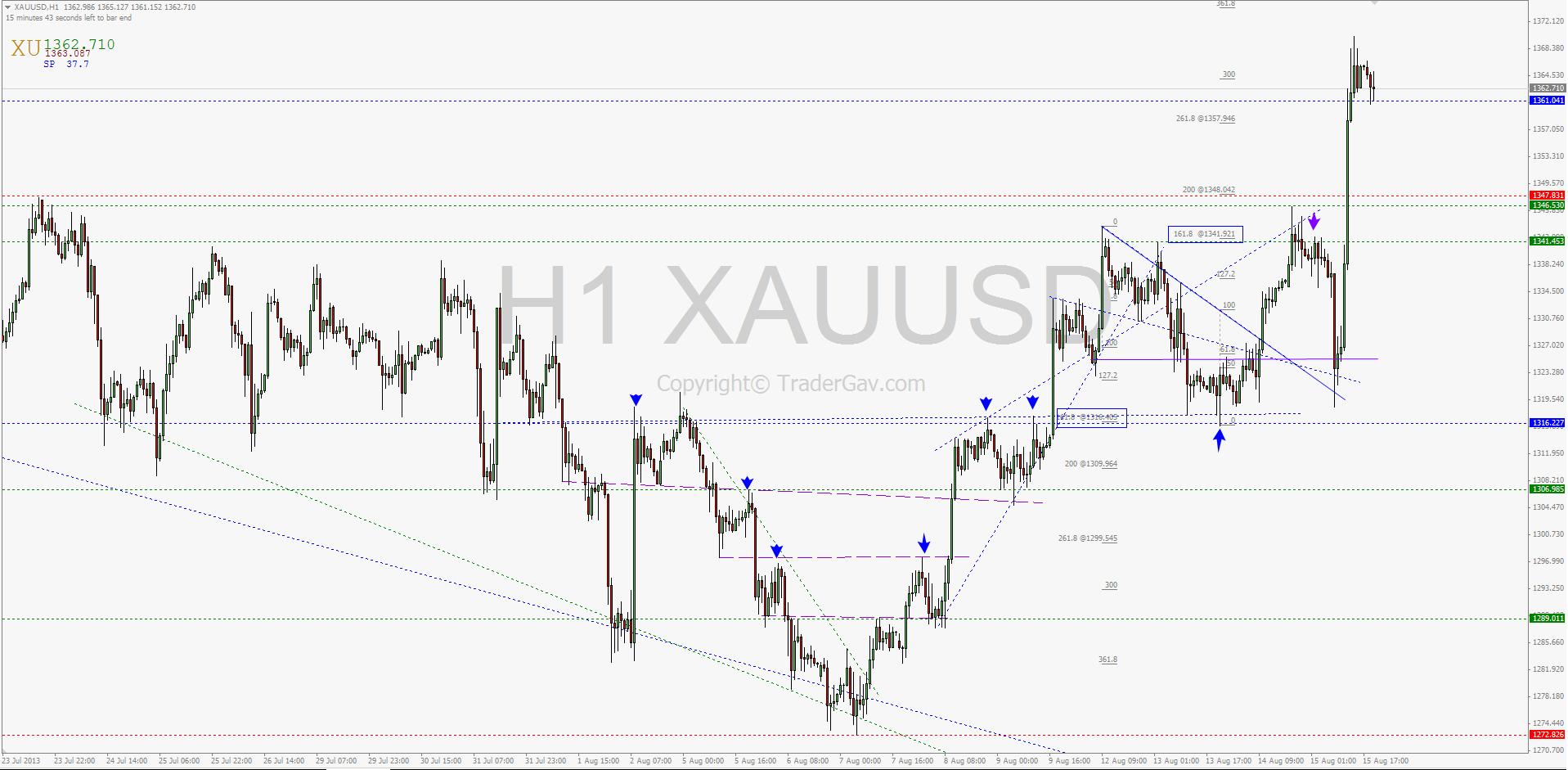

Weekly Review of spot GOLD (XAUUSD) 16 AUG 2013

Here is the quick chart review of spot GOLD XAUUSD. You can also find last week’s chart review here. The best way to understand the movement is to look at the charts in multiple time frame. The charts basically explain everything. I will just try to give brief descriptions. On Thursday, Gold broke away from […]

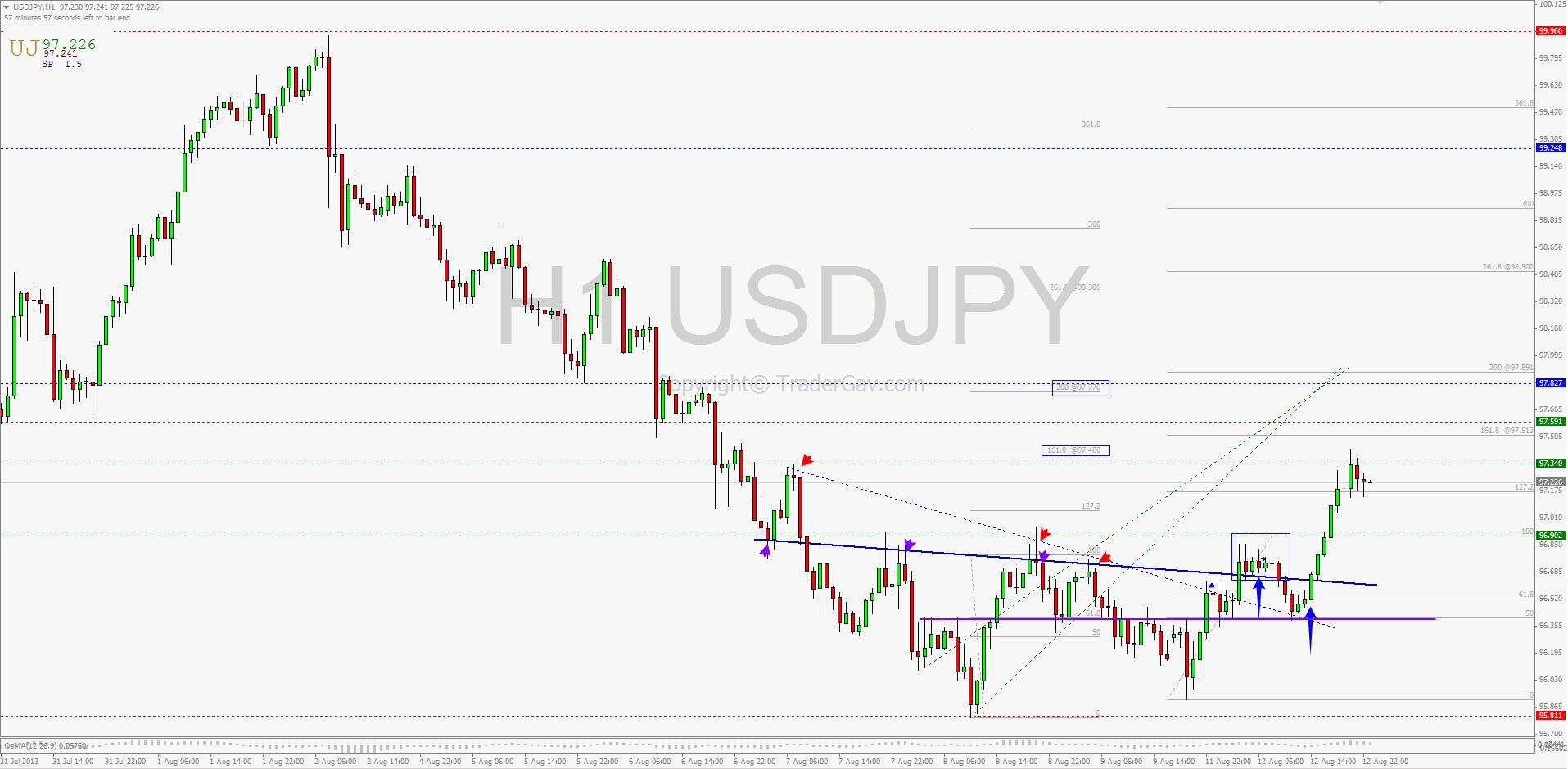

One USDJPY trade 12 August 2013

Just a quick post of one of the trades I made yesterday. I thought it might provide some educational value to my now 13 readers. I went long of USDJPY around mid London session yesterday. My entry was not the best I would like to have. I saw a small consolidation cluster around 96.75 , […]

Levels trading tips from hindsight analysis

First of all, AUDUSD approached 0.9130/40 resistance level. This is a daily level, and price reacted and immediately pulled back to intraday (hourly) support level 0.9085. If you managed to get in short position at the first test of 9130 level, the setup should give you around 1 R at 0.9085. (Unless you used a […]