Very often, on twitter or forums, I see people posting some simple trading setups, and give them some odd names, then call it their inventions. Laughable indeed. Anyway, kudos to them for providing some amusements. One of the most commonly seen setup is Immediate retest of broken support/resistance level. Well, regardless of the names given […]

Trading Journal

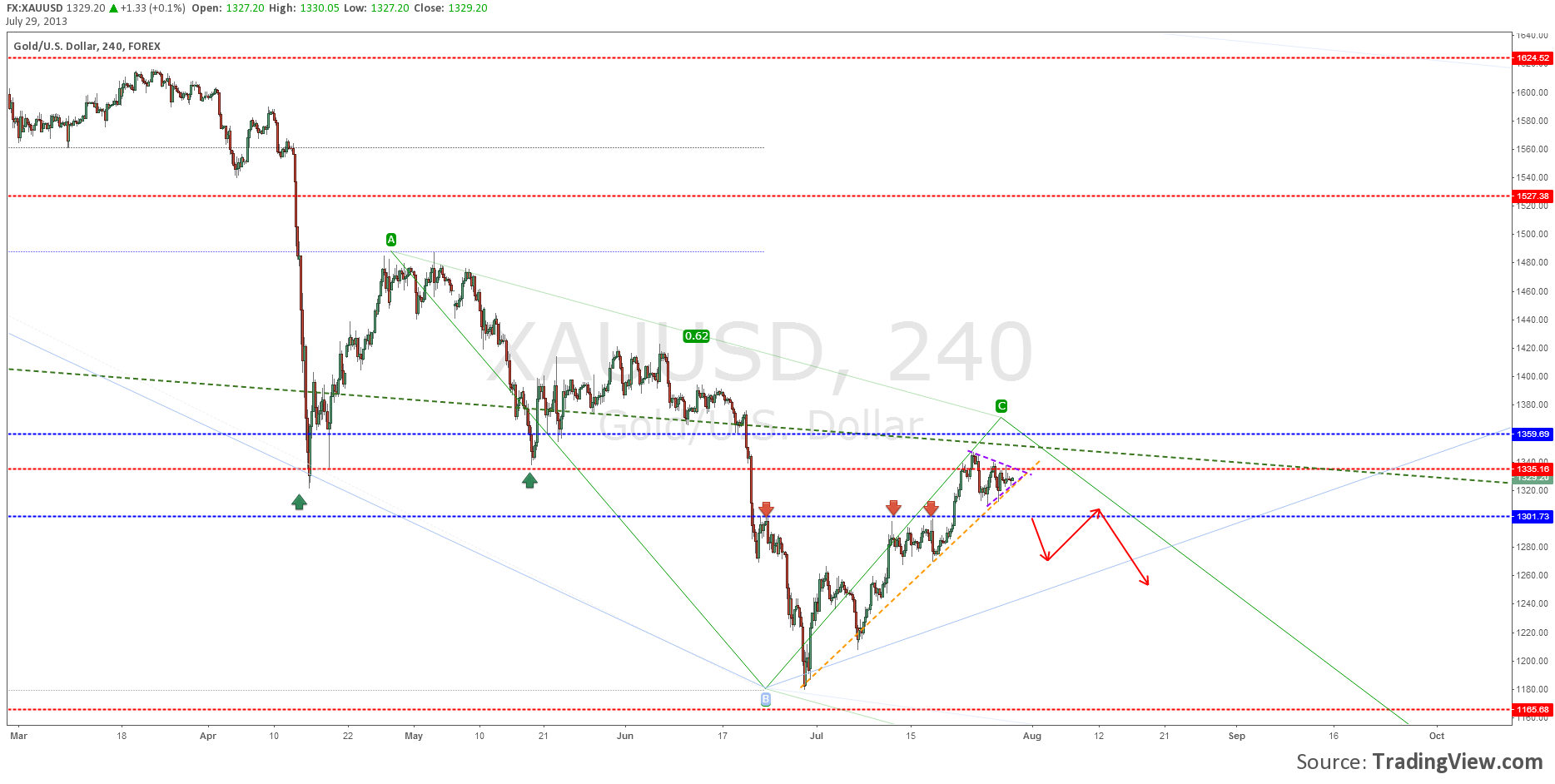

Weekly Review of GOLD (XAUUSD) 30 JUL 2013

In my previous post, we have identified the potential resistance zone around 1335. We are right there now. I would like to see a turn at this area, and projected target is at 1000 should the selling resumes. But, it is not as simple as it sounds. There are road blocks in front of us. […]

Waiting for the nobrainer trades AUDUSD USDJPY

AUDUSD Aussie remains trapped within the trading range. You can trade your range play strategies, I prefer to wait for nobrainer setups. 0.93 is still the key level to watch for any bullish movement. 0.9030 is the immediate support area to watch. A break of these levels will interest me. For short term intraday trading, […]

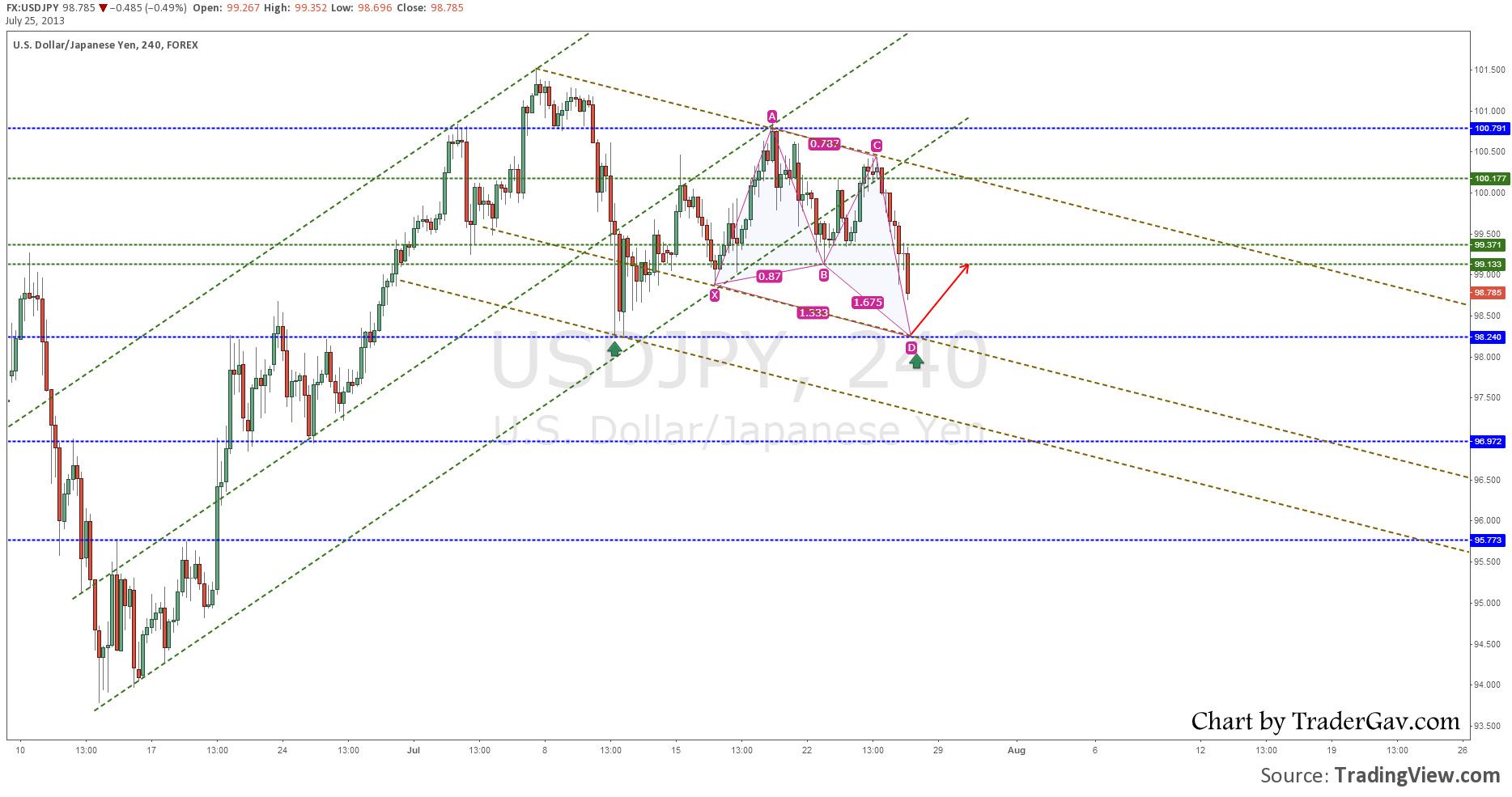

USDJPY level to watch 26 Jul 2013

USDJPY 98.25 is the immediate target for now. And this is also the level to watch for any potential bounce. I am interested in watching this level for potential false break before attempting long position.

Chart Review GOLD (XAUUSD) 17 Jul 2013

I always prefer to look at GOLD chart at the bigger time frame. It gives me a better picture. Let’s have a look at Spot GOLD (XAUUSD). Here is the Daily chart of Spot GOLD (XAUUSD). It is trading slightly below 1300 area. My immediate upside target is around the 1337ish which is also the […]

About the old SIMSCI trading journal

Just thought I would write a quick post here. Although I have moved to TRADERGAV.com a few years ago, I am keeping my old blog (Better Trading Blog) alive. The recent change of hosting server has caused some problems , such as loss of images etc of the old blog posts, particularly, the SIMSCI trading […]