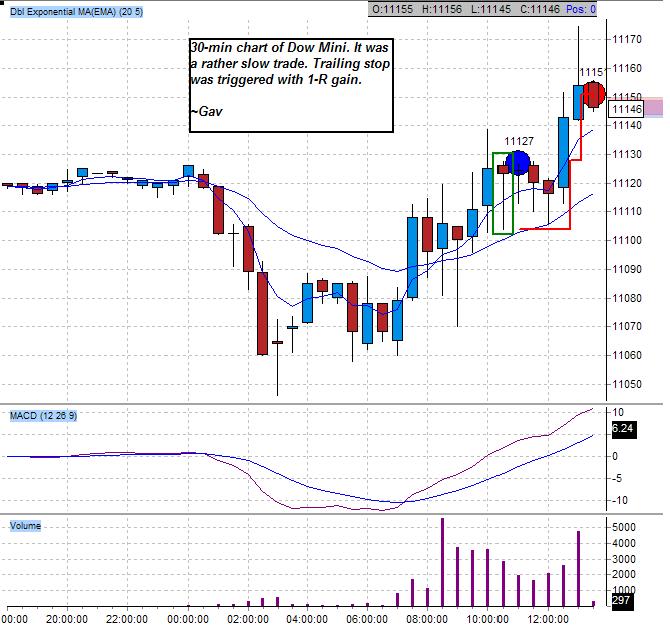

It was another bullish day, and it was indeed a repeat of tuesday’s session. S&P, Dow Mini as well as Nasdaq were having nice dummy set up. Long position of Dow mini was established above 9am(chicago time) candle. It was a very slow trade. Position was closed at 11309, and I have left E-mini Nasdaq […]

Trading Journal

Dummy day trading #13 15-August-2006:E-Mini Nasdaq:Long trade closed

This is the last trade of the day. Long position of E-mini Nasdaq was established above 9am(chicago time) reversal down candle. Trailing stop was moved to break even after 1-R gain. Subseqently, I did not wait for 2-R gain and decided to closed the trade with 1-R profit with the same consideration as Dow mini […]

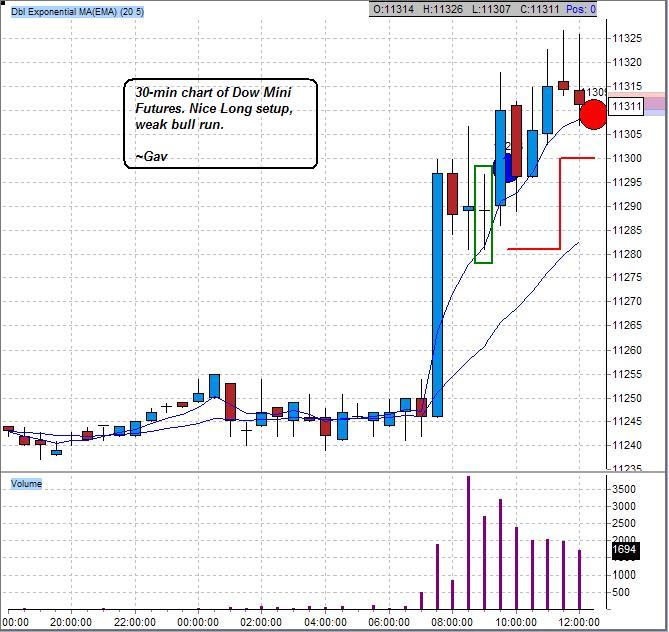

Dummy day trading #12 15-August-2006:Dow Mini:Long trade closed

Long position of Dow Mini was established above the 9:00am (chicago time)reversal down candle. I decided to closed the trade at break even point as I do not like to see a doji immediately after the initial entry candle. Secondly, given the consideration of Core CPI report which is due tomorrow, it might limit the […]

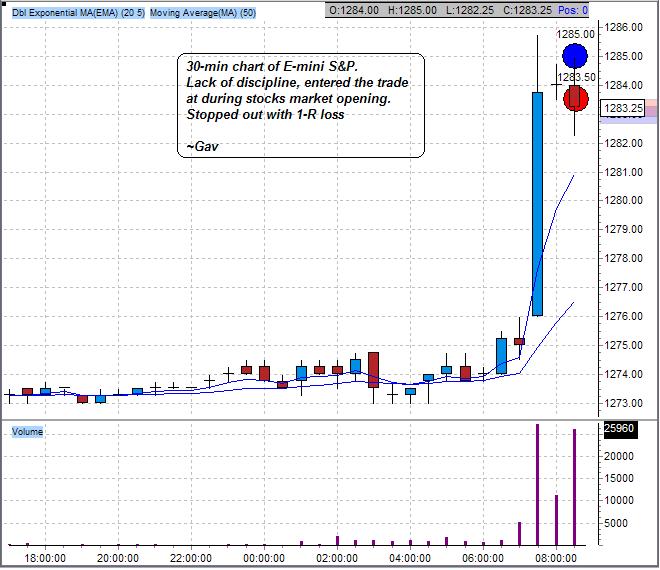

Dummy day trading #11 15-August-2006:E-mini S&P:Long trade closed

First trade of the day was a loss, and I was a loser. However, I deserved the loss. It was the result of lack of discipline to follow my trading rules, that is never enter a trade during the first hour of stocks market opening. I was eager to enter Long trade of E-mini S&P […]

TraderFeed: What Trading Teaches Us About Life

Here are 10 life lessons from learnt from trading – If you have not read Brett Steenbarger's latest posting , you better do. It is just great. I quote the 10 lessons stated by Brett here. 1) Have a firm stop-loss point for all activities: jobs, relationships, and personal involvements. Successful people are successful because […]

SIMSCI trading journal migration completed

I have finished moving all my SIMSCI (MSCI Singapore Free Index) futures trading journal from my old blog (clogspot). It is located in SIMSCI category. Another way is reading my June Archive . I started SIMSCI day trading since end of May. SIMSCI trades are important to me during the development as a futures day […]