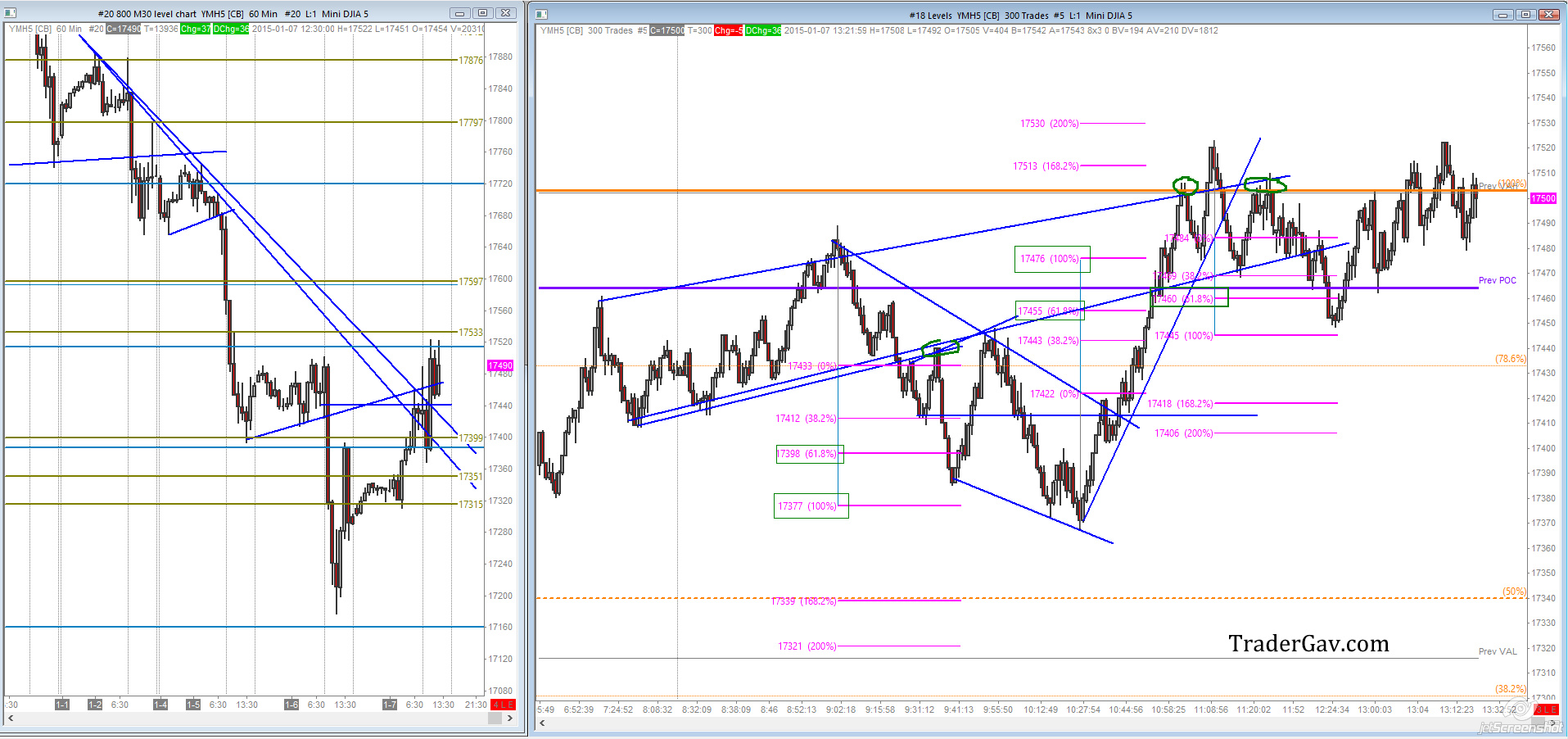

There were a couple of entry setups formed during Asian session (if you even watched this market during that hours), otherwise, YM was grinding up in the RTH morning, patience was required to wait for entry opportunity (well, at least for my type of trading). Looking at the context in hourly chart on the left, […]

headline post

Day review: YM 07 Jan 2015

Here is a quick review of YM for the past day

Christmas, A season of giving

If you had a great trading year, make it better by giving more! If you had a challenging one, trust me, giving makes you feel better.

My Weekend reading list: Saturday ,6th December 2014

Here are the articles, webinars I have collected for this weekend’s reading.

My Weekend reading list: Saturday ,29 November 2014

Happy ThanksGiving weekend. Here is my reading list for this long weekend. Gartley Patterns part 1: Video lesson by Nictrade — Gartley Patterns part 1 – Tags: traders development – http://screencast.com/t/fCzMf5eVQ Gartley Patterns Part 2: Video lesson by Nictrade — Gartley Patterns part 2 – Tags: traders development – http://screencast.com/t/O3P4msLmuo Chasing success: I talk […]

My Weekend reading list: Saturday ,22 November 2014

I have “weekend blue”, because, weekend to me, is all about driving around, sending kiddo to different enhancement classes. So the term TGIF means nothing to me. Anyway, on the bright side, the driving-waiting period is also a good time for me to clear my reading backlog.

Here are the articles I have collected this week, I thought might be valuable for traders’ development.