Here is something I thought might be helpful to some new traders.

My wife recently started her driving lesson. She is very keen to drive, but lack of confidence (and experience). Last evening, before heading out for grocery shopping, I thought it might be a good idea to let her drive while the traffic was low at that time.

She replied ” I will try later when I am more confident, and ready”.

My immediate reply was ” You will never be ready if you don’t drive”

How much screen time, readings, or even demo trading do you need before start live trading? It is good to get yourself prepared before investing your money in the market.The problem is, you will never be more ready, there is no “Right time” to start trading. I am not discounting the importance of getting the basic knowledge before start, but sometimes, we take too long to take the first step. Experienced traders will tell you, the real learning experience starts from live trading.

While I can’t promise you profitability in trading, rest assured you will discover something new every single trading day. Regardless how many books you have read, or how much time you have spent backtesting, you will be confronted with dilemmas when market moves against you swiftly, or it grinds you to death, or punches you on face with a series of losses, or it gaps so much in your “predicted” direction that makes you want to kill yourself for exiting too early etc.

You thought you are a disciplined person, maybe not. Market will tell you that. You thought you are patient, maybe not, market will test your patience. You thought you are a calm person, market will make you lose your cool soon.

The point is, you can’t buy, read, watch these experience. Put your money on the table, enjoy the challenge, learn from the challenge.

So, hope this small thought helps some of you. Meanwhile, I am going back to make sure she starts practicing driving now.

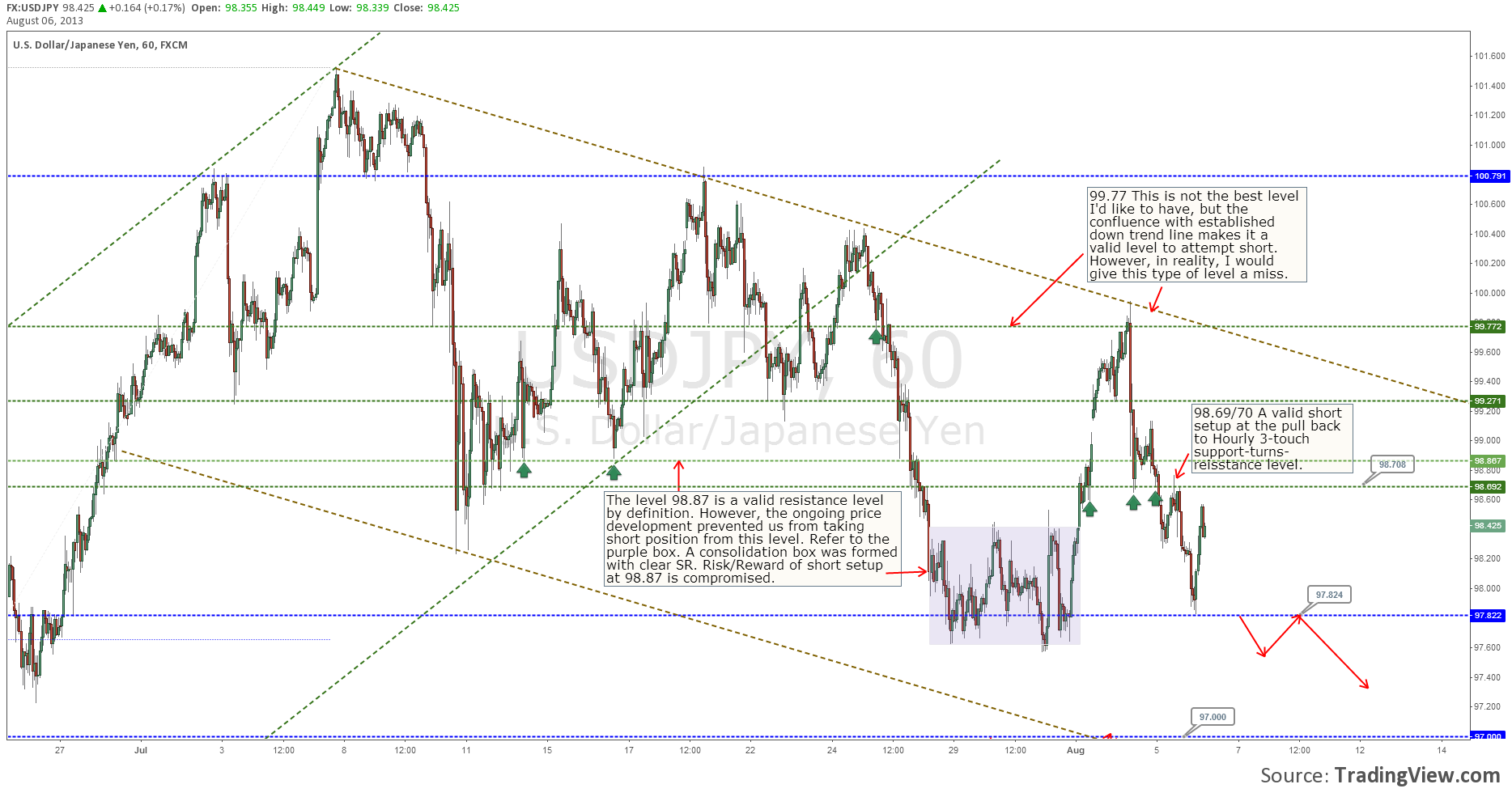

In case you haven’t noticed, trading is very similar to property purchase or development, it about Location, Location, Location. (Of course, during crazy market cycle, like what is happening in Australia right now, properties at some waste lands, or crappy locations, can also be sold for a couple of hundreds thousands, who are those buyers?!, really.). But, we are looking for consistent result, and long term prospect, then location is a key consideration. This is common sense.

In case you haven’t noticed, trading is very similar to property purchase or development, it about Location, Location, Location. (Of course, during crazy market cycle, like what is happening in Australia right now, properties at some waste lands, or crappy locations, can also be sold for a couple of hundreds thousands, who are those buyers?!, really.). But, we are looking for consistent result, and long term prospect, then location is a key consideration. This is common sense.