We spend most of our time staring at one ledger. We track the account balance. We obsess over the P&L. We calculate the risk of ruin and the potential reward. But I noticed years ago that there is a second ledger. It is invisible, but it dictates the movement of the first one. This is […]

blogs

The Art of Becoming Less Wrong

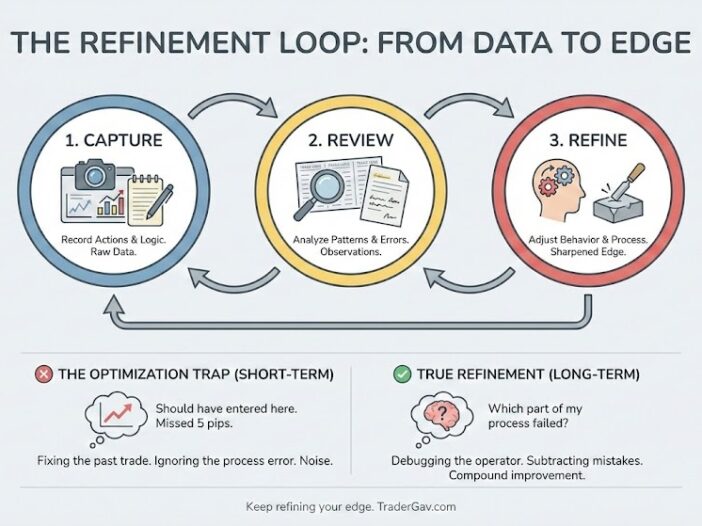

We established the capture system. The folder is now full of trade screenshots. The document is full of daily observations. But data alone provides no edge. It is just a record of history. A journal full of logs is only useful if it alters future behavior. The final step in the loop is refinement. This […]

From Records to Refinement

So, here we are! It’s the last part of my ‘Trading as a Feedback System‘ series. We have built the structure to capture our thoughts. We have the daily logs and the trade records. But a journal on its own changes nothing. It is just an archive of what happened. If the data sits there […]

Key Lessons from Trading Risk by Kenneth Grant

I recently finished reading Trading Risk by Kenneth L. Grant. It is not a book about technical patterns or finding the perfect entry. It is a manual for the business side of trading, the unglamorous math that keeps you alive long enough to win. Most traders treat risk management like a set of brakes. They […]

Building Your Trading Knowledge System

We often treat our trading journal as a storage unit. We take a trade. We capture a screenshot. We write down the entry and exit price. Then we close the file and look for the next setup. Over time, this creates a graveyard of data. You have hundreds of logged trades, but they are disconnected […]

The Honest Mirror of a Trading Journal

The Journal as a Second Chart Price shows you movement.Your journal shows you meaning. I used to think the chart was the only place to study my trading. Over time, I realised the journal is the second chart that runs in parallel. One tracks the external market. The other tracks the internal one. Both matter.Both […]