The Journal as a Second Chart Price shows you movement.Your journal shows you meaning. I used to think the chart was the only place to study my trading. Over time, I realised the journal is the second chart that runs in parallel. One tracks the external market. The other tracks the internal one. Both matter.Both […]

Blog and Rants

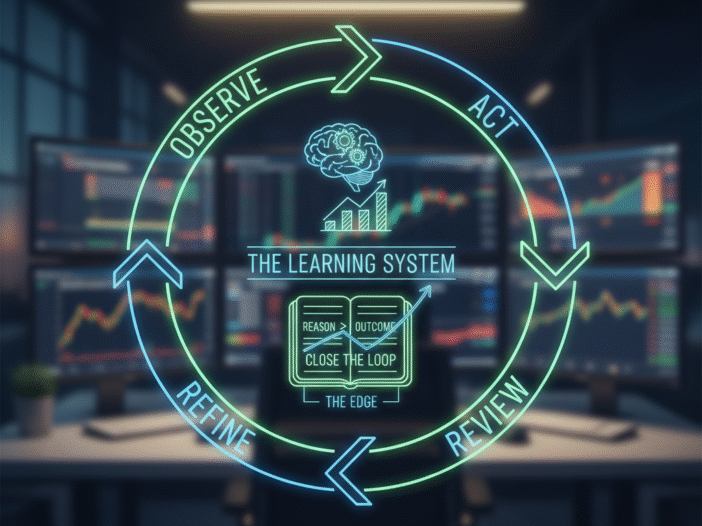

Trading as a Feedback System

Markets as a Mirror Most traders think of the market as a puzzle to solve.I’ve come to see it more as a mirror. Every trade reflects what you believed at that moment. Your read of structure, your emotional state, your confidence in execution. When the position moves against you, it’s not just the market saying […]

Trading the Energy, Not the Noise

Some days, the market moves but nothing really happens.The candles stretch, the price flickers, and your charts light up, yet you can sense it’s hollow. The rhythm is off. The movement has no weight. Other days, you can almost feel it.The tape tightens, the flow picks up, and every push seems to draw real participation. […]

Trading the Frame, Not the Candle

How refocusing on the right timeframe restores clarity and discipline I noticed something last week.The tighter I zoomed in, the more I lost the plot. Each time I stared at the five-minute chart, pressure built, that quiet urge to act, to fix, to catch something. The smaller the chart, the louder the noise. I started […]

Flat Isn’t Failure

Last week, there were two days, I didn’t take a single trade. This post is to share the lessons I learned from those two days. Tokyo sessions offered no structure. London teased setups that never completed.Each day, I logged in, mapped the anchors, and walked away flat. By Friday, frustration crept in. That quiet feeling […]

The Hidden Battle After a Winning Trade

Most traders think the hardest part of trading is finding the right entry. But the real challenge often begins after you’ve already done the hard work, executed cleanly, and booked a win. The danger isn’t missing setups. It’s what happens when you’ve had a good trade and suddenly the urge to do more creeps in. […]