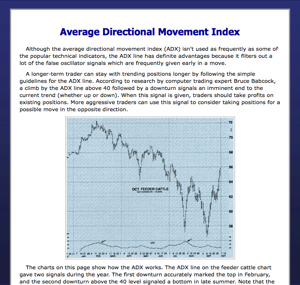

Here are some free stuffs for the weekend. MarketClub is offering 10 free trading lessons right now. Well, free courses, why not?

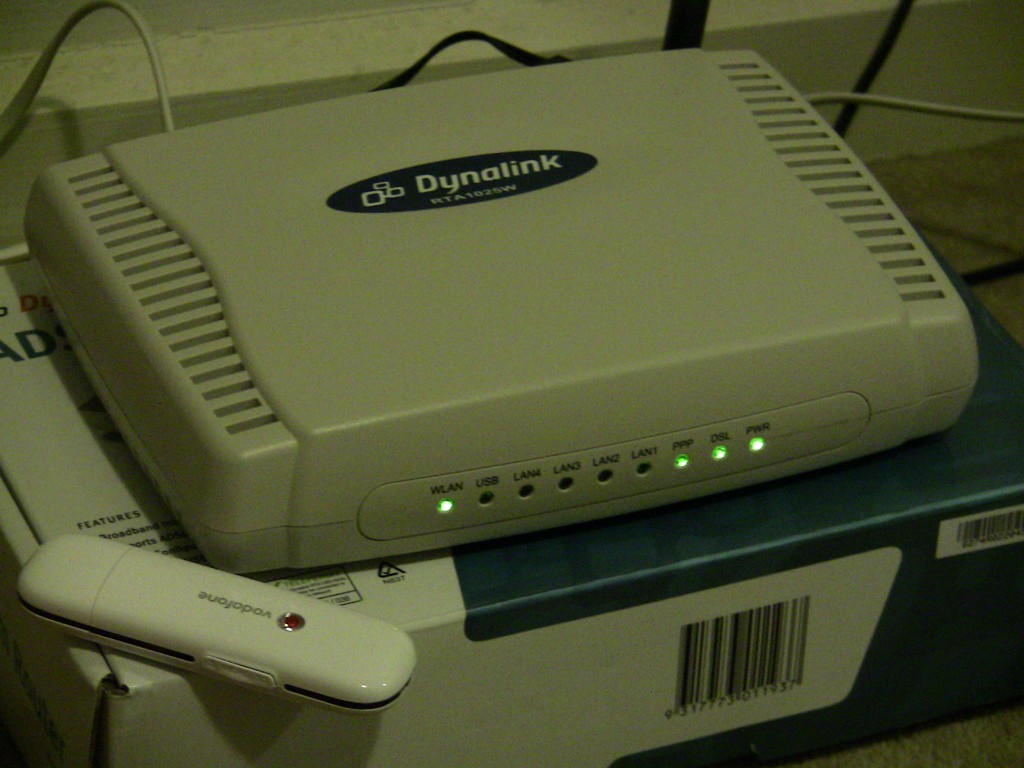

New toys in the office

My two-year-old ADSL2+ modem has declared death three days ago. I was in the panicking situation…

Anyway, I decided to go for all-in-one solution, ADSL2+ modem+wireless. I go for Dynalink ADSL2+ 4-port Wireless Modem. So, instead of switching on two devices, I am having one to serve me. In addition, I just bought myself a Vodafone Mobile Broadband USB Modem. This serves really well as back up connection. No ISP in Australia is perfect. In fact, most of them are problematic. So, instead of fighting with the fact, I get myself prepared. Well, at least, I need to make sure my trading is not affected.

what’s next?

This is interesting.

I see both GOLD and Aussie dollar losing momentum now.

What’s next?

Chart of the moment : $EURUSD

A blog post and something about stocktwits

I read a recent blog post on TraderFeed. This caught my attention, echoing my mind.

Traders need to develop ways of seeing markets that are unique to them, that make sense for them, that fit their risk tolerance and lifestyle, and that best make use of their skills and talents. Simply giving traders ideas could actually stunt their development, much like doing a child’s homework for them.

An important challenge in trading is that there is typically more valuable information streaming from markets than a single individual can reasonably process on their own….

That is the main reason why I hardly, or never use service like Stocktwits. OK, I am not against Stocktwits. It is a brilliant idea from some entrepreneurs. But, is it really useful for trader’s development? Well, Caveat emptor. Personally, I do not find it to be useful for my own development. To me, it is just a stream of random tweets, good or bad of so called ‘trading ideas’, valuables and junks, marketing of premium services, repeated links etc. But, this is just me. I believe, some users are finding it to be helpful to them. By all means, go for it. I’ll leave it to you to decide, and please, do not try to argue in the comment why I am wrong. I don’t care.

Instead of wasting time following somebody, I guess, it will be better off for trader to be away from social networking, and develop his own view, own way of seeing markets. With that skills, then the streams of tweets might give you some good ideas.

Federer’s game

It was a shaky performance at the begining. I am talking about Roger Federer’s match with Lleyton Hewitt. Federer’s forehand, and backhand were out of control. It looked really dangerous, and he lost the first set. But, you know the result, Hewitt lost the 13th time.

OK, I am not a tennis player, so, I am not trying to discuss any technique here. I am a trader, so here is what I observed from the match. He knew his forehand and back hand strikes (do we call it strikes?) were unusual, kinda out of control. However, that did not stop him from trying. Again and again he hit the ball, and tried to gain back the rhythm that he needed. He was not afraid of hitting the ball again even though he had failed so many times. I was impressed.

When you have 3, 4 or 5 losses in row, do you start doubting yourself ? The message is pretty clear.

By the way, Maria is out….what the…..never mind…