Here is the chart I mentioned in my tweet. We have the completion of bullish harmonic formation, price reaching bottom of the channel and support level. Setup will be invalidated if 1.3180 level is broken. Here is the ….. CHART!

$EURGBP 13 April 2011

Here is the EURGBP chart I mentioned earlier on in my tweet. The pair has recently completed a Bearish ABCD formation, and it is trading right in the supply level. I am looking at the short side for now, and the setup will be invalidated above 0.8945. Here is the…. CHART!

$EURUSD 12 April 2011

I am playing my plan here. EURUSD has made highs, and finally reach my defined supply level and a bearish harmonic formation has completed in weekly chart. I am at the SHORT side now. Let’s see how it goes. Here is the ….. CHART!

$EURUSD 21 March 2011

Here is the Daily chart of EURUSD. Looking at it carefully, we are entering supply zone, and we have confluence of harmonic patterns, top of channel, and resistance level. I am watching closely for potential short opportunity. Let’s see how it goes.

Quick update

I have recently moved to a new place, and hence, setting up a new office. It is a tiring work, and this also explains the lack of update recently. I have a very slow start of March, and I should be back to full swing this week. More later.

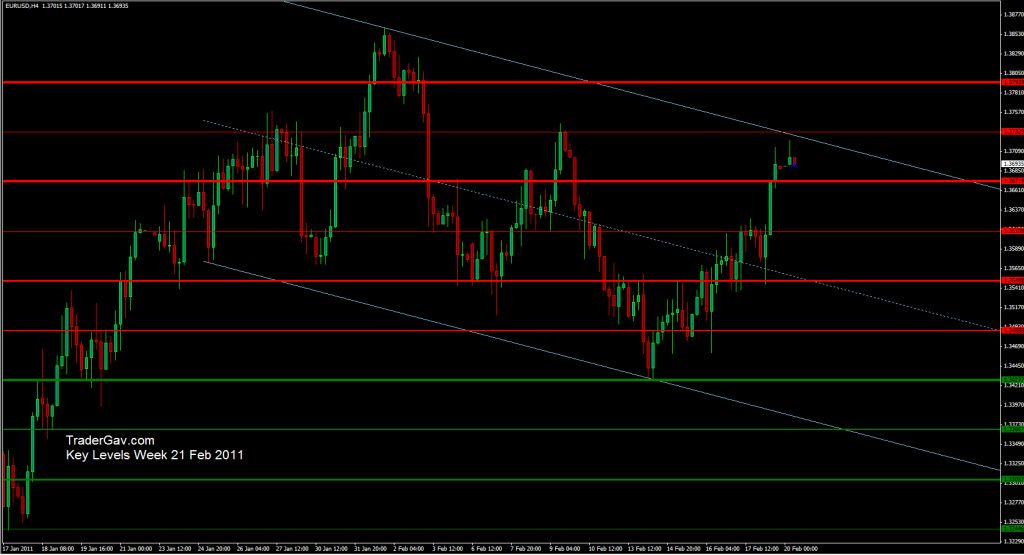

Key Levels to watch for Week 21 Feb 2011

Here are the currency pairs and the key levels on my watch list for this week. I am not sure if I have any extra energy to trade this week, since I am busy preparing for next week’s house moving. Anyway, that’s not the point of this post. Again, these levels are just support/resistance that […]