So it sets to be a negative morning. Nikkei opened slightly positive and drifting down to negative territory now. No surprise for SIMSCI Futures. It is flat with negative biased. It is still too early to define direction for the day. I am watching it closely for trading opportunity.

Paper Trade Series: Mini Dow

15-min Mini Dow Finally , i got my new charting service up and running. I have been watching Mini Dow for opportunity. I have decided to perform paper trading for few days in order to get use of this new chart service. First entry is when Mini Dow broke recent downtrend and RSI making is […]

Charting Headache Continues: No trade today

It is going to take sometime for my new chart service to be activated. Maybe it is time for me to take break after some winning trades for the past 2 weeks. I can't risk by doing day trading with delayed chart. I 'll be back when the chart is available to me again. Be […]

Charting headache: No trade today

I do not believe it. My broker just replaced their charting service which delays 2 bars. This has a big implication to my day trading strategy. I can't make a timely decision based on the delay chart. I have decided not to trade today in order to sort out the charting problem. This is a […]

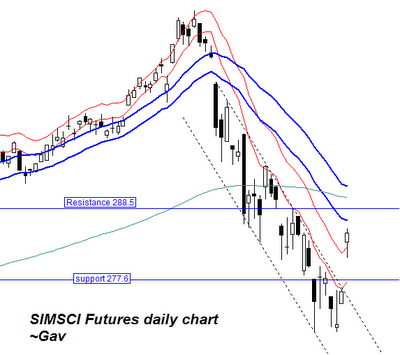

Chart Eye: SIMSCI Futures : ended 16-June-2006

This is daily chart of SIMSCI futures. It broke out from existing downtrend channel last Friday after a strong day. It is currently facing resistance soon. Directional index has started ticking up after reaching oversold level. And trend index shows a same picture as well. Sentiment is improving though it is still remain negative. It […]

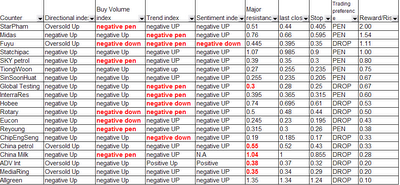

Opportunist series: Stocks for 19-June-2006 onwards

This opportunist series is to capture stocks which experience extreme bearish sentiment and starts rally. Tight stop loss is implemented as broad market sentiment and trend remains bearish. I have found some counters for agressive trading style to capitalise in the rebound rally in the existing downtrend. Almost all of the stocks I have found […]