I am not going to post charts today. In summary, my Long positions of GBPJPY and USDJPY were slaughtered , Long AUDUSD made it all back with additional profit.Read my twit here. If you live or visited Melbourne, Australia before, you should know about our most ‘Fabulous’ and ‘efficient’ public transport system. Let’s only […]

USDJPY

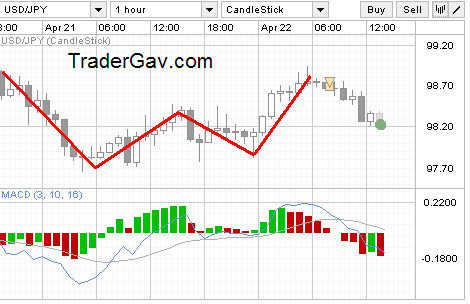

One USDJPY trade 22-April-2009

At the end of Tuesday U.S session, I saw a nice short setup in USDJPY. Classical text-book pattern to me, and offered me 1:2 R/R. Short position was established, profit target was achieved at the mid day of Asian session. Not too bad with +2R gain. Here is the…CHART! Well, forget about the MACD, […]

Weekly Wrap up

Before I start writting about trading, I would like to let you know…I HATE SUMMER!!!!! I HATE SuMMER!!! I am baked in over 100 F or 40 degree Celsius for the whole week. And , the best situation is..I do not have air conditioner in my apartment.Well, … I HATE SUMMER!! Alright, let’s get back […]

Busy week

The idea box generated quite a number of trades after the first disastrous day. 😆 All trades were focusing on Long EURGBP, and short USDJPY. Friends on my Facebook would have known I was trading these two pairs frequently this week. The idea box is built with a stupid trend following method couple with fundamental […]

Broken box & idea for Tuesday

Holy cow! The very test of my trading idea box failed miserably… 😆 Whatever.. Here are the ideas for Tuesday: – NOTHING! Yup, no formed setup exists now. Instead there are a couple of them on the wathlist. EURGBP – Still looking at Long USDJPY – Looking at Short Let’s see how it goes.

Tale of two trades — USDJPY, EURUSD

In order to salvage my getting lower blog readerships (in fact, it is consistently low readership 😆 ) , I am going to post two trades that I have made today , 01-Dec-2008, London session. it is show off time again! 🙂 Scalping? Yeah, I do scalp. But, I have a box of trading styles, […]