I thought I was going to call it a week early, but Cable gave me some bonus before the weekend. I was looking to short $GBPUSD around 1.48 area, however, the sluggish price action around 1.47 and yesterday’s high prompted me to give it a short earlier. 2 profit targets were achieved, and 1 still […]

Trading Journal

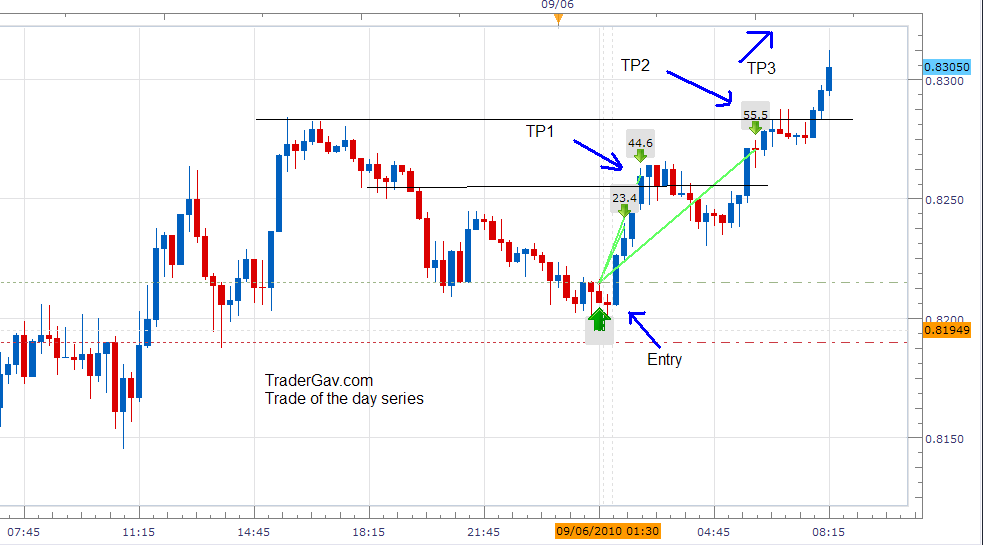

Trade of the day 09-June-2010: $AUDUSD Long

I like the way bears got rejected around 0.8210 area, which formed a nice short term support. I went Long $AUDUSD. 2 Profit targets were achieved, and I thought it would be wise to take some money off the table in front of 83 cents. Last portion of position is still trailing the market. Here […]

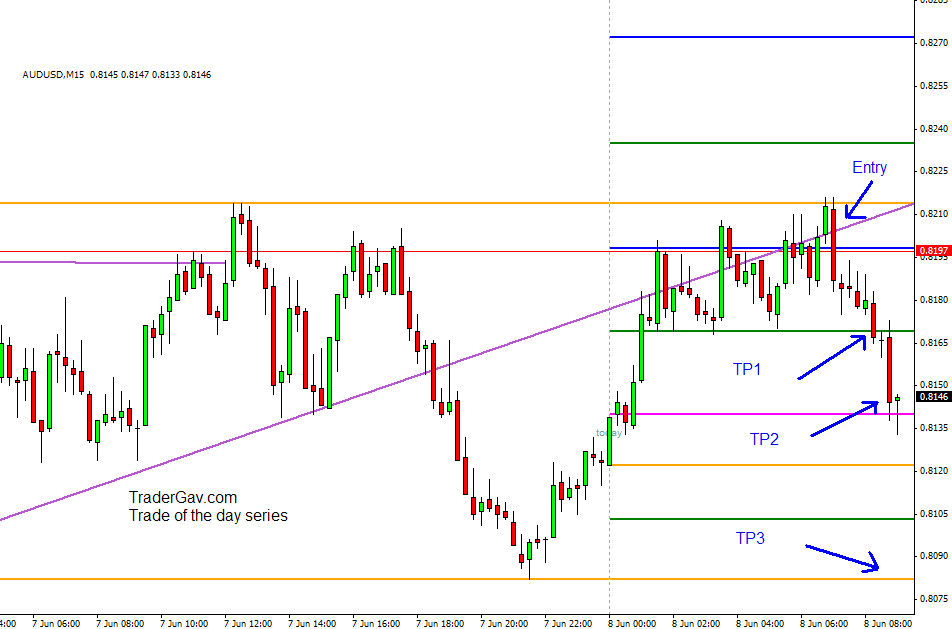

Trade of the day 08-June-2010: $AUDUSD Short

I shorted Euro and Aussie dollar again today. Both worked out nicely. Here is the $AUDUSD short trade. I liked the rejection of 82 cents, and the struggle of the price action around yesterday’s high. It was a pretty obvious short to me. 2 profit targets were taken, and last portion is trailing. Here is […]

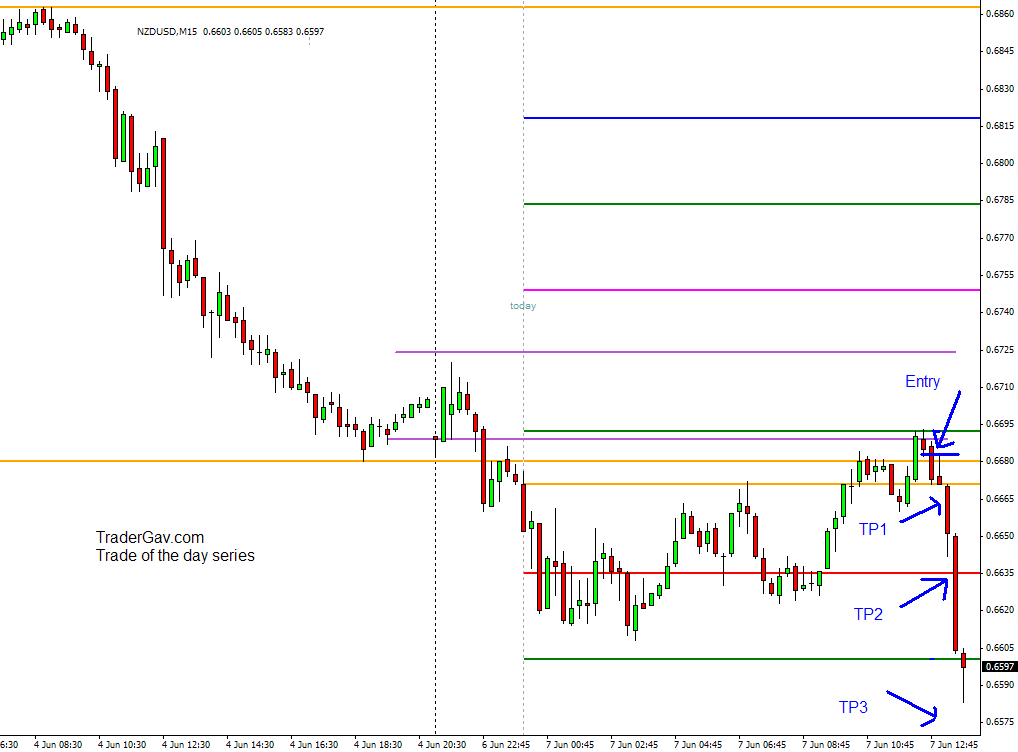

Trade of the day 08-June-2010 : $NZDUSD short

I opened few short positions during since early London session, and they came to fruition during early U.S session. I decided to share $NZDUSD trade, which was a fast, and aggressively sold off. I have waited for few hours for Kiwi dollar to pull back , and I decided to pull the trigger when it […]

Trade of the day 3-June-2010: $USDCHF Long

Here is the trade I would like to share today. After observing USDCHF hanging around yesterday’s low throughout Asian session, and ‘seemingly’ forming short term bottom. I thought it was worth trying out a long trade. I went long $USDCHF. 2 profit targets was achieved and trailing stop was, unfortunately, triggered. Here is the chart.

Trade of the day 2-June-2010:$GBPUSD short

I thought I would choose a good trade a day (if there’s any) to post here. Maybe some of my 12 readers might find it to be useful. I shorted GBPUSD during early European session when cable failed to exceed yesterday’s high. My entry was not ideal, it was a little bit late. The trade […]