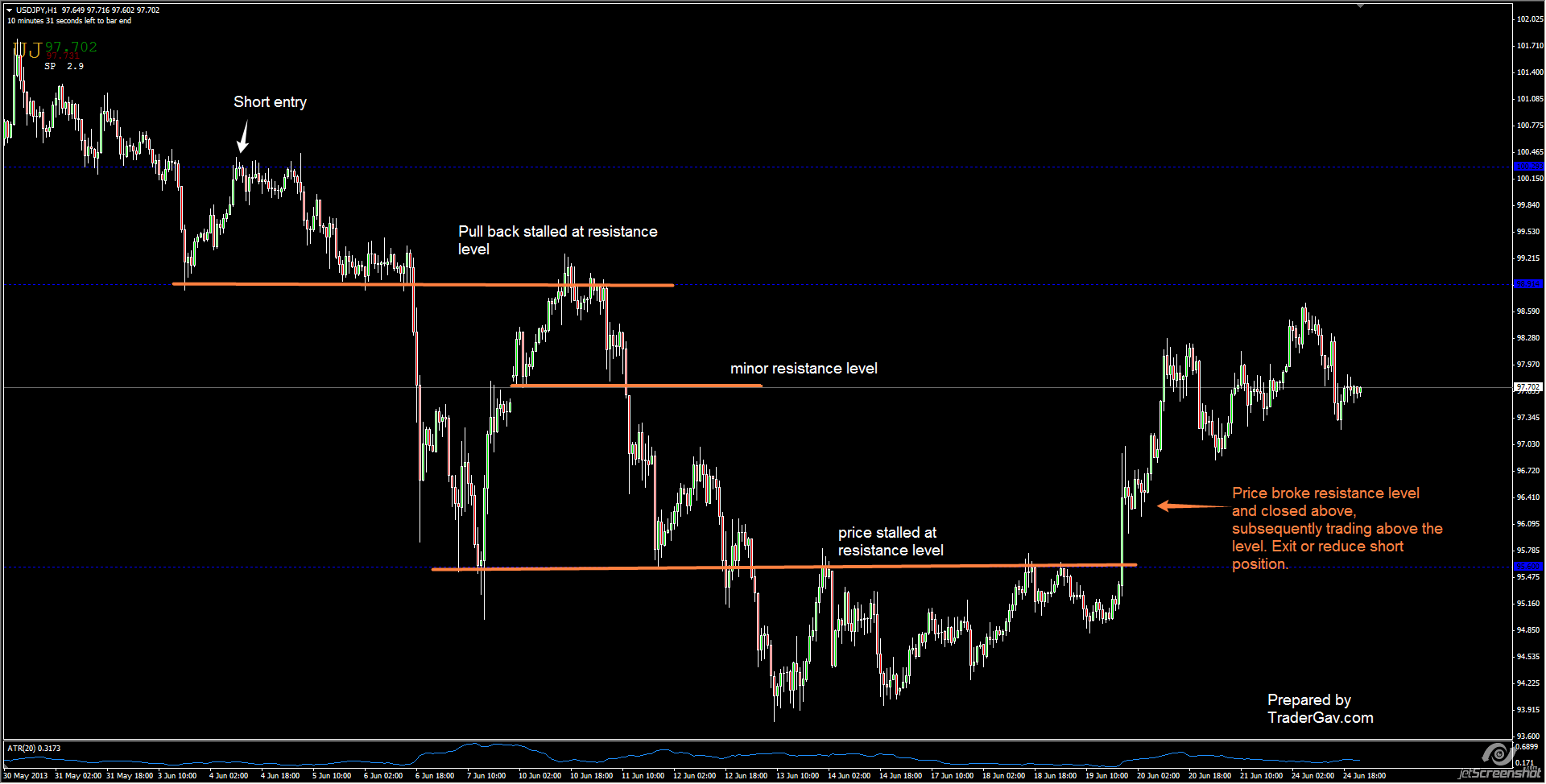

I am not the inventor of this strategy. It is widely available on the internet, and I have no idea who was the originator. I have found it to be effective when using simple support/resistance methodology to manage trades. The Simple Exit Strategy This is an exit strategy using a 5-min chart, however, it […]