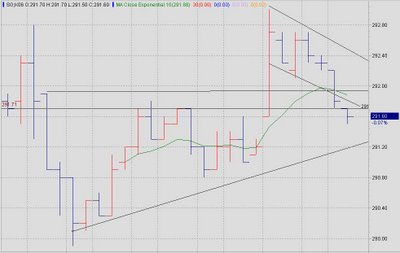

This 12-min chart of SIMSCI closed.

It appeared to be a mistake by moving stop loss to break even too early. SIMSCI had a nice swing today indeed. Initial stop loss of 291 was not violated at all. And planned target was reached at the last 12-min of trading. It happens in trading. Missing profit.

It appeared to be a mistake by moving stop loss to break even too early. SIMSCI had a nice swing today indeed. Initial stop loss of 291 was not violated at all. And planned target was reached at the last 12-min of trading. It happens in trading. Missing profit.

The market sentiment caught my attention when Nikkei and Hang Seng are gaining above 200 points. A ascending triangle was formed before SG market re-open for afternoon session. These supports my buy decision just above resistance at 292 with stop loss set at 291.

First Target was set at 293.8. I expect this as a fast movement trading.

SIMSCI failed to performed. Instead , after reaching high of 293, it starts to drift down. Trailing stop has been moved to break even point. I am pretty cautious when seeing SIMSCI failed to stay above morning high of 292.8.

Stop loss was triggered. No gain for this trade.

This is a 12-min chart of SIMSCI.

Seems stop loss at below 290.8 is a better option based on standard technical analysis.

Seems stop loss at below 290.8 is a better option based on standard technical analysis.