I recently finished reading Trading Risk by Kenneth L. Grant. It is not a book about technical patterns or finding the perfect entry. It is a manual for the business side of trading, the unglamorous math that keeps you alive long enough to win.

Most traders treat risk management like a set of brakes. They see it as the thing stopping them from making money. Grant flips this view entirely. He argues that risk is an asset. It is your inventory.

I read this text so you don’t have to. Below are the core mechanics of the book, stripped down to what matters for your daily process.

Risk is Currency

You have a finite amount of risk capital. If you spend it on low-quality setups, you are squandering your inventory. If you spend it wisely, you purchase high returns.

The cost of a loss is not just financial. The real price is time.

When you lose 50% of your account, you need a 100% gain just to break even. That recovery takes months or years of grinding.

Grant’s philosophy is simple:

strict risk control ensures you are still standing when the easy opportunities finally arrive.

The Line in the Sand

Before placing a trade, you need a hard floor. Grant calls this the Stop-Out Level.

This is not a stop-loss on a single ticker. It is the maximum economic loss you will accept for your entire portfolio before you liquidate everything.

If your equity hits this number, you stop trading. Without this number, you are gambling, not managing a business.

The Lung Concept (Sizing)

Most traders size their positions based on their total account balance. Grant suggests a different approach called the “10% Rule.”

Your risk capacity should breathe like a lung. It expands when you are winning and contracts when you are losing.

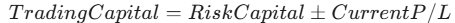

He defines Trading Capital differently than most. It is not your total cash. It is the money you have left to lose before hitting your Stop-Out Level.

The formula is:

If you are in a drawdown, your Trading Capital shrinks mathematically. Therefore, your position sizes must shrink. This mechanical rule prevents you from “doubling down” to make back losses.

This is a habit that destroys careers.

The 90/10 Reality

Here is the statistic that matters: 10% of your trades will likely generate 100% of your profits.

The other 90% will essentially break even or wash out. You cannot predict which trades will be in the top 10%.

Your job is not to be right every time.

Your job is to manage the bottom 90% so they don’t bleed you dry while you wait for the outliers. If a trade in the 90% pile starts acting poorly, cut it. Do not waste your limited risk currency on a trade that isn’t working.

The Diagnostic

Grant suggests tracking your Impact Ratio.

Divide your Average Win ($) by your Average Loss ($). This number must be greater than 1.0.

You can survive with a win rate as low as 40% if your Impact Ratio is high enough. But if your average loss exceeds your average win, no amount of technical skill will save the account.

Summary of Actionable Points

If you want to apply Grant’s framework to your trading tomorrow, start here:

- Define your “Walk Away” number: Write down the exact dollar amount where you will liquidate all positions.

- Earn the right to risk: Only increase your position size after you have booked profits. When losing, trade smaller.

- Check your lung capacity: Calculate your “Trading Capital” (distance to stop-out) daily. Base your risk on this number, not your total balance.

- Audit your ratio: Look at your last 50 trades. If your Average Loss > Average Win, cut your sizing by 50% immediately until the data improves.

Risk management is not about playing defense. It is about preserving your capital so you can afford to be aggressive when the market offers a fat pitch.

Keep refining your edge.

Leave a Reply