It is a brand new year. Shrugging off the dust, let’s start the engine again. I would like to have a long term view of currencies pairs and commodities movement before go into details of my trade preparation. Gold caught my eyes. I see something beautiful in the weekly chart. What do you think? Are we heading to a breakout? And if Gold is having a inverse relationship with Dollar. Where do you think Dollar will be heading to? Let’s see.

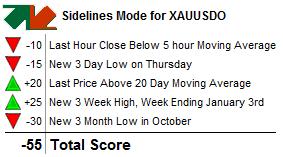

And here is some short term technical statistics:

And here let’s have a look at weekly Dollar index:

Charts generated by Market Club.

Fundamental wise, Kathy Lien has written a detailed analysis here. Check it out.

US interest rates have fallen 400bp from 4.25 percent to 0.25 percent in 2008. For most people, interest rates at 0.25 percent are as unattractive as zero interest rates. With US rates pretty much at zero, the Federal Reserve has informally adopted its own version of Quantitative Easing. Some people may even argue that the Fed has been pursuing this strategy for months now. In conjunction with the Treasury department, the Fed has doubled their balance sheet in the past 3 months to more than $2 trillion. They have done this by purchasing direct equity investments in banks, easing standards on commercial paper purchases, made efforts to relieve institutions of their toxic asset-backed securities and are now considering buying Treasury bonds and agency debt. By buying these assets, they are adding money into the financial system. Like the Yen, Quantitative Easing exposes the US dollar to significant downside risks because the Federal Reserve is basically printing money and using that money to flood the market with liquidity, eroding the value of the dollar in the process. However it is a step that the central bank needs to take to stabilize the US economy and to prevent a deflationary spiral. The central bank will not be worried about a weak currency and will in fact welcome one because they know that a weaker currency is like an interest rate cut in many ways because it helps to support and stimulate the economy.

I think gold will breakout higher.. but I’m not sure dollar index..

I think gold will breakout higher.. but I’m not sure dollar index..