Refer to pre market prep post here.

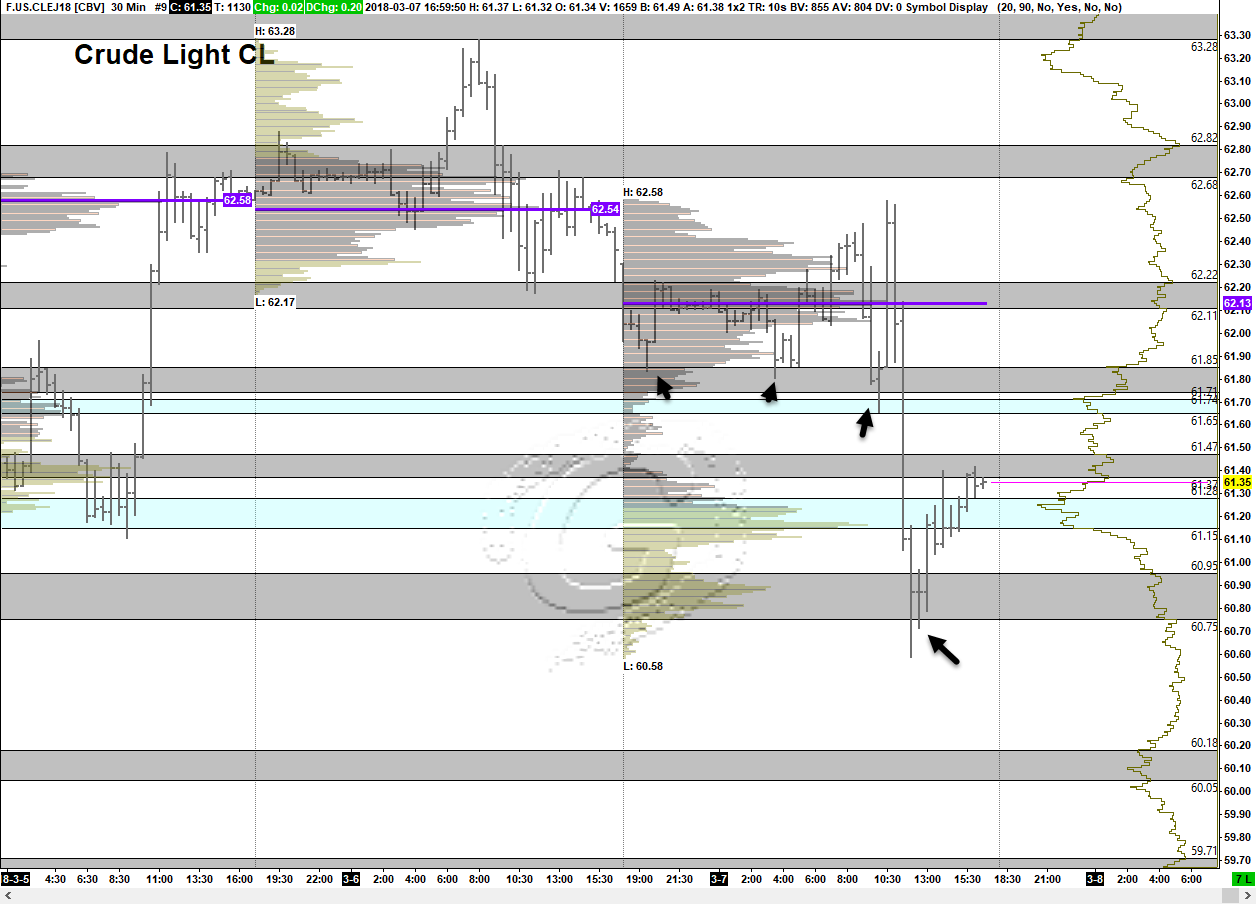

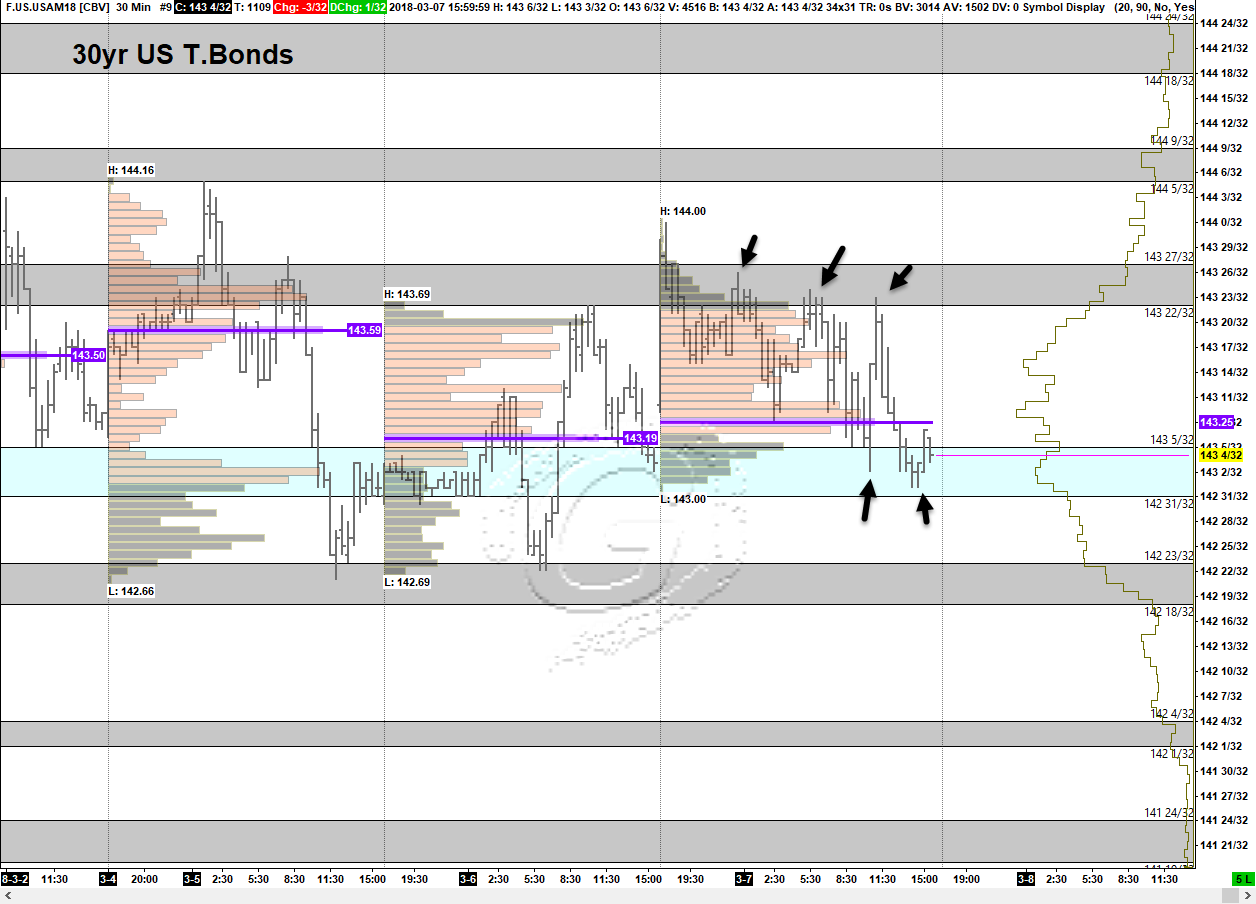

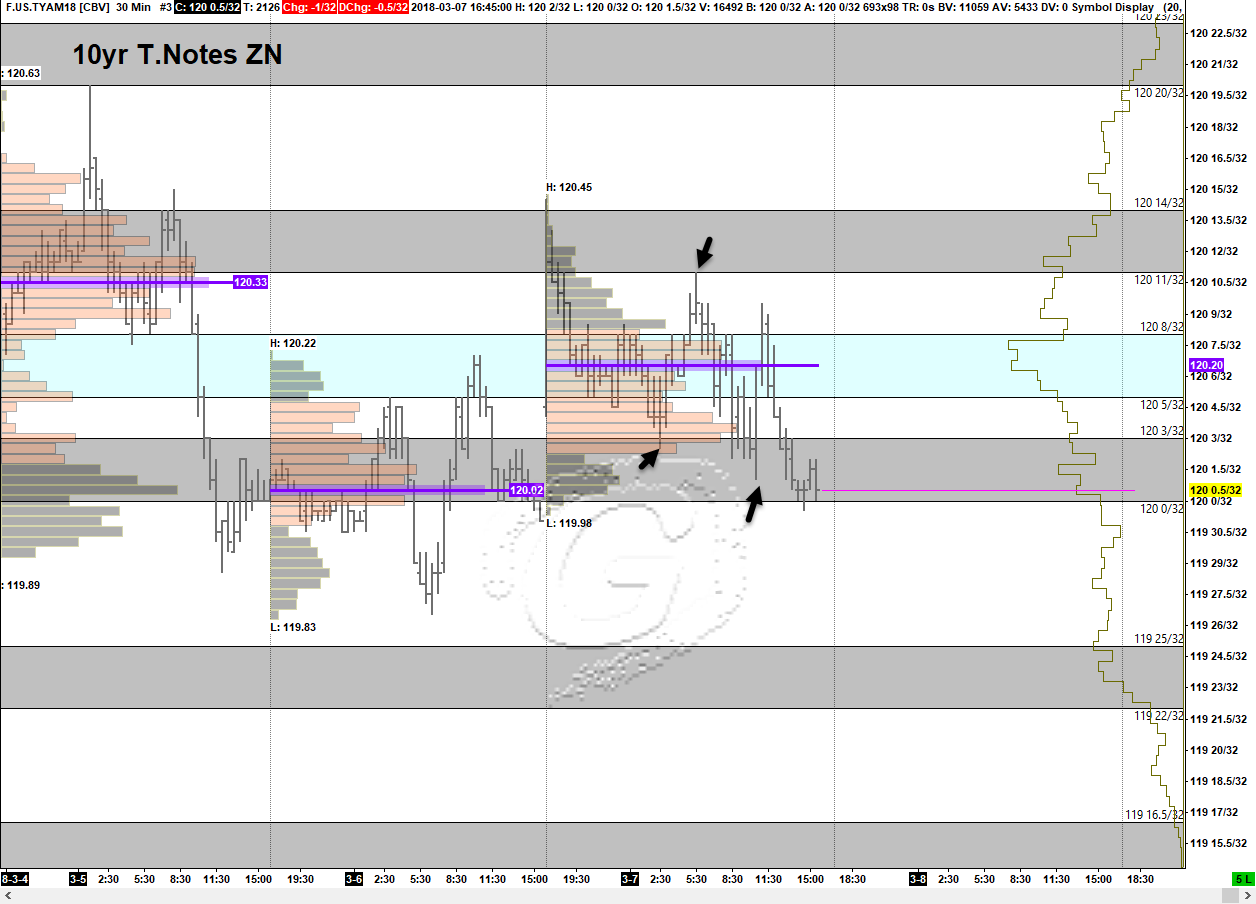

Here are the EOD reviewed Charts.

Markets covered:

- Crude Light – CL June 18 Contract

- 30yr US Treasury Bonds – ZB June 18 Contract

- 10yr US Treasury Notes – ZN June 18 Contract

- Ultra 10yr Treasury Note – TN June 18 Contract

The arrows in the charts are not some magical top and bottom pickers, they are meant to show the reactions at the designated zones according pre market plan. Big part of my execution process is order flow trading at these zones.

The basic principle is Trade Location (zone) + Order flow analysis (Entry, Exit execution).

Leave a Reply