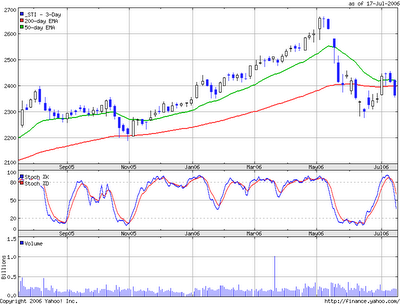

It is not a nice picture for STI. It , in fact, failed to stay above 50-day moving average and closed below 200-day moving average. And it formed a lower high. It is a bit difficult for me to stay bullish. I would prefer to stay at Short side. In addition, looking at stochastics, it […]

Old blog archive

RE: TIMSCI 17-Jul-2006: Short trade closed :chart

This is 15-min chart of MSCI Taiwan Index Futures (TIMSCI). It was easy to observe price set-ups were all for Short. I entered with entry and missing out good profit and taking silly losses. I have been reading money management stuffs from Van Tharp and other web blogs. Thanks to TraderMike who has a well […]

RE: TIMSCI 17-Jul-2006: Short trade closed

Short position of TIMSCI was established at 258.2. Initial stop was set at 259.8 which was subsequently triggered. One trade closed with -1.6 point loss which converted into -1.37R loss (uh! ugly). I should not have allowed the trade to be place since the initial risk was more than 1R. What was going on here? […]

Day trading for 17-Jul-2006

Day trading view: TIMSCI is having some upward movement in an existing downtrend. I am not interested in chasing the bull. Instead, I am looking for opportunity to establish short position if the downtrend is not violated. SIMSCI, bearish. Nice downtrend. It is likely to trade above 2,000 contracts in the first hour trading. I […]

Article read: Master the Four Fears of Trading

Ahead of another new week, here is an great article to prepare myself. Master the Four Fears of Trading Merriam-Webster’s dictionary defines fear as “an unpleasant, often strong emotion caused by anticipation or awareness of danger, going on to explain that fear…implies anxiety and usually the loss of courage.” This definition of fear is useful […]

TIMSCI 14-Jul-2006: Short trade closed: Chart

This is 15-min chart of MSCI Taiwan index Futures (TIMSCI). Nice downtrend setup and short entry. No trade for the rest of the day. Though I was having two losing days in this week, I manage to close the day and the week in positive note.