It does not look better even after last Friday’s rebound. SIMSCI futures is current stucked between support and resistance level. Immediate resistance level 289.5 while immediate support appears to be at 277.6 A downtrend channel is well formed. An analysis on SIMSCI futures can also be found at Traderswin Futures Trading Blog.

Old blog archive

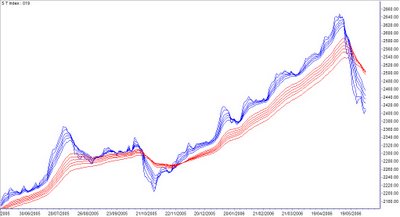

Trend analysis : STI & UOB Sesdaq

STI To evaluate market condition , I am always examining trend characteristics. Short term group moving averages continue drifting downward and stay below long term moving averages. There was a minimal rebound at the end of last week, however, it is still below trigger line. Directional analysis wise, downtrend strength is staying flat, while negative […]

Week end 02-June-2006: After thought

It has been a week that I did not post any article about stocks trading. In fact, current singapore stocks market does not excite me much. I position myself as a swing trader for stocks and day trader for SIMSCI futures. Currently, I can’t find any good setup for stocks. And sentiment is not encouraging […]

SIMSCI view ended 31-May-2006

Before market open, I am looking at overview of SG market. Analysis on SIMSCI futures can be found at Traderswin Futures Trading blog. The overnight rebound at U.S does not contribute a strong bullish view. For stocks, it might be a time to sell on strength. I am not looking for any stocks trading for […]

Snapshot daily chart of SIMSCI

A daily snapshot chart and comment of SIMSCI can be found in Traderswin Futures Trading blog.

News: William,No jogging on Bondi for stockbroker guru

I am very interested in following news about Larry williams. I have been learning a lot from his books, and respect him as a excellent trader. Here is news for morning coffee No jogging on Bondi for stockbroker guru